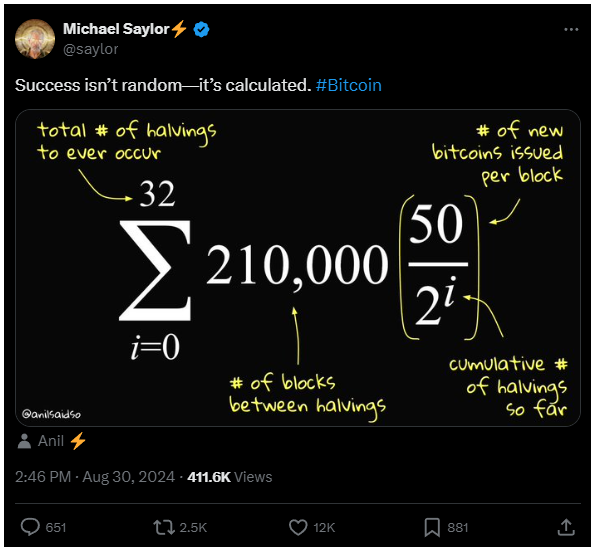

Michael Saylor recently took social media to argue that Bitcoin’s success isn’t due to luck but to careful planning and design.

He pointed to elements like the Bitcoin halvings, the fixed supply of 21 million BTC, and the consistent issuance of 50 new tokens per block.

Strategic design

Michael Saylor, the CEO of MicroStrategy, is one of Bitcoin’s most vocal advocates. His company made huge investments in Bitcoin, believing in its long-term value.

He thinks the technological and economical factors behind the system, when examined alongside historical halvings, reveal the strategic planning behind Bitcoin’s impressive performance.

Bitcoin’s price dropped to around $59,200 after an 8% decrease over the lastt week, so there are struggles nowadays, but Saylor thinks the growth is pre-determined.

Since MicroStrategy started buying Bitcoin in 2020, the company amassed 226,500 BTC.

Other investors followed their path, including Japan’s Metaplanet and the government of El Salvador, which holds about 5,748 BTC worth over $340 million and also launched a Bitcoin investment certification program, and an own mining facility.

Bitcoin’s global impact

Bitcoin took time to gain widespread acceptance since its launch in 2009, but it has now established itself in the cryptocurrency market as leader.

Its decentralized structure, along with its anonymous creator Satoshi Nakamoto, also helped Bitcoin reach a market capitalization of $1.1 trillion.

The introduction of Bitcoin ETFs, like BlackRock’s IBIT, just further strenghtened its position, facilitating millions of trades daily.

Resistance is futile

In a not-so-surprising way, even some of Bitcoin’s early critics are beginning to recognize its importance.

Former U.S. President Donald Trump is one of the most well-known person who has shown support for the cryptocurrency.

But he also issued own NFT collections too, and we can fairly say he isn’t Bitcoin maximalist.