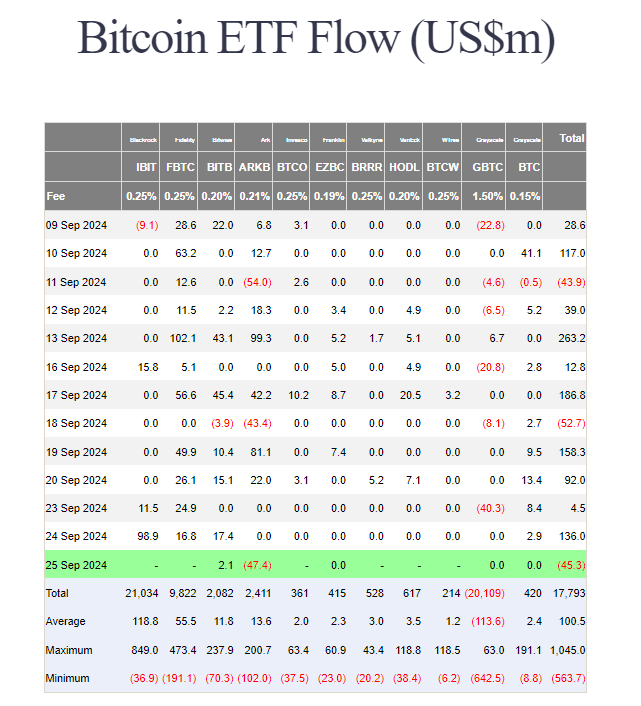

Bitfinex analysts shared that ETF inflows is starting to grow again, which could help maintain Bitcoin’s price even as demand for spot buying on crypto exchanges declines.

Price support from Bitcoin ETF buyers

In a report Bitfinex analysts stated that “sustained ETF inflows could buoy the BTC price,” which they see as a legit argument against to their prediction of short-term price consolidation due to the decrease in Bitcoin purchases on exchanges.

“With Bitcoin spot market buying slowing, evidenced by spot Cumulative Volume Delta flattening when the price reached $63,500, we foresee BTC moving in a range in the near term.”

This September is different?

On September 24, spot Bitcoin ETFs recorded total cumulative inflows of $136 million, marking a four-day streak of positive inflows.

This is pretty important, because September is often viewed as a bearish month for Bitcoin traders, with losses, not gains, as over the last 11 years, Bitcoin posted an average monthly loss of 4.49% in September.

At the time of writing, Bitcoin’s price increased by approximately 6.26% since the last week, trading at $63,700, but Bitcoin’s dominance, which represents its share of the total crypto market cap, has dipped 1.35%, now standing at 57.62%.

Upside or consolidation, what’s next for the BTC price?

The exchange’s analysts suggested that Bitcoin could see further jump if ETF inflows remain positive while traditional finance markets like the S&P 500 continue to rally.

Of course, if spot buyer demand doesn’t return, they believe the most likely scenario is that Bitcoin’s price will consolidate or see a partial correction without sustained spot buying.

There is a general consensus in the industry that the U.S. election in November will play an important role in Bitcoin’s future price direction.

But others aren’t that concerned, and some industry leaders expect Bitcoin to reach $200,000 by the end of 2025 regardless of who wins the 2024 U.S. presidential election.