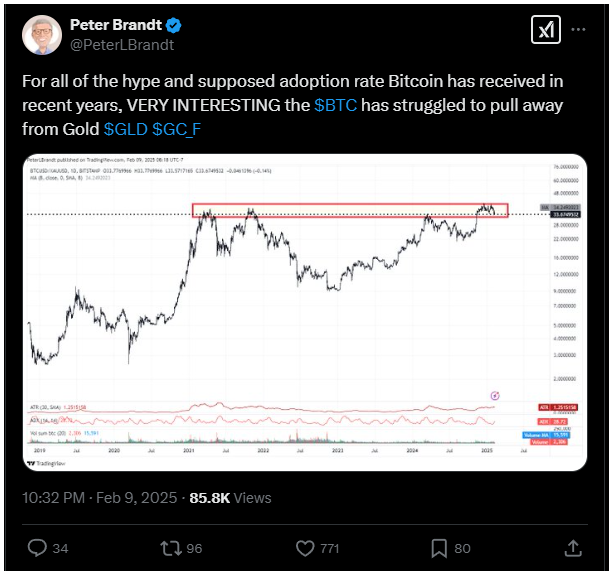

Bitcoin, the king of crypto, has had an amazing year, but a trading veteran, Peter Brandt, is pointing out something weird.

Bitcoin hasn’t really left gold in the dust, even with all the hype and institutional money pouring in.

Bitcoin’s struggle is bigger

Brandt thinks it’s very surprising that Bitcoin hasn’t significantly outperformed gold so far.

Think about it, Bitcoin ETFs have been a massive success story in 2024, making it easier than ever for big institutions to invest. But the market is rather quiet. Or maybe there’s a delay in performance?

Bitcoin-gold ratio

The Bitcoin-gold ratio, the indicator of how many ounces of gold one Bitcoin can buy, also not long ago hit its lowest point since November.

It’s down over 19% from its peak in December. On the other hand, gold is flirting with record highs, trading around $2,830 per ounce. Since mid-December, gold has jumped over 11%.

Is Bitcoin really the new gold?

Gold’s strong performance might throw a wrench in the narrative that Bitcoin is replacing gold as the ultimate store of value.

Some Bitcoin enthusiasts have even called on the U.S. government to ditch its gold reserves and buy Bitcoin instead, arguing that Bitcoin’s historical performance promises better returns.

But worth to remember, Bitcoin hasn’t managed to consistently outpace gold over the last four years. It seems gold is still the king of safe haven assets.

The question remains, can Bitcoin ever truly dethrone gold? Only time will tell. Maybe a longer-than-4-year time.

Have you read it yet? Bitcoin and Ethereum: Price Ranges, Key Influences, and Market Dynamics

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.