Bitcoin miners are experiencing a visible decrease in their reserves, raising minor concerns among market analysts.

Everything is for sale

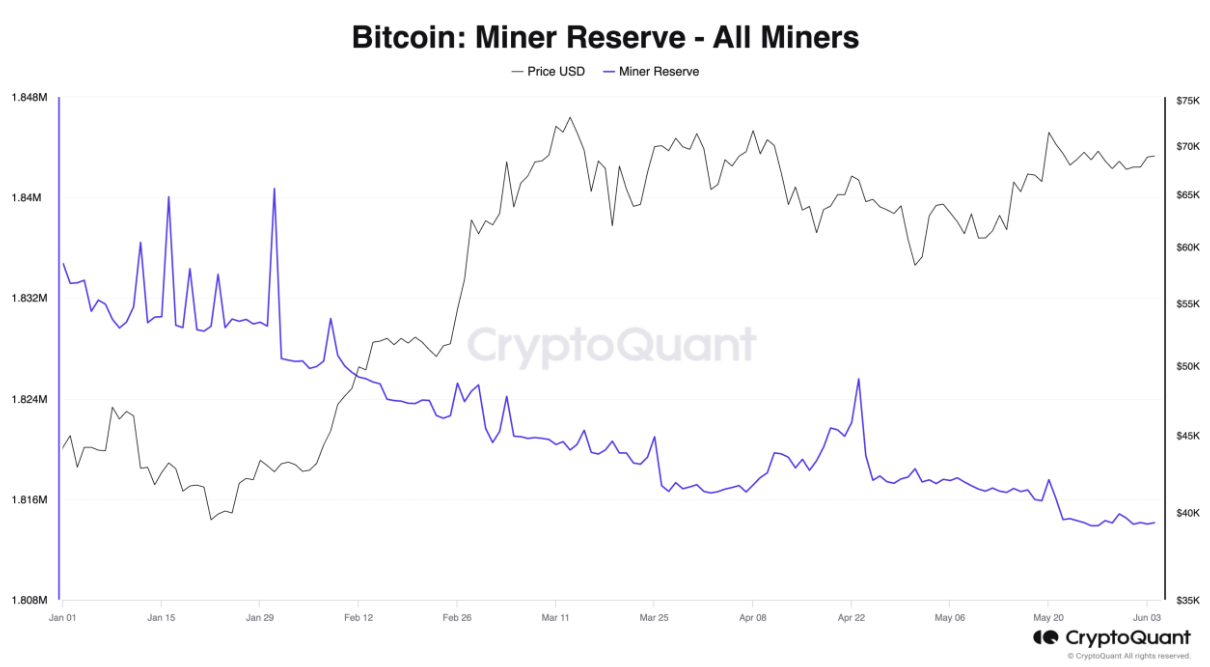

According to data from CryptoQuant, the Bitcoin Miner Reserve has reached its lowest level since the beginning of the year, as this metric, which tracks the amount of Bitcoin held in miners’ known wallets, has dropped to 1.81 million BTC, valued at approximately $125 billion at current prices.

The Bitcoin Miner Reserve is closely watched by analysts who focus on fundamental analysis, as miners are among the major sellers in the market due to the need to cover operational costs like electricity and maintenance.

When the Bitcoin Miner Reserve declines, like now, it shows that miners are selling their coins, and bigger changes in this metric often attract attention from the crypto community, media, and traders, given the central role miners play in the Bitcoin network.

The most significant event in every four years

The Bitcoin Miner Reserve had been declining for an extended period before initiating an uptrend on April 8th, as the market anticipated the fourth Bitcoin halving scheduled for April this year.

Following the halving, the reserve jumped to 1.82 million BTC, but after that, it started a downward trend. Since then, the amount of BTC held by miners has decreased by 1%.

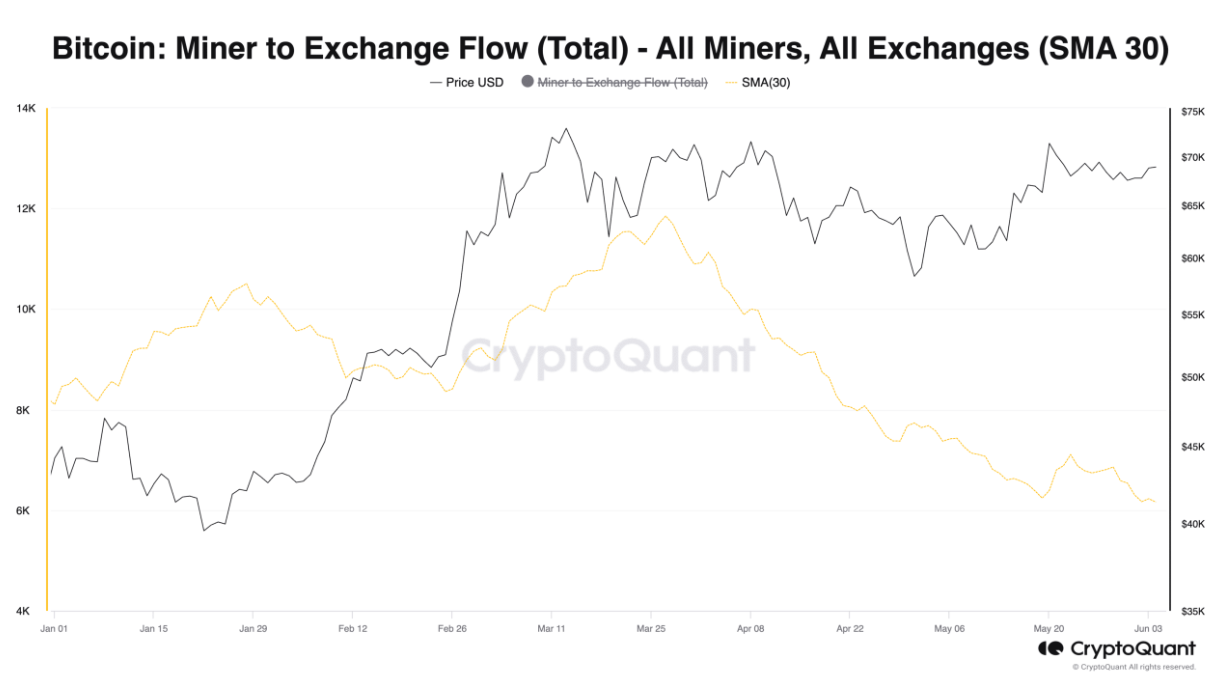

The past three months have seen a reduction in miner-to-exchange activity.

The flow of Bitcoin from miners’ wallets to exchanges, measured using a 30-day moving average, has dropped by almost 50% since its year-to-date high of 11,853 BTC on March 27th.

Are they selling or not?

Despite the common view, this decline in miner-to-exchange transfers doesn’t necessarily mean that miners aren’t selling their coins, because they may be using alternative methods such as over-the-counter markets or peer-to-peer sales to liquidate their Bitcoin holdings without involving exchanges.

The decrease in Bitcoin Miner Reserve and the possible shift to alternative selling methods could have various consequences, and one can speculate that this trend might lead to reduced liquidity on exchanges, thi is the so-called supply shock, potentially affecting Bitcoin’s price.

Also, the reduced flow to exchanges could mean a strategic move by miners to find more favorable selling conditions.