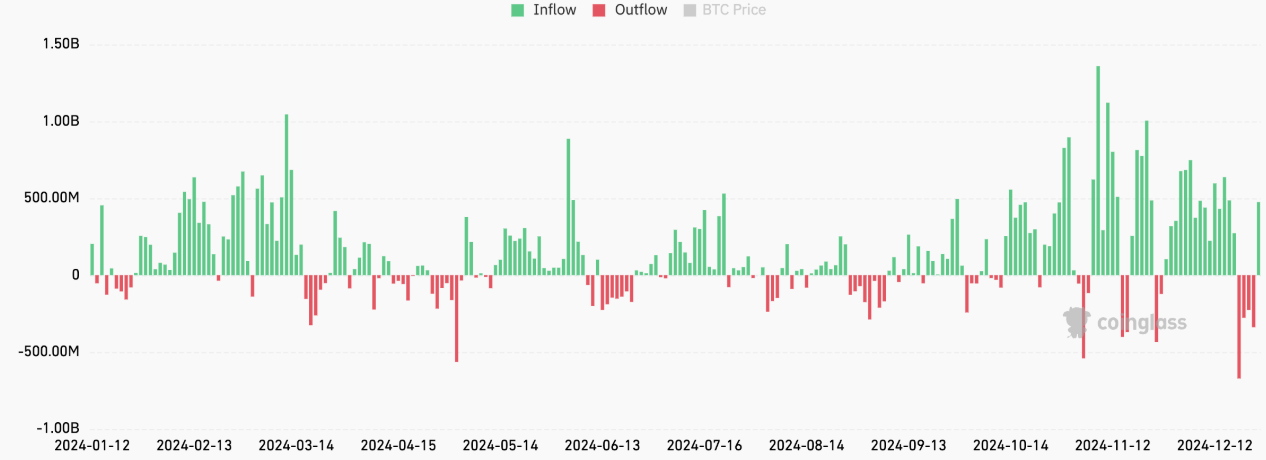

U.S. Bitcoin ETFs saw a strong rebound after four days of painful outflows that totaled over $1.5 billion.

On December 26, these ETFs collectively welcomed $475.2 million in net inflows, signaling renewed investor interest.

Xmas gift?

This jump was led by Fidelity’s Wise Origin Bitcoin Fund, which alone attracted $254.4 million, but following closely was the ARK 21Shares Bitcoin ETF with $186.9 million, and BlackRock’s iShares Bitcoin Trust ETF brought in $56.5 million.

Even Grayscale’s mini Bitcoin ETF and VanEck’s ETF managed to snag some modest inflows of $7.2 million and $2.7 million, respectively.

This positive shift comes after a tough stretch for the ETFs, which experienced a total net outflow of about $1.52 billion between December 19 and December 24.

IBIT had a particularly rough day on December 24, suffering its largest single-day outflow of $188.7 million, which is more than double its previous record.

Up&down

Bitcoin itself has been on a bit of a rollercoaster ride, dropping 2.2% to just above $96,000 after flirting with the $98,000 level earlier.

Meanwhile, Ethereum ETFs have also been enjoying some love, raking in a total of $301.6 million over three consecutive trading days, including $117.2 million on December 26 alone.

Fidelity’s Ethereum ETF led the charge with $83 million in inflows, while BlackRock’s iShares Ethereum Trust ETF followed with $28.2 million.

Most successfull ETFs ever?

As we approach the end of the year, it’s worth noting that Bitcoin ETFs have accumulated an impressive total of $35.9 billion in net inflows since their launch, with total assets under management now sitting at around $111.9 billion.

On the other hand, Ethereum ETFs have seen net inflows of $2.63 billion and have an AUM close to $12 billion.