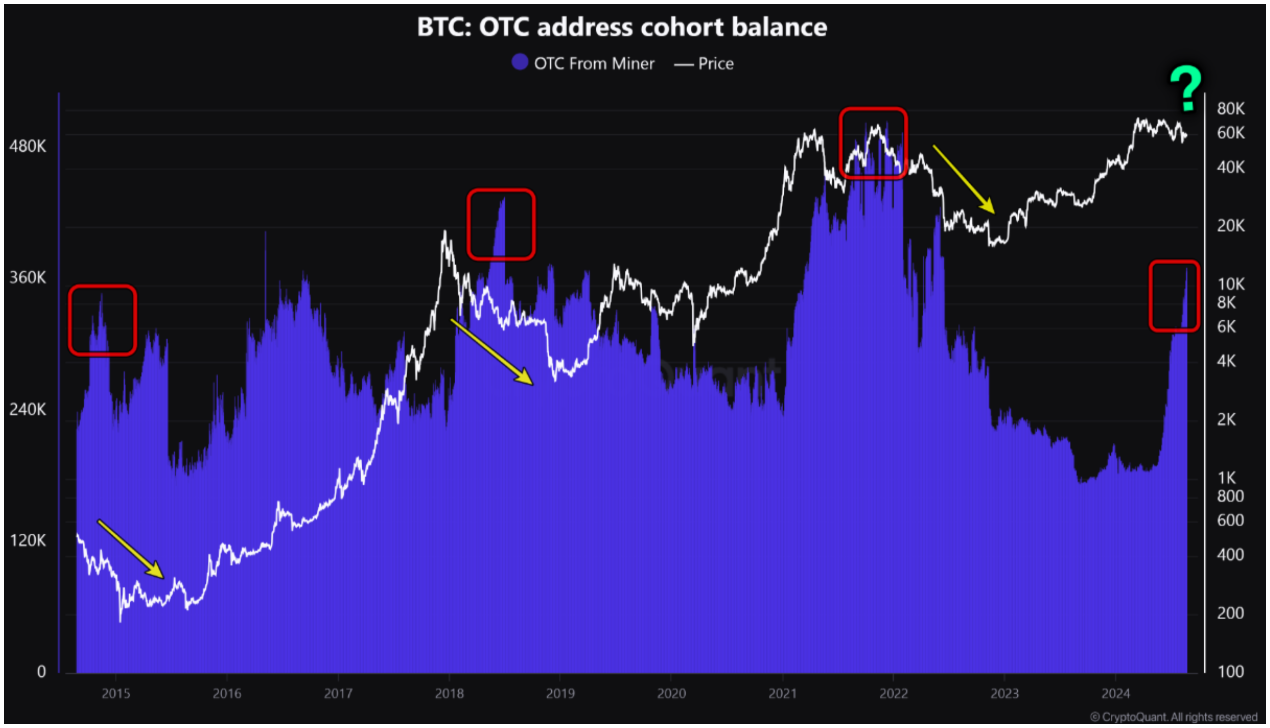

Bitcoin miners are holding more on over-the-counter, on the OTC desks than they have in the last two years.

Now experts say this trend historically foreshadowed big price drops.

Market correction on the horizon?

Bitcoin miners’ reserves held on OTC desks just grew to their highest level in over two years, and this could be a problem for the Bitcoin price.

Historically, when miners increase their holdings on OTC desks, it often precedes a bigger decline in the prices.

CryptoQuant reported on August 21 that the recent spike in Bitcoin OTC balances could be a pretty bearish signal.

The total amount held has now reached 368,000 Bitcoin, roughly equivalent to $22.36 billion.

Quite a lot, but what is more important, this is also a 70% increase over the past three months.

Historical precedents of miner selloffs

Looking back, increases like this in OTC balances often led to declines in Bitcoin’s price. For example, in May 2018, when OTC balances exceeded 400,000 BTC, Bitcoin’s price was at $8,500. But by December of that year, it had plummeted by 63% to $3,200.

A similar pattern occurred in November 2021, when Bitcoin was priced at around $64,000.

OTC balances then were near an all-time high of 500,000 BTC, and within two months, guess what? The price fell by 45% to $35,000.

Rising OTC balances could bring bad news, but for the good news, many thinks that other market dynamics could offset this selling pressure.

Bitcoin supply on exchanges is decreasing, and large investors, the whales accumulated 94,700 coins over the past six weeks.

Halving: less revenue, more challenges

The rise in OTC balances shows especially bad outlooks, because Bitcoin miners are already suffering with higher operational costs and reduced rewards following the April Bitcoin halving.

Right now the global average cost to mine a Bitcoin currently stands at $72,224, while the market price is less, meaning many miners are operating at a loss.

Colin Harper, a Bitcoin analyst, shared that big miners have been upgrading their equipment to cope with reduced revenues.

NEW: PUBLIC BITCOIN MINERS' NOT BAD (BUT NOT GREAT) Q2 IN 7 CHARTS

The Q2-2024 financials are in for public bitcoin miners, and I cover the highlights in my latest for Blockspace.

So where do these miners stand in the wake of the 2024 Halving?

Let's dig in👇

— Colin Harper 🥪 (@AsILayHodling) August 21, 2024

In a post on X, he highlighted that “every public miner has made significant efforts to upgrade their fleets to the latest technology.”

Have you read it yet? PayPal and Anchorage Digital partnership for rewards program

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.