Bitcoin’s price movements have drawn attention, especially as it briefly dipped below the 200-day exponential moving average, but since then, it’s rebounded above $60,000.

Just hodl it!

Bitcoin’s price dipped below its 200-day EMA only three times this year. The first time was on July 4, marking a temporary bearish phase, but Bitcoin quickly reclaimed its position above this level within 10 days.

This new dip below the EMA lasted less than 24 hours, clearly showing that bullish momentum is strong.

The realized cap, which represents the total value of Bitcoin onchain minus capital lost through sales, now reached $3 billion.

This metric signals that long-term holders continue to believe in Bitcoin’s potential, no matter how volatile is the market.

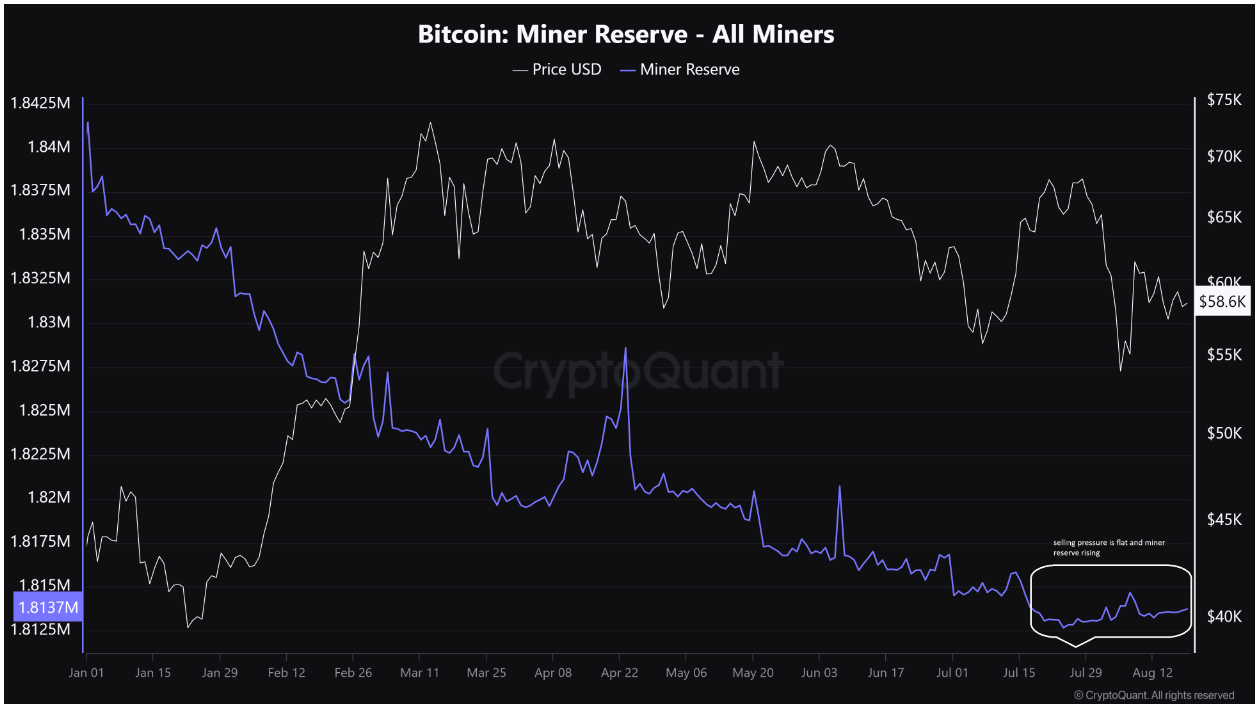

Miner selling is slowing down

Bitcoin miners, who had been offloading their holdings during the second quarter of 2024, are now showing signs of slowing down their sales.

Over the past two weeks, the selling pressure has flatlined, and miner reserves are beginning to trend towards accumulation again.

This is a good sign, considered as incoming price rise, and suggests that miners are starting to see more long-term value in holding onto their Bitcoin. With fewer sale, this could reduce downward pressure on the price.

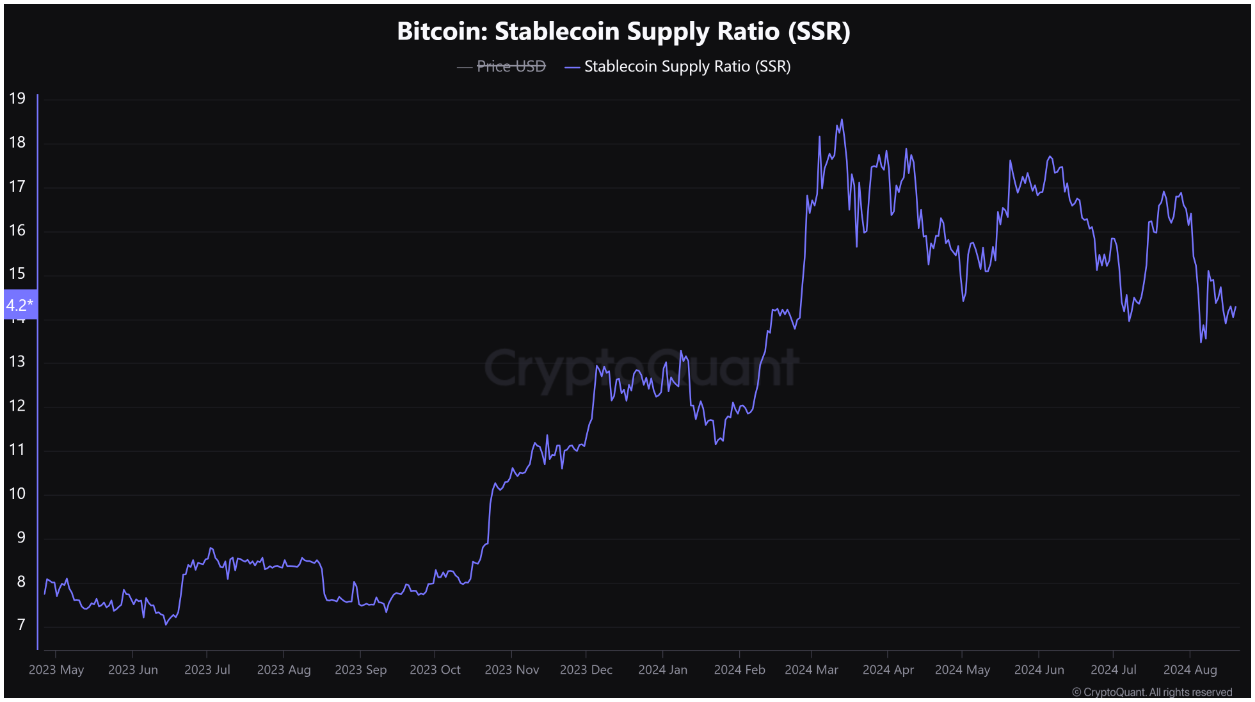

Stablecoin supply ratio, the SSR indicator flashing a rally signal

Another bullish indicator for Bitcoin is the increasing global liquidity, as reflected in the global M2 money supply.

The stablecoin supply ratio, aka SSR, a metric that compares the total cryptocurrency market cap to the aggregated market cap of all stablecoins is also decreasing.

A lower SSR means that stablecoin supply is rising faster than the market cap, suggesting that there is more liquidity available for purchasing assets like Bitcoin.

Right now the SSR is down to levels last seen in early February, and this could mean that a nice amount of fresh capital is ready to be deployed in the market.

This could be the catalyst needed to drive Bitcoin’s price higher in the coming weeks.