Bitcoin’s reduced volatility suggests that the market is maturing. Last week, Bitcoin experienced a dramatic rise from $66,000 to almost $70,000 in just one day, influenced by macroeconomic updates from the US.

Up and down

By the end of the week, it settled back above $66,600, according to the Kaiko BTC Benchmark Reference Rate, but despite this rollercoaster-like ups and downs, the price only dipped by about 4% for the week.

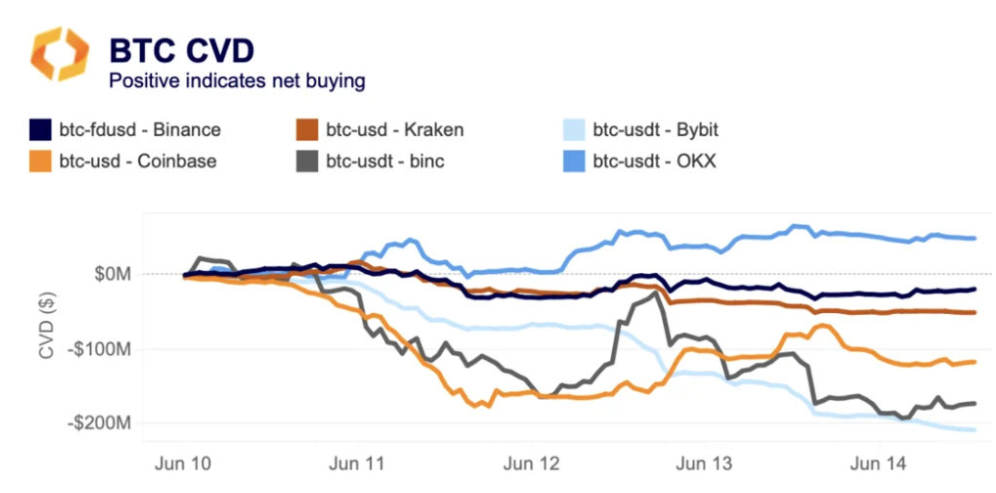

Selling activity outweighted buying on nearly all exchanges, with Binance and Bybit seeing the biggest selling volumes.

Many of the experts think the fluctuations last week were a sign of Bitcoin’s increasing maturity.

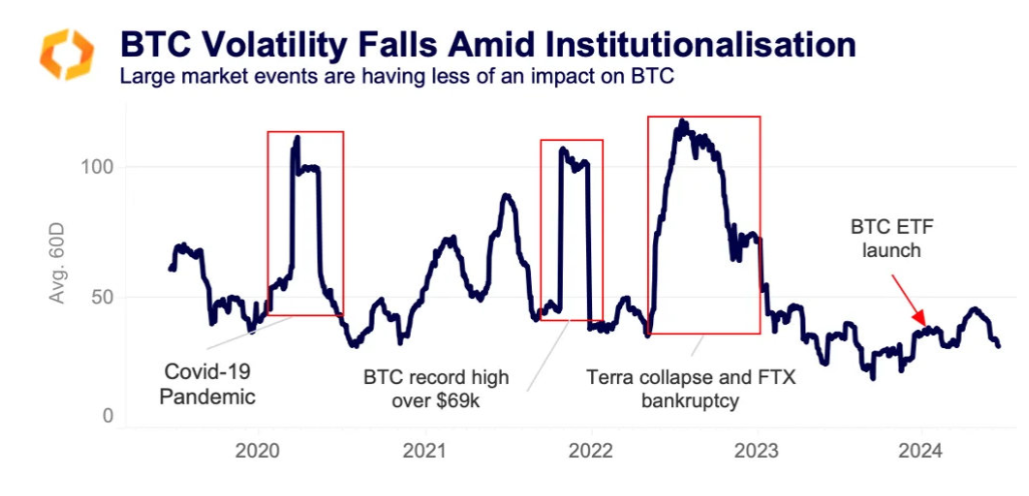

This can be seen in its declining volatility, with Bitcoin’s 60-day historical volatility staying below 50% since early 2023. This is a pretty stark contrast to 2022, when volatility exceeded 100%.

In 2024, Bitcoin hit an all-time high with volatility at 40%, much lower than the spikes of over 106% in 2021. Even the launch of spot Bitcoin ETFs in the US didn’t increase volatility too much.

This isn’t the well-known retail market from few years back

It might be too soon to declare this as the new normal, but changes in Bitcoin’s market structure over the past year could explain the more stable price action.

