The Bitcoin futures-to-spot trading volume ratio dropped by 63% since the last bull market’s peak, and experts warn this is a big shift in market dynamics.

The ratio

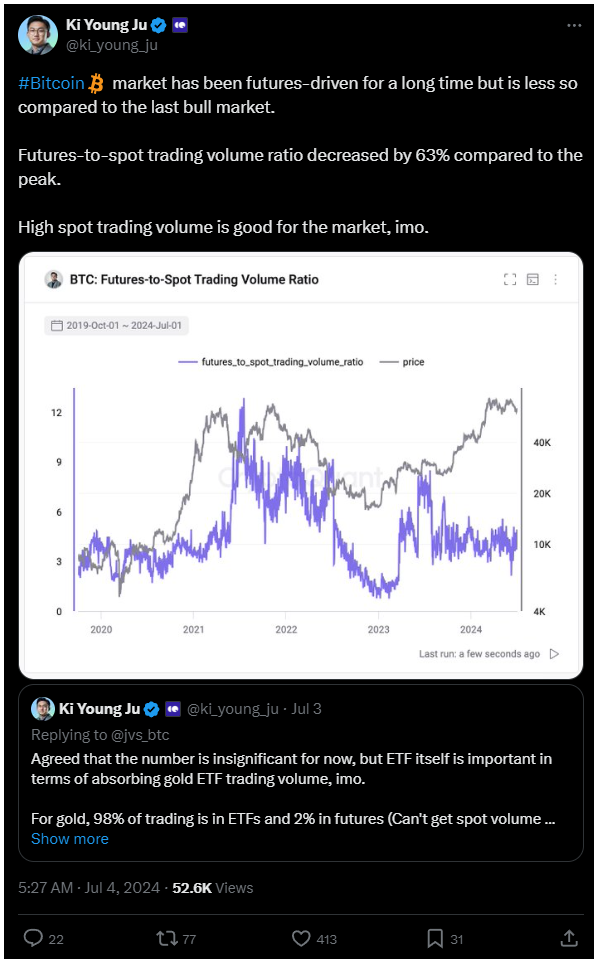

According to Ki Young Ju, founder and CEO of CryptoQuant, the Bitcoin market has become less dependent on futures trading compared to the previous bull run.

As he told, the key metric here is the futures-to-spot trading volume ratio, which measures the relationship between Bitcoin futures and spot trading volumes.

Which one is bigger, and how many times?

This ratio indicates the total amount of Bitcoin being traded on various exchanges, both in spot and futures markets.

A high ratio means the futures market has more trading volume than the spot market, while a low ratio suggests that spot trading is more dominant, and both situation tells us something important.

Once upon a time futures ruled the market

During the 2021 bull run, the futures-to-spot trading volume ratio reached very high levels, exceeding 12 at its peak.

This meant that futures trading volume was more than twelve times higher than spot trading.

Then the ratio decreased in the second half of 2021, it remained relatively high into early 2022.

But ass the bear market set in, the ratio dropped big time as speculative interest waned.

In 2023, the ratio briefly returned to early 2022 levels but since then it decreased and stabilized at lower levels. Compared to its 2021 peak, the ratio has declined by about 63%.

Right now, the futures markets aren’t that important, or dominant like in 2021, and Ju thinks this is a pretty positive sign for the markets in general.

Paper Bitcoin

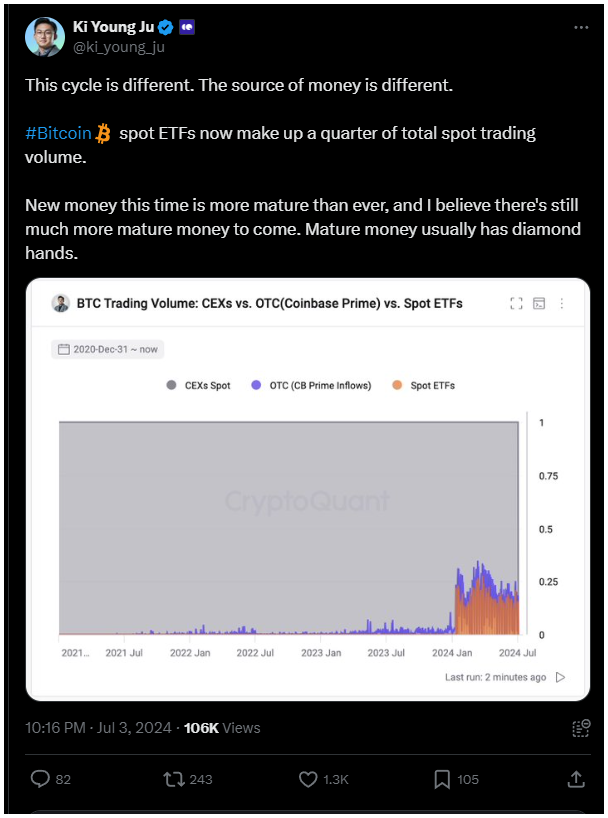

Likely the biggest change in this cycle is the rise of spot exchange-traded funds, the long awaited ETFs as a new way to trade Bitcoin.

Ju shared that these ETFs now, six months after their launch, account for almost a quarter of the total spot trading volume, which means they have strong influence to the trading sector, the exchange dynamics.

These changes may have unintended consequences. Some experts think the reduced dominance of futures trading and the rise of spot ETFs could lead to a more mature, more stable market with less volatility.

Which is considered as a good thing. Also the growing popularity of spot ETFs also suggests that investors may be seeking more direct exposure to Bitcoin rather than engaging in derivative trading, but a Bitcoin ETF is still paper Bitcoin, an IOU, not a real asset.