Bitcoin ETFs have seen their biggest outflow in nearly a month as tensions in the Middle East seems to escalate.

Geopolitical concerns causing inconvenience

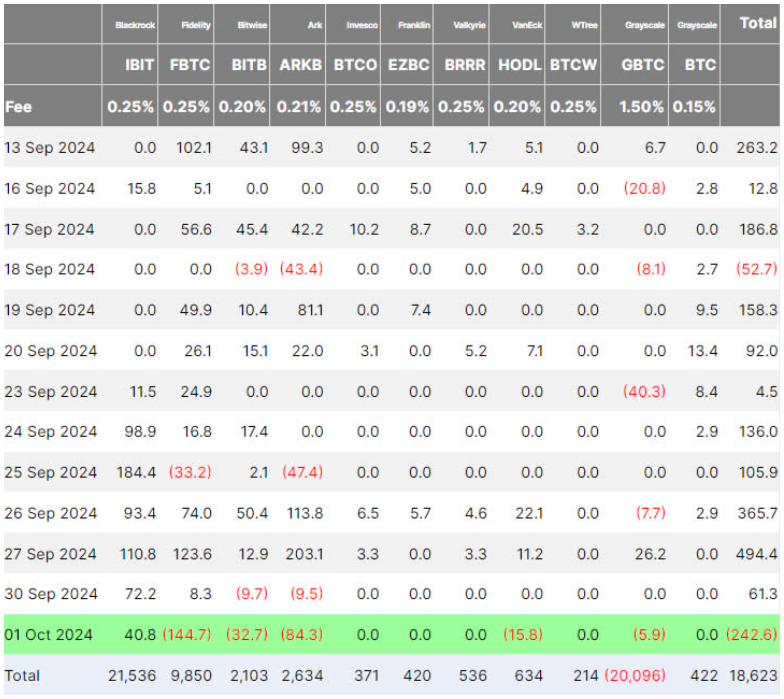

U.S. spot Bitcoin ETFs faced nearly $243 million in outflows on October 1.

The total outflow for the 11 U.S. spot Bitcoin ETFs was $242.6 million, making it the largest drop since September 3, when $288 million left BTC ETFs.

This outflow is also the third-largest in the past five months, breaking an eight-day trend of inflows that peaked at $494 million on September 27.

The Fidelity Wise Origin Bitcoin Fund experienced the largest outflow, losing $144.7 million.

No land for Bitcoin ETFs

Other big losses included the Bitwise Bitcoin ETF, which had an outflow of $32.7 million, and the VanEck Bitcoin ETF, which dropped by $15.8 million.

The Grayscale Bitcoin Trust also lost $5.9 million. Not every issuer bleeded, there were no changes for Invesco, Franklin, Valkyrie, WisdomTree, and Grayscale’s Mini Bitcoin Trust.

Interestingly, the BlackRock iShares Bitcoin Trust was the only fund to record positive flows, gaining $40.8 million for the day and marking its 15th consecutive day without an outflow. But BlackRock is the biggest player, so maybe this is not so interesting.

Price drops

Spot Bitcoin prices fell sharply by nearly $4,000 following Iran’s missile attack on Israel on October 1.

The price dropped to a two-week low of $60,315 before recovering slightly to $61,620 at the time of writing. In addition to Bitcoin ETFs, nine U.S. spot Ether ETFs also reported outflows, totaling $48.6 million for the day.

Grayscale’s Ethereum Trust led these losses with a drop of $26.6 million on October 1, while the Fidelity Ethereum Trust lost about $25 million.

Institutional investors seek safer assets, so if tensions in the Middle East continue to rise and affect market stability further, we might see more decline in crypto prices, and also, more withdrawals from ETFs.