Bitcoin shorts are ramping up their bets on a price drop, but hold onto your hats because this might lead to something pretty intriguing.

Long squeeze is coming?

There’s a chance for long liquidations if Bitcoin retraced after hitting its latest all-time high. Despite being in overbought territory, the sell pressure hasn’t really taken off, and as of now, Bitcoin holders are still hanging in there.

What’s keeping the sell pressure at bay? Well, market confidence is still riding high after that new peak.

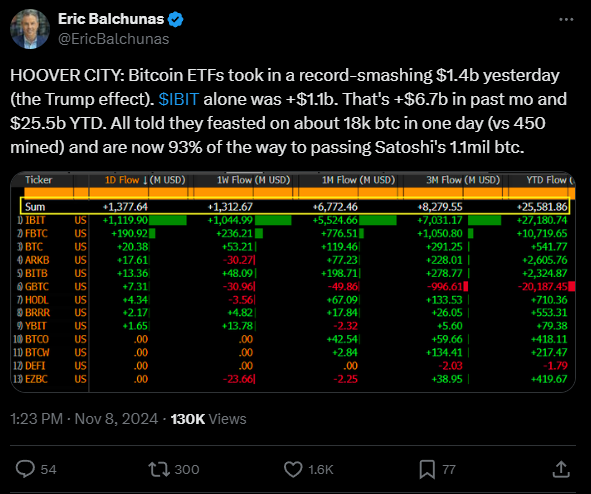

A big factor contributing to this positivity is the massive inflow into Bitcoin ETFs just in the last days.

ETF flows have become a solid gauge of market sentiment, and according to Bloomberg’s Eric Balchunas, $IBIT alone bagged $1.1 billion.

That’s a whopping $6.7 billion over the past month and $25.5 billion year-to-date. They picked up about 18,000 BTC in one day, compared to just 450 mined and are now 93% of the way to surpassing Satoshi’s 1.1 million BTC. That’s a lotta BTC.

Short or long? Who will win?

With all this ETF money pouring in, we could be looking at even higher Bitcoin prices.

A new analysis from CryptoQuant hinted that we might see a short squeeze due to these inflows.

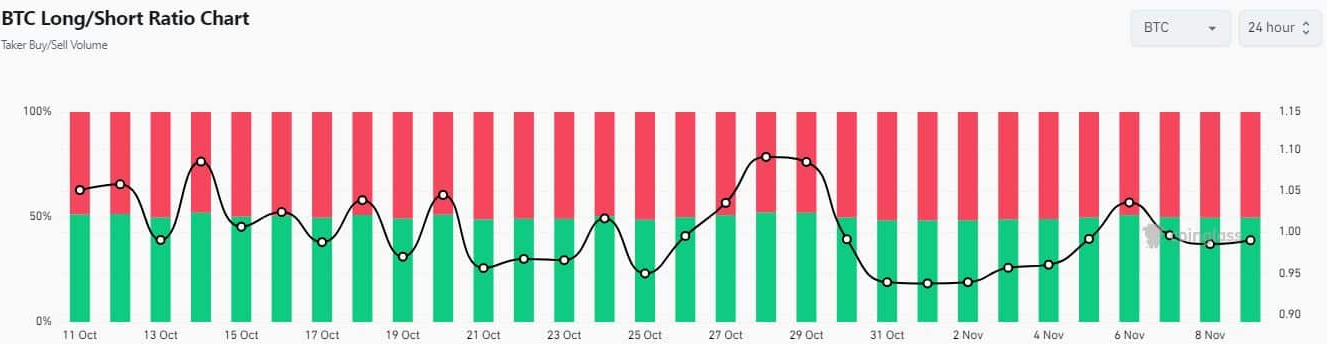

While Open Interest is climbing, funding rates are negative, historically a sign that traders are feeling bearish about the market.

Coinglass’s BTC long/short ratio shows that shorts have outnumbered longs for the past three days.

Why all these shorts? It seems that derivatives traders expect the previous price peak to act as a resistance level or are just looking to cash in on short-term profits before another dip.

But here’s the catch, if Bitcoin’s price starts climbing again, those shorts could find themselves in hot water with liquidations.

Nothing stop this train

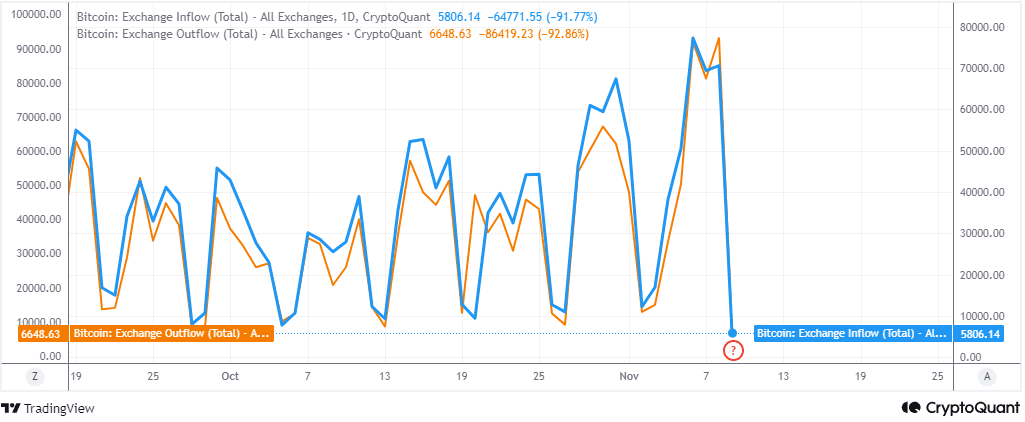

Looking at exchange flows, it seems like demand is still outpacing sell pressure. Fresh data shows that while overall exchange flows have dipped significantly, hinting at possible bullish exhaustion, there were still more BTC flowing out than coming in.

On November 9, Bitcoin saw outflows of 6,648 BTC compared to inflows of 5,806 BTC. This suggests that bullish sentiment is still alive and kicking, meaning prices could continue to rise.

Putting all this together, it looks like there’s still some bullish momentum keeping those bears at bay.

The influx from Bitcoin ETFs likely adds to this optimism, but don’t get too comfortable! BTC’s price action indicates that bulls are struggling to push higher.

This could mean demand is starting to cool off, which might open the door for a bearish retracement once sell pressure gains some strength.