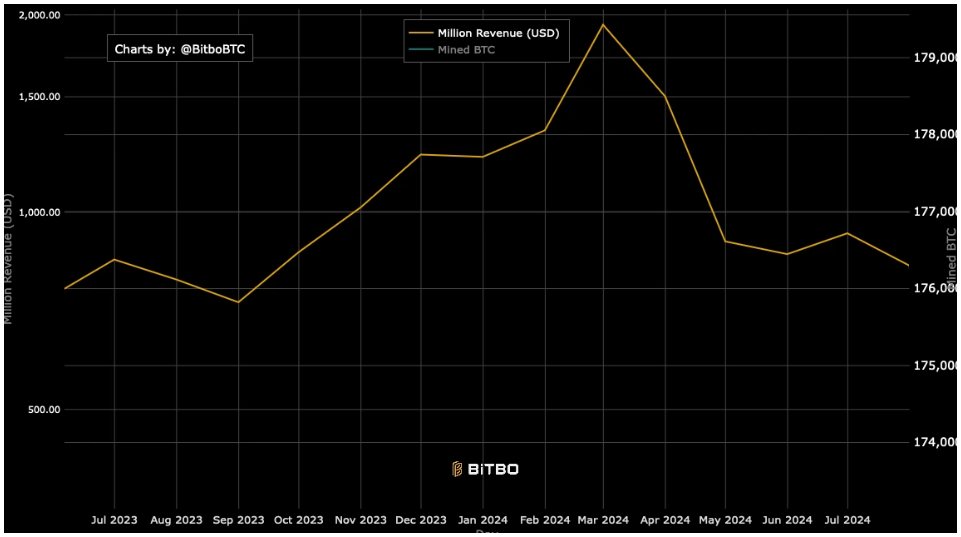

August delivered a pretty challenging time for Bitcoin miners, with revenues plummeting to their lowest levels since September last year.

Bitcoin mining, the hardest competition

In August, Bitcoin miners earned $827.56 million, a drop of more than 10.5% from the $927.35 million generated in July.

This figure is up 5% from August 2023, but is still 57% decrease from the peak revenue of $1.93 billion in March, when Bitcoin hit its all-time high of over $73,500.

This makes August the worst month for miners since September 2023, when they earned $727.79 million with Bitcoin prices was around $25,000 that time.

Bitcoin’s price is more than doubled since then, trading at $58,844 in the time of writing, but the revenue drop is a harsh reminder of the strong competition between the players.

The amount of Bitcoin mined in August also decreased slightly, with 13,843 BTC mined compared to 14,725 BTC in July.

So with lower transaction volumes and rising mining difficulty, this is yet another hardship to endure.

The April Bitcoin halving, which reduced mining rewards by 50% to 3.125 BTC per block, also played an important role in squeezing miners’ earnings.

Difficulty adjustment, the innovation in the system

Mining Bitcoin has become increasingly difficult, reaching an all-time high difficulty level of 89.47 trillion in August, up from 86.87 trillion in July.

More miners means higher difficulty, but this feature also grows the competition pressur too.

And some can’t keep the pace. This rise in difficulty, coupled with reduced profitability, already forced some miners to explore alternative revenue streams, or even stop their operations.

Some companies started to provide computing power for AI projects, after securing lucrative deals worth billions of dollars.

The situation is further complicated by the median transaction fees, which made up only 2% of the block rewards in August.

The daily transactions also saw a decline, with the 30-day average peaking at nearly 631,648 on July 31 before falling to 594,871 by the end of August.

It’s a make-or-break situation for miners

Experts speculate that if these trends continue, Bitcoin mining could become even less profitable, leading more miners to diversify into other areas like AI.

The rising difficulty and lower rewards could also discourage new miners from entering the space, especially if they can’t getting cheap or discounted electricity, potentially reducing the overall network hash rate.

But as many pointing out to the long term hashrate chart, the growth, this may be a concern, but not a really big one.