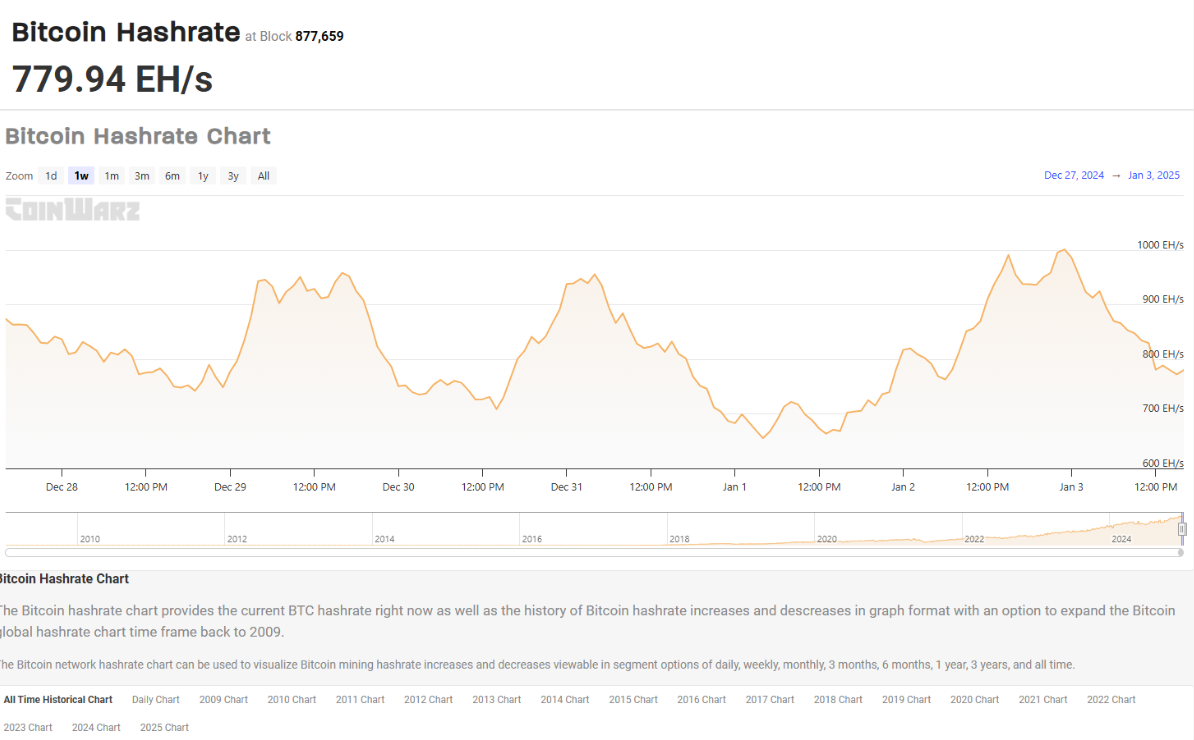

On January 3, the Bitcoin network’s hashrate surged to a staggering 1,000 exahashes per second.

Just a year ago, we were sitting at around 510 EH/s, so this jump is almost double the previous level.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

The progress is unstoppable

Now, you might be wondering why miners are still ramping up production despite the halving event in April that slashed mining rewards from 6.25 BTC to 3.125 BTC per block.

Well, it seems that miners like Riot Platforms and CleanSpark have managed to navigate these challenges quite well, as these companies have been acquiring other miners with ready-to-go facilities to boost their near-term hashrate and power supply.

Reserve asset

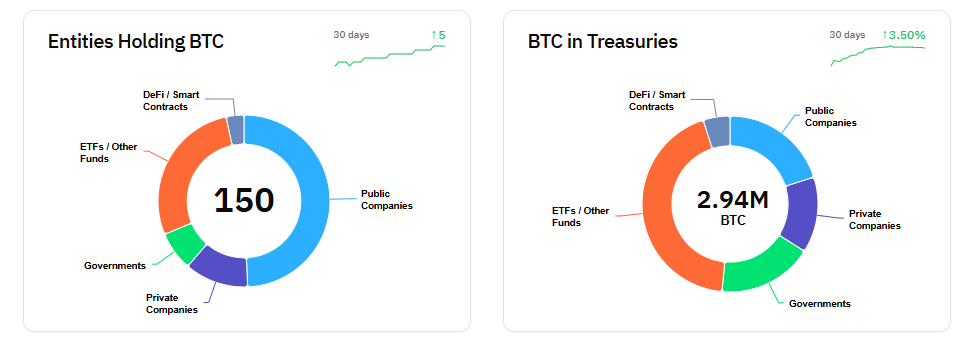

These firms are also focusing on stocking up on Bitcoin itself. In December, JPMorgan raised price targets for several Bitcoin mining stocks, taking into account their valuable electrical assets and Bitcoin holdings.

MicroStrategy was trading at about 2.4 times the value of its BTC treasury as of December 10.

Speaking of treasuries, let’s take a quick look at some of the big players! Marathon holds around $4.4 billion in BTC, Riot has about $1.7 billion, and CleanSpark is sitting on roughly $910 million worth of Bitcoin.

Hashpower is the key

The rising hashrate is quite important as institutional investors are stepping into Bitcoin ETFs and other regulated crypto investments like it’s Black Friday at a tech store!

In November alone, Bitcoin ETFs surpassed $100 billion in net assets for the first time ever, and according to Sygnum, an asset manager, this trend is expected to pick up speed in 2025 as major players like sovereign wealth funds and pension funds start adding Bitcoin to their portfolios.

Martin Burgherr from Sygnum highlighted that with clearer regulatory guidelines in the U.S., 2025 could see a significant uptick in institutional interest in crypto assets.