When whales start moving, you better pay attention. Something’s happening beneath the surface of Bitcoin’s price action. A quiet storm. A movement.

A shuffle of digital fortunes. And the big-money players who can make or break a market, are getting busy.

Whale watching is a dangerous game

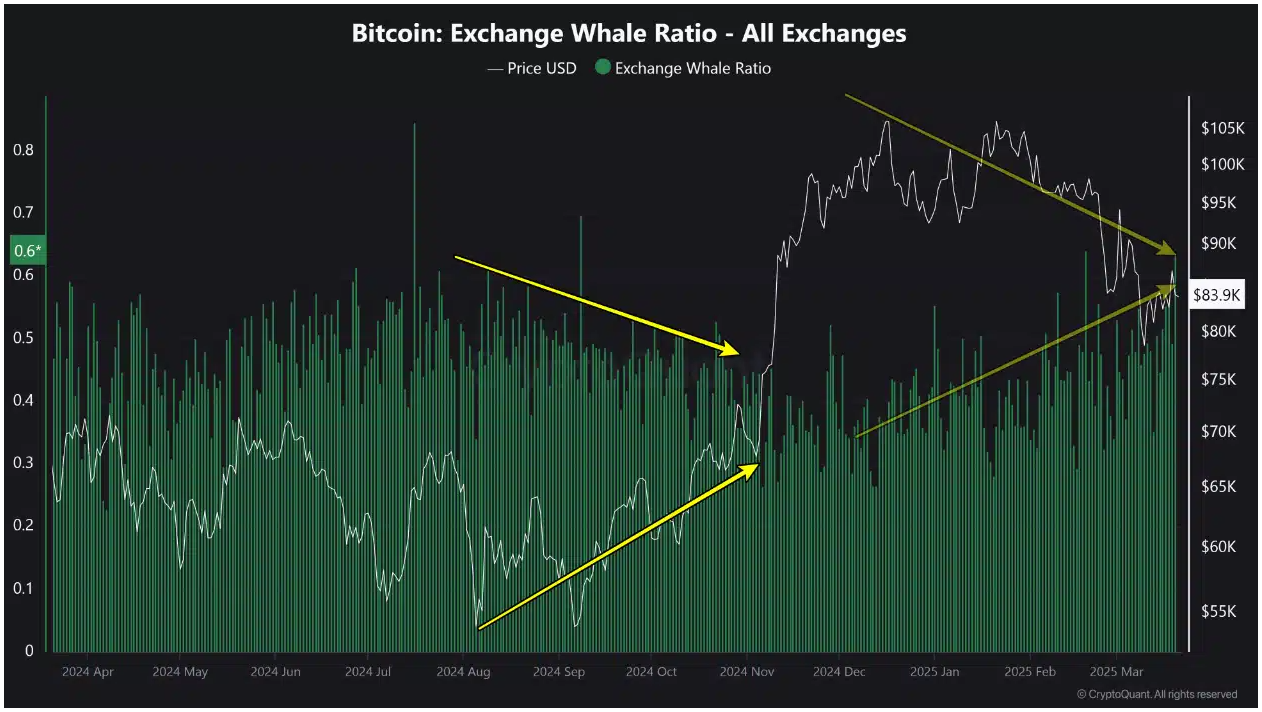

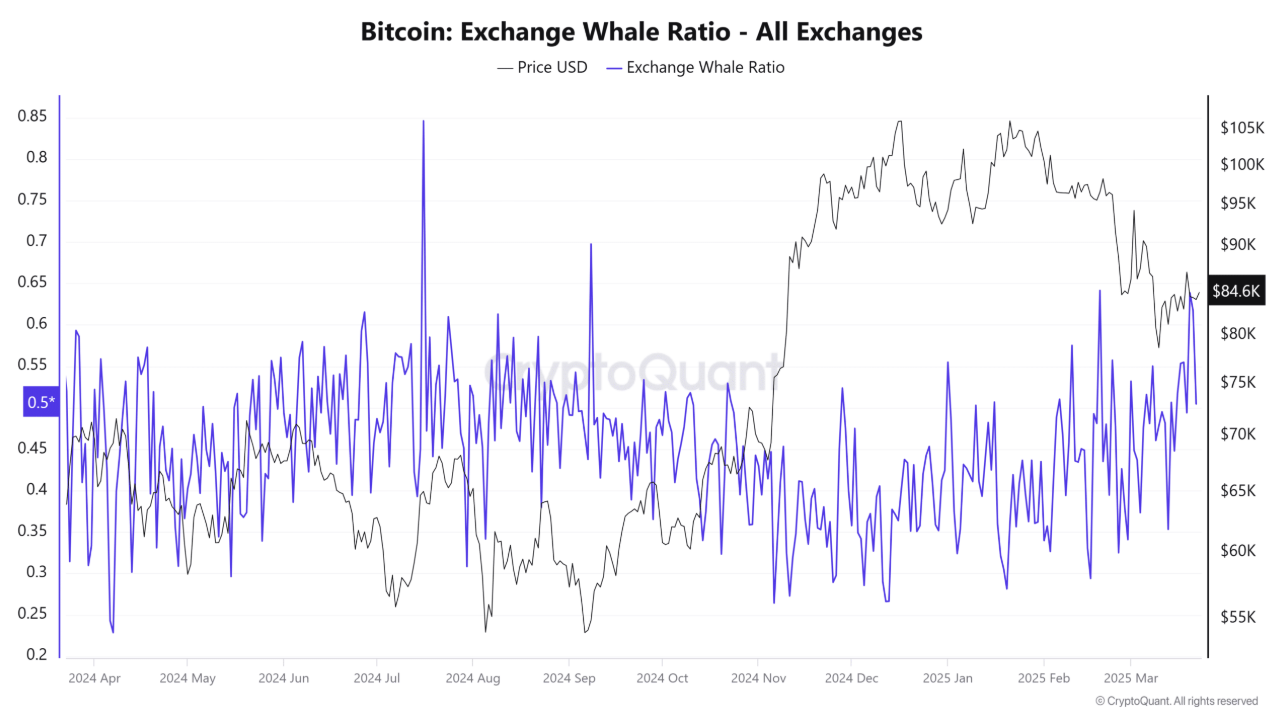

So, here’s the deal. CryptoQuant’s data shows that the Exchange Whale Ratio, a fancy way of saying how much of the Bitcoin flowing into exchanges is coming from whales, just hit its highest level in months.

Over 0.6, to be exact. Historically, when that number gets too high, whales aren’t just moving money around for fun.

They’re gearing up to sell. Translation? The crypto market might be in for some turbulence.

“Big players are reallocating their assets, which usually means selling pressure is coming.”