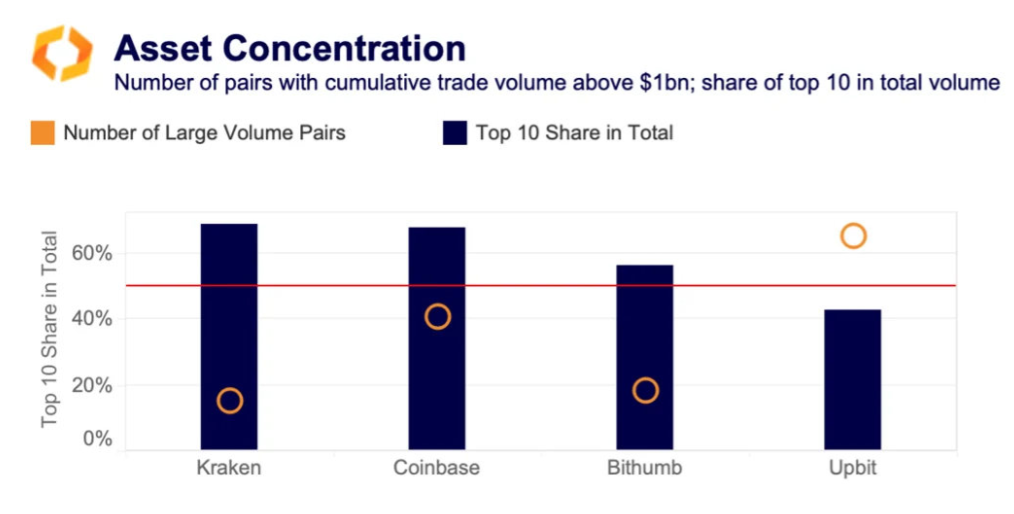

The US market close now has a larger share of trading volumes, with Bitcoin liquidity becoming more concentrated around the East Coast trading window.

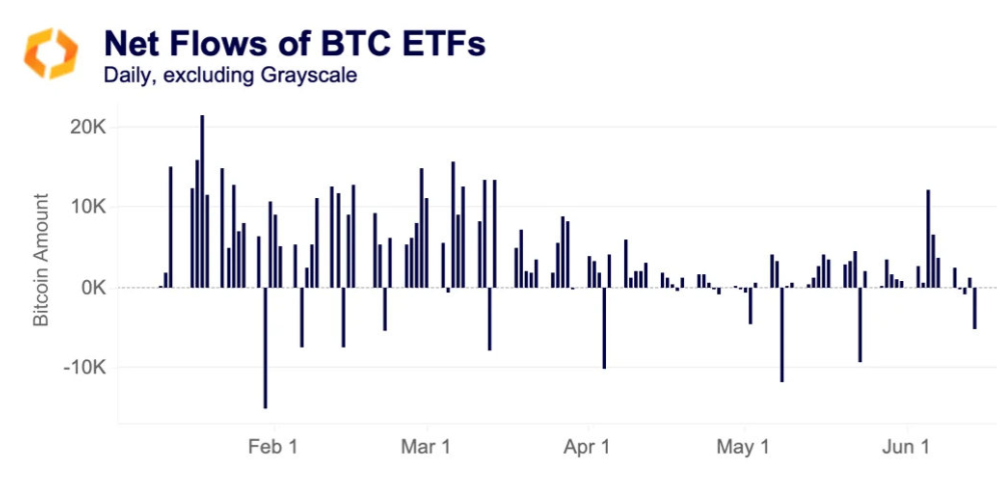

Trends in Bitcoin ETF, or other paper Bitcoin products demand in the US likely contributed to selling pressure last week, along with macroeconomic news like inflation, or possible rate cuts.

BlackRock surpassing Grayscale’s GBTC in assets under management signals the changes’ importance.

BlackRock, with $10 trillion in assets, now holds the largest spot Bitcoin ETF stack, surpassing the crypto-native Grayscale.

Silent summer

The bid-ask spread on major US exchanges has decreased, this is also signaling better liquidity for Bitcoin, deeper market.

The spread, which is the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept, has narrowed.

On Bitstamp, it fell from 2.3 to 1.9 basis points, on Coinbase from over 1 to 0.3 basis points, and on Kraken from 0.4 to 0.1 basis points. In case of the crypto market, this is a big drop.

The introduction of spot Bitcoin ETFs has likely played a role in this trend, with other liquidity indicators like market depth also looks better.

This enhancement is good news for the traders or investors, especially since the third quarter has historically seen the lowest Bitcoin trading volumes.

Analysts often speculate if these trends continue, Bitcoin’s market may become even more stable and more attractive for investors.