Bitpanda, the Austrian crypto platform just got the green light from the Financial Conduct Authority, the FCA to expand its services in the United Kingdom.

Crypto services in the UK

So, what does this mean for the UK crypto investors? Bitpanda is offering access to over 500 cryptocurrencies, and Lukas Enzersdorfer-Konrad, Bitpanda’s deputy CEO, emphasized that this will be the broadest range available to UK investors.

Besides a massive selection of cryptos, Bitpanda will also provide UK investors with staking, savings plans, and crypto indices, like a full-stack investment platform.

Business law

Bitpanda actually pressed pause on onboarding new UK users in 2023 due to the FCA’s stricter Financial Promotions Regime, but existing customers were able to keep using their accounts.

With this new approval, Bitpanda is back in action, ready to roll out the red carpet for new British investors.

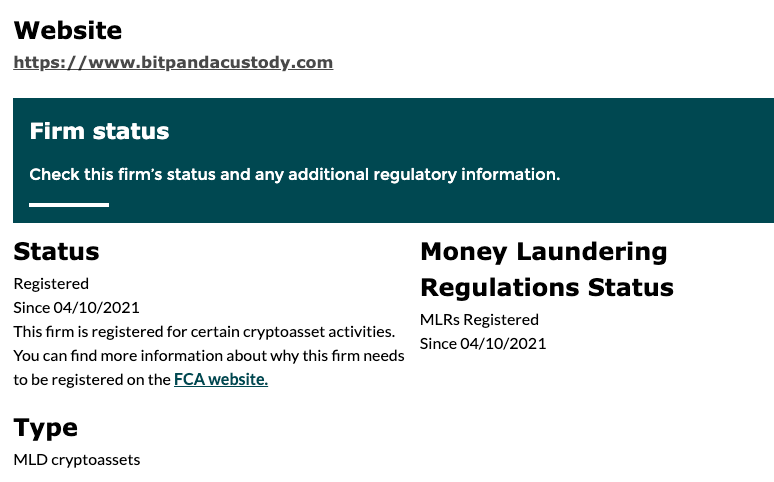

Since 2021, Bitpanda has been a registered crypto custody provider for business clients in the UK, with a local team in place.

This new expansion is a pretty big step, solidifying Bitpanda’s commitment to the UK market.

Expansion

Bitpanda’s expansion follows the firm securing a license under the European Union’s Markets in Crypto-Assets Regulation, the MiCA framework, that allows them to operate across all 27 EU member states under a unified regulatory regime.

According to Enzersdorfer-Konrad, the UK crypto offering will mirror that in Europe.

“Our range is constantly expanding, with over 100 new coins listed last year alone.”

But here’s a little twist, as Bitpanda won’t be offering Tether’s USDT, the largest stablecoin, to its clients in the UK or the EU, citing compliance with MiCA.