Arthur Hayes, co-founder of BitMEX and chief investment officer at Maelstrom, said Bitcoin may soon move past the $100,000 mark.

On April 20, he posted on X, calling it the “last chance” to buy Bitcoin under six figures. He referred to upcoming US Treasury buybacks as a key event.

The US Treasury plans to repurchase its own bonds from the market. These buybacks increase financial system liquidity and can lower interest rates.

That often makes risk assets like Bitcoin more attractive to investors.

Hayes described these buybacks as a “Bazooka” for Bitcoin. The term points to their potential to change liquidity levels and market behavior without forecasting price movements. Treasury buybacks have previously aligned with rising Bitcoin demand.

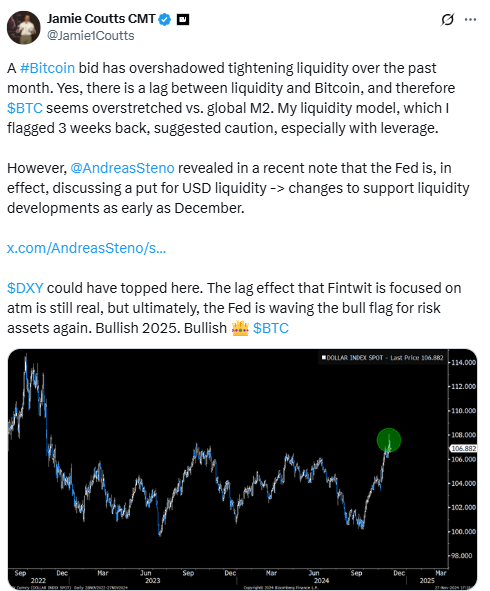

Arthur Hayes and Jamie Coutts See Liquidity as Key Factor

Real Vision analyst Jamie Coutts added to the discussion. He said Bitcoin’s value may reach $132,000 in 2025. He connected this to the rising M2 money supply — a measurement of cash, checking deposits, and near money in circulation.

Coutts argued that as M2 expands, Bitcoin’s price historically climbs. His chart showed a direct relationship between fiat supply and crypto asset performance. He did not refer to investor emotions or market hype but relied on previous monetary cycles.

M2 growth is not limited to one country. Central banks around the world have issued more money to support economies. That trend may keep increasing fiat circulation globally.

Weakening US Dollar Aligns With Bitcoin Momentum

Bitcoin crossed $87,700 on April 20, reaching a three-week high. The move followed a drop in the US Dollar Index (DXY), which tracks the strength of the dollar against other currencies. The DXY touched its lowest level since March 2022.

André Dragosch, Bitwise’s European head of research, said the dollar weakness likely supported the Bitcoin price.

“Looks like Bitcoin is pumping on continued Dollar weakness,”

he said on X.

The US dollar fell after President Donald Trump announced new tariffs on imported goods. Market reactions included selling the dollar, which often pushes investors toward assets like gold or Bitcoin.

Institutional Bitcoin Adoption Continues Despite Volatility

Japanese and UK firms are still buying Bitcoin during recent price fluctuations. On April 21, Japan-based Metaplanet bought 330 BTC for $28.2 million.

That brought its total Bitcoin holdings to 4,855 BTC, worth $414 million.

Metaplanet raised 2 billion yen ($13.3 million) through a bond sale in March. The funds went toward increasing its Bitcoin portfolio. Simon Gerovich, the company’s CEO, confirmed the acquisition on X.

Have you read it yet? Pi Network’s new roadmap is here, but people say it’s a big pile of sh*t

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.