The cryptocurrency market is on edge as Bitcoin’s drop raises fears of more possible decline to the $40,000 support level.

The great flushing of leveraged positions is coming again?

It’s about the psychological levels

Andrew Kang of Mechanism Capital warns that Bitcoin might face a much more brutal price correction, possibly falling to the $40,000 range.

He noted the importance of Bitcoin’s current trading range and the potential impact if it doesn’t hold.

Kang thinks that many market participants don’t fully understand the importance of losing a four-month range on Bitcoin.

Also many market participants thinks Kang don’t fully understand this doesn’t affect the hodlers who aren’t selling.

Higher

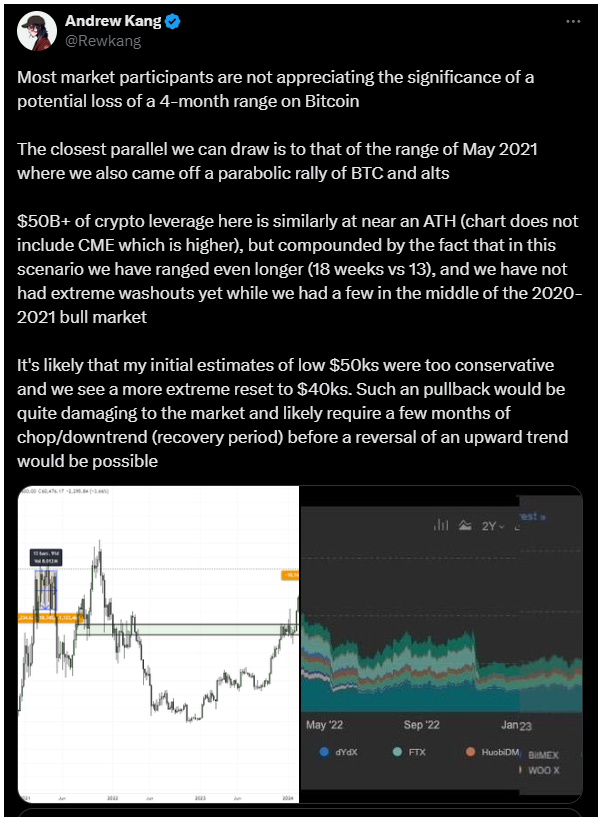

Kang compared the current situation to May 2021, when Bitcoin and altcoins experienced a similar correction after a parabolic rally.

He shared that the market was near all-time high levels of leverage, with over $50 billion in leveraged positions before the dip.

The trading range has also been extended for 18 weeks, longer than the 13-week range during the 2020-2021 bull market.

Not for the touchy feely

Kang suggested that his earlier estimates of a low $50,000 range for Bitcoin might have been too conservative.

Now the $40,000 range is possible. This isn’t unprecendented, there are numerous huge crashes in each and every cycle, often with 30-40% drawbacks.

This pullback could lead to a prolonged period of market weakness, lasting several months before any uptrend resumes.

The whole cryptocurrency market could also feel the effects, deterring new investors and shaking the confidence of current ones.