The timeline

Let’s rewind a bit. December 17th, 2024, Bitcoin hits a jaw-dropping $109k, an all-time high.

Champagne bottles pop, laser eyes flash, everyone’s feeling invincible. Then reality kicks in. Since then, BTC has tumbled nearly 20%, landing at $84,000 as of now.

And guess what? Every major price drop has coincided with a spike in the EWR. In other words, whales have been unloading their bags while the rest of the market catches up to the fact that the party might be over.

And it gets better. Back in December, when Bitcoin was already retreating, EWR was still climbing.

That’s a telltale sign of distribution, big players cashing out while smaller traders keep the faith.

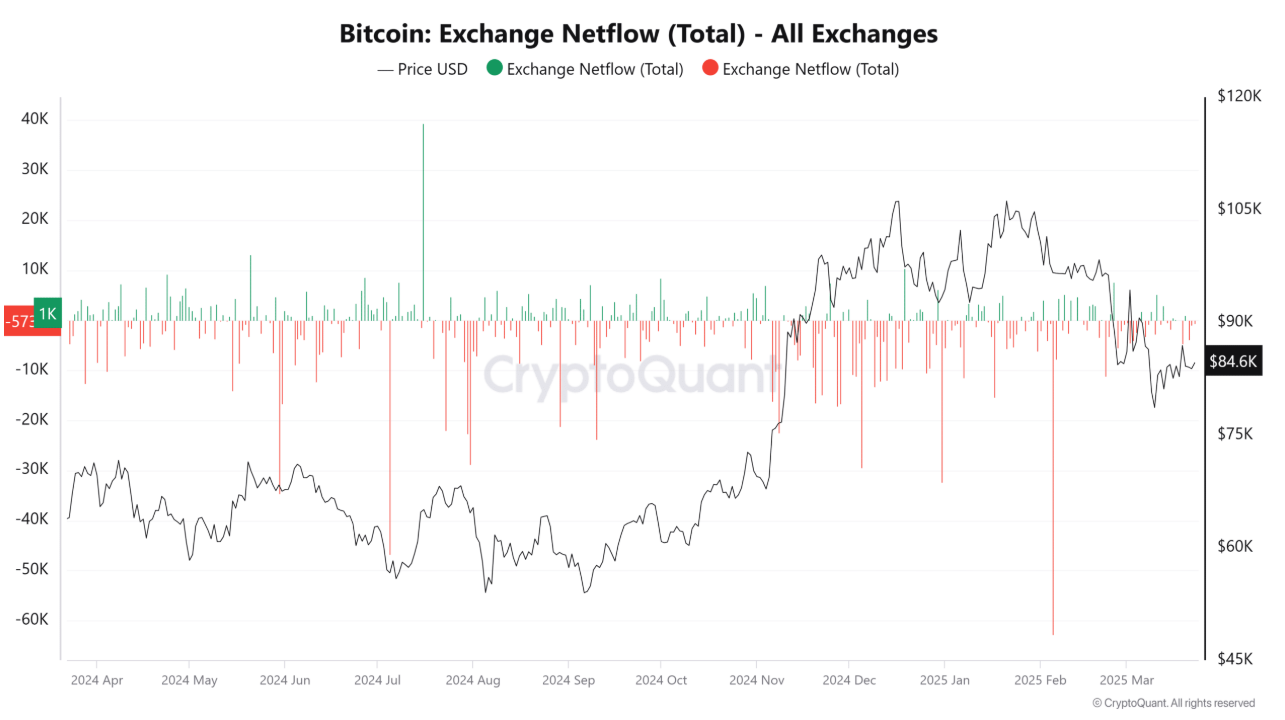

Exchange netflows, basically, the balance of Bitcoin moving in and out of exchanges, tell a similar story.

