Bitcoin’s price has been rising this week, bringing back a positive, opimist feeling in the crypto markets.

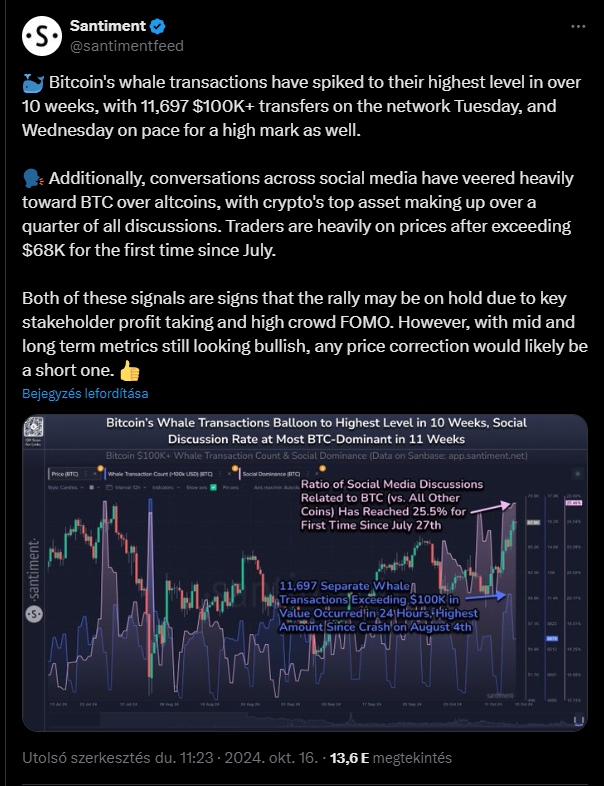

Santiment reported that Bitcoin whale transactions reached their highest level in over ten weeks.

Shift in market sentiment, Uptober is coming?

Santiment noted that discussions on social media have shifted towards Bitcoin, making up more than a quarter of all conversations.

This change indicates that the current rally might be slowing down due to profit-taking by major investors and increasing fear of missing out among the crowd. While long-term metrics appear positive, suggesting that any pullback may be brief, the market sentiment has shifted to greed.

The Bitcoin Fear and Greed Index reached 73 on Wednesday, the highest level since late July.

Another result of this week’s rally is Bitcoin’s dominance in the market, which hit a three-and-a-half-year high of 58.98% on October 16. This is the largest market share Bitcoin has held since April 2021.

The real bull run please stand up

In a post on X Benjamin Cowen, founder of ITC Crypto, predicted that Bitcoin’s dominance could peak around 60% between now and December before dropping in 2025.

He mentioned that it is more likely for Bitcoin to exceed 60% rather than fall short, especially since alt pairs with Bitcoin are still weak.

Industry advisor Dan Held explained that this breakout happened as buyers began to outnumber sellers.

He added that the overall economic conditions are strong and that liquidity will soon flood the market, with much of the fear surrounding exchange distributions and government selling now gone.

He believes that once Bitcoin breaks its all-time highs, retail investors will jump in, signaling the start of the real bull run.

Alt market struggles

On Wednesday, Bitcoin reached a ten-week high of $68,250, pushing its weekly gains to 11%.

Since then it retreated to around $67,400 during Thursday morning trading in Asia, but momentum remains strong.

The cryptocurrency is now just $1,500 away from its previous bull run peak of $69,000 from late 2021.

Analyst ‘Rekt Capital’ believes that the recent higher high indicates a break from the previous sideways or downward trend.

On the other hand, most altcoins are either flat or losing value as Bitcoin continues to dominate and expand its share of the cryptocurrency market.