Mark Cuban, the billionaire and star of Shark Tank believes that Bitcoin has a bright future ahead, and he thinks Bitcoin’s price could skyrocketing pretty soon.

Trump rocket

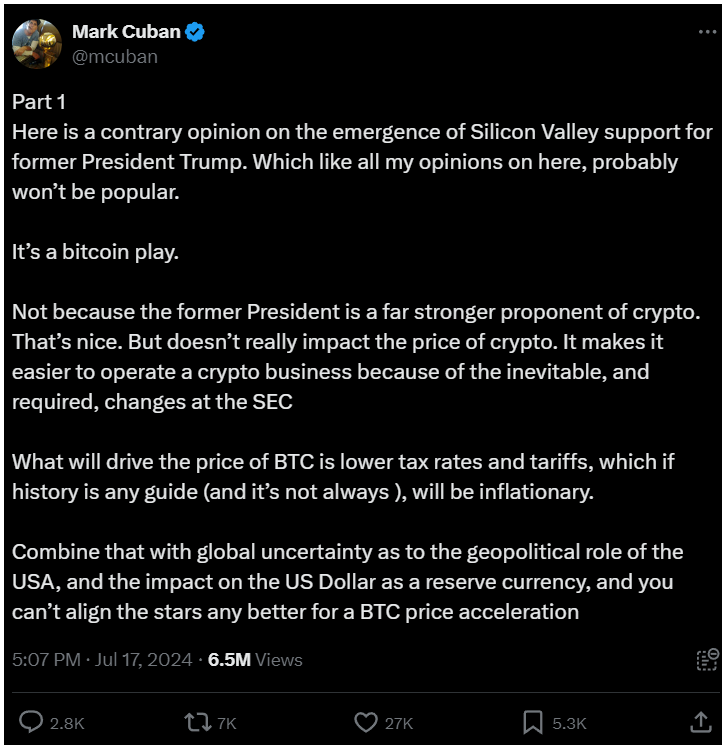

Talking to his 8 million followers on X, Cuban shared that the growing support for former President Trump among Silicon Valley elites is beneficial for Bitcoin.

He believes that a Trump presidency would lead to changes at the U.S. Securities and Exchange Commission, making it easier to run crypto businesses in the U.S.

Given the reputation of the current administration, and especially Gensler’s SEC, fair to say masses awaiting for changes in this field.

Thriving in hostility

Cuban also points out that monetary inflation and global political uncertainty also will push Bitcoin’s price higher.

He explains that lower taxes and tariffs can lead to more inflation, this is historical trend.

This, combined with doubts about the U.S.’s geopolitical role and the impact on the U.S. dollar as the world’s reserve currency, creates a perfect storm for Bitcoin to rise in value.

Safe harbor

Cuban thinks that under Trump’s leadership Bitcoin could become a safe haven, despite the global uncertainty.

He believes that this is the main reason why Bitcoin’s price could rise much much higher than expected because it has a limited supply of 21 million BTC, yet it can be divided into smaller units, to sats.

Which means everyone can get some, but no one can dilute, debase the supply.

If the U.S. dollar loses its status as the world’s reserve currency, and many experts think it could in the near future, people and countries might turn to Bitcoin to protect their savings, as there would be no other way to do it.

Cuban mentions that this scenario is already happening in countries experiencing hyperinflation.

He speculates that if things worsen globally, Bitcoin could become the global currency that its biggest supporters envision from the beginning.