For most of 2024, Bitcoin was pouring out of exchanges at a rate of 30,000 to 60,000 BTC per month. That’s bullish. That means people were buying and hodling. But then something changed.

By Q4 2024, outflows slowed down. In November, as Bitcoin neared $68,000, we suddenly saw 7,033 BTC flowing into exchanges.

A small red flag, but nothing crazy. Then, on the exact day BTC hit its peak in December, netflows were barely negative at -1,531 BTC, a fraction of what we saw in earlier accumulation phases.

Profits are being booked

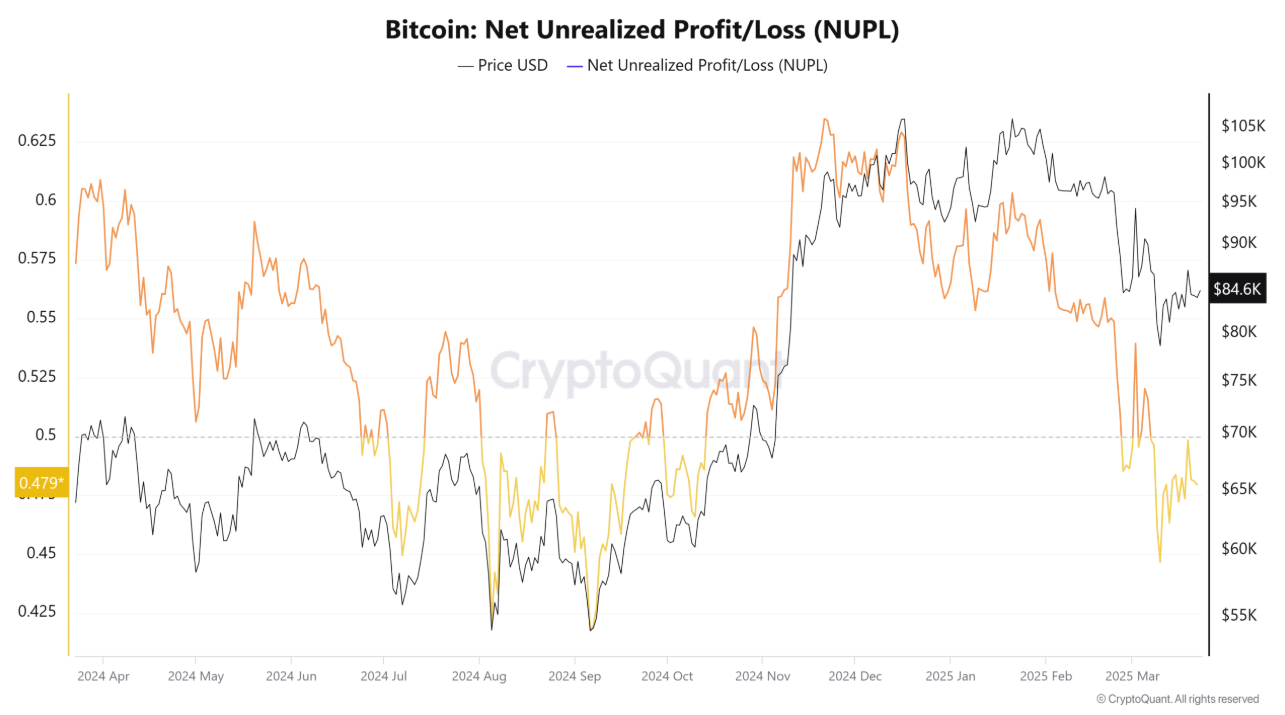

Another interesting metric is the Net Unrealized Profit/Loss, or NUPL, which measures whether the market is in a state of euphoria or panic.

From August to December 2024, NUPL climbed from 0.442 to 0.627, which basically means people were making money, and lots of it.

But by March 2025, it had slumped back down to 0.480, outpacing Bitcoin’s price drop. In other words, long-term holders and whales have been cashing out.

The good news? NUPL is still in the green, meaning the market is not in full-blown panic mode yet. But with whale activity rising and netflows stabilizing, Bitcoin stands at a crossroads.

Have you read it yet? The people have spoken, delisting vote is coming on Binance

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.