In the past week, both Bitcoin and Ethereum experienced double-digit losses, making the market particularly bleak, but in longer time frame? Bitcoin is the king as always.

Bitcoin’s performance is strong compared to Ethereum

Over the last two quarters of 2024, Bitcoin’s performance slowed down, but it continues to outperform Ethereum in market activity.

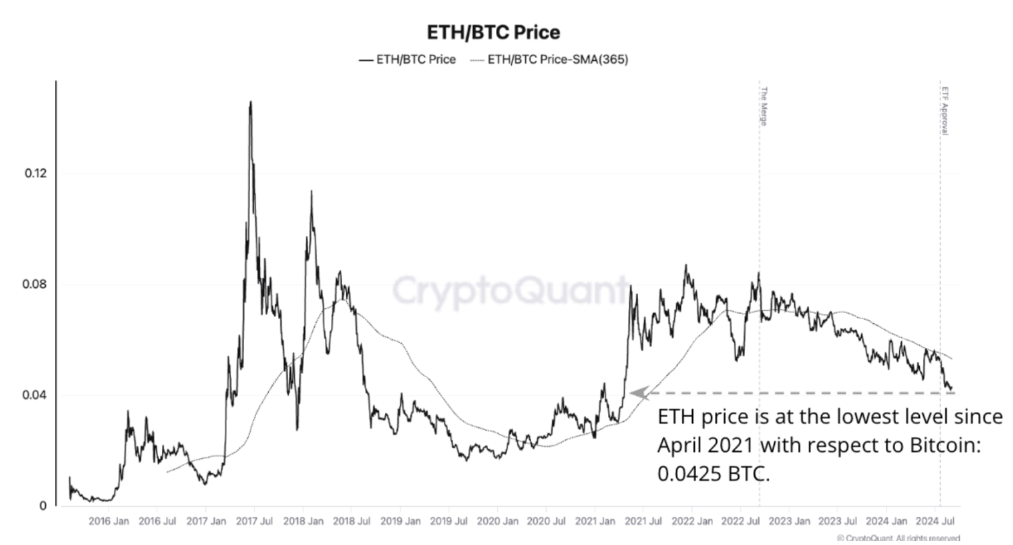

CryptoQuant provided insights into the reasons behind this trend, and according to their report, Ethereum has lagged behind Bitcoin by 44% since The Merge.

This was the event in 2022 that transitioned Ethereum from a Proof-of-Work consensus to a Proof-of-Stake network with stakeholder voting.

The ETH/BTC price ratio is around 0.04122, the lowest level since April 2021.

This weak performance has continued even after the launch of spot Ethereum ETFs in the United States, with the ETH/BTC pair dropping by 18% since these funds were approved.

Ethereum’s underperformance isn’t by accident, but comes from fundamenttal flaws?

CryptoQuant attributes Ethereum’s struggles to its relatively low network activity. Following the Dencun upgrade, Ethereum’s total transaction fees have been on a steady decline, and the number of transactions has reached a multi-year low.

Also, the supply dynamics haven’t been favorable for Ethereum compared to Bitcoin.

The total supply of ETH is increasing consistently since early April, shortly after the Dencun upgrade, nullifying the whole ’ultrasound money’ narrative.

In contrast, Bitcoin experienced its fourth halving in April, which reduced miners’ rewards from 12.5 BTC to 6.25 BTC.

Investor sentiment also appears to favor Bitcoin over Ethereum. This is evident in the drop in the relative spot trading volume of ETH compared to BTC, which fell from 1.6 times greater to 0.76 in just the past week.

Ethereum and Bitcoin, what’s next?

CryptoQuant suggests that Ethereum may continue to underperform against Bitcoin, especially since it is still above the undervaluation zone.

The firm believes that the ETH/BTC ratio would need to decrease by at least 50% from its current level to enter this zone.

Right now Bitcoin is priced around $54,000, while Ethereum is valued at about $2,213.

If these trends continue, and many thinks it will, Bitcoin may solidify its position as the preferred cryptocurrency, while Ethereum could struggle to regain its footing in the market, and holders better forget the flippening.