Bitcoin is on a roll, hitting new all-time highs this week, but analysts are saying it’s not showing any signs of overheating.

Alex Thorn, head of research at Galaxy shared that the fundamentals behind Bitcoin suggest that there’s still room for growth.

The fearless Bitcoin market, forged in the icy storms of the crypto winter

Thorn explained that the current state of Bitcoin doesn’t look overheated from a fundamental standpoint.

This sentiment was echoed by Aurelie Barthere from the crypto analysis firm Nansen, who noted that Bitcoin’s recent surge in volume signals strong momentum following the elections.

Barthere pointed out that after Donald Trump’s victory on November 5, traders have been eager to jump back into the market, which is reflected in the rising prices of cryptocurrencies.

Funding rates and Open Interest, the name of the game?

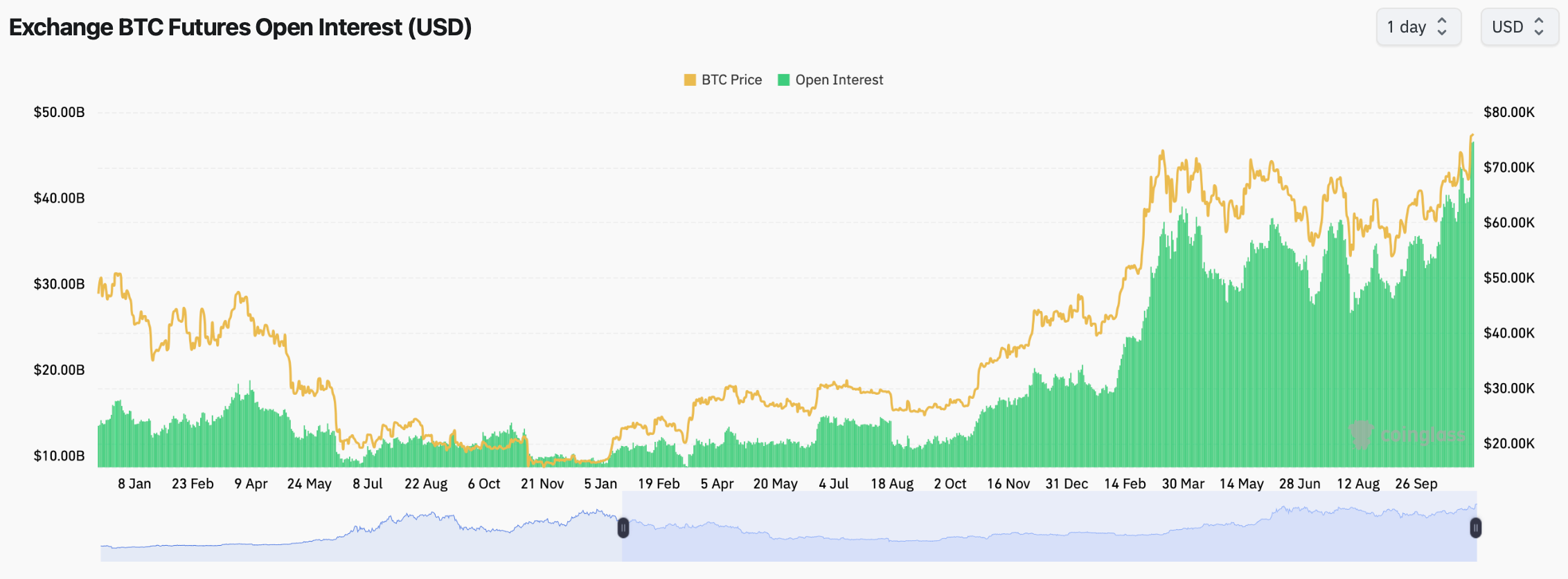

Thorn also mentioned that while Bitcoin’s Open Interest already increased slightly to new yearly highs, funding rates have remained mostly stable.

A stable funding rate suggests that traders are optimistic about Bitcoin’s future price movements and are willing to pay fees to hold their positions.

Bitcoin’s OI reached $45.4 billion, showing a 13.3% increase since November 5. As of now, Bitcoin’s funding rate on Binance stands at 0.0100%.

Thorn is optimistic about Bitcoin and other cryptocurrencies will trading significantly higher over the next 12 to 18 months.

Technical analysis suggests that traders are eyeing a potential rally that could push Bitcoin into the $78,000 to $85,000 range soon.

Markets are waiting for Fed

Adding to the positive vibes in the crypto market is the U.S. Federal Reserve’s decision on November 7 to implement a 25-basis point rate cut, something many market participants had anticipated since earlier cuts in September.

This rate cut is seen as pretty bullish for crypto because it makes traditional investments like bonds less appealing.