The Bank of England has reduced its interest rate by 0.25%, bringing it down to 5%.

This move was quite unexpected, because it ends one of the longest periods of high interest rates.

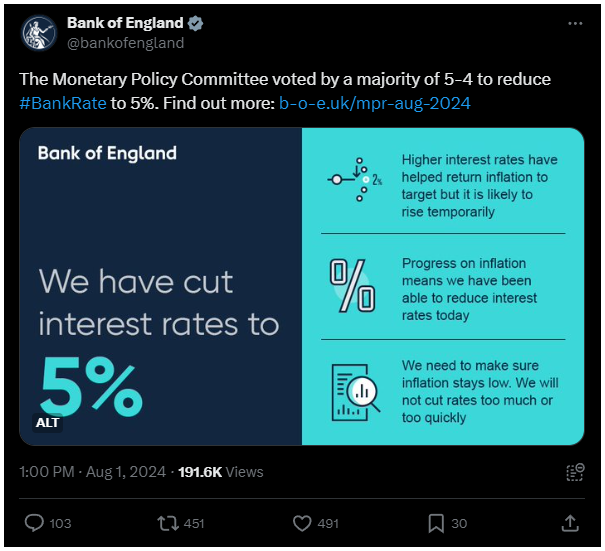

Bank of England’s rate cut

Bank of England announced via an X post, on August 1. that it had decided to lower the interest rate.

This decision was largely influenced by a bigger-ish drop in inflation, which fell from 8% to 2% over the past year. This is the first rate reduction by the bank since March 2020.

The surprise rate cut could positively impact Bitcoin prices, as it can grow the liquidity in the monetary system.

Before the announcement, there was uncertainty among economists about whether the bank would reduce or maintain rates.

While there is potential for further cuts below 5% later this year, possibly in November, the Bank of England’s governor told the bank is cautious about cutting rates too quickly or too drastically.

Inflation is expected to rise again from the 2% target in the coming months. Given the inflation comes from the monetary policy, they know how big it will be.

What is more interesting thing now, for the investors, easing monetary policy typically benefits risk assets like Bitcoin and gold, and many expects a price jump in an environment where liquidity grows.

US monetary policy set the trends as USD is the world’s reserve currency

Despite the UK’s first rate cut in four years, Bitcoin’s price remains below the $65,000 mark.

This disappointing performance likely be due to the United States Federal Reserve’s decision to keep its rates unchanged in August.

Yes, there is a possibility that Bitcoin might experience a big boost if the US indeed cuts rates in September.

According to CME’s FedWatch tool, there is an 86.5% chance that the Federal Reserve will lower its rate to 5.00% – 5.25% in September, down from the current 5.25% – 5.50%. Bring it on!

Federal Reserve set the price of money

Federal Reserve Chair Jerome Powell told that a rate cut could come as soon as September, but also told they need for strong economic data before making borrowing easier.

In August, the central bank kept its main interest rate unchanged, as expected, and Powell mentioned that a rate cut in September depends on further positive data on inflation and the job market.

The recent ADP report showed slower job growth, with only 122,000 new jobs in July, compared to the expected 150,000. Additionally, annual pay increased by 4.8%.

This weak data and a significant drop in 10-year U.S. bond yields suggest decreased confidence in future economic growth, reinforcing expectations for a rate cut.