Bitcoin’s market share reached nearly 60%, to its highest level since April 2021, while altcoins have struggled to gain traction in the past 24 hours.

As Bitcoin’s price continues to rise, the alt market remains relatively quiet.

Rise and shine

Bitcoin’s dominance hit a three-and-a-half-year peak of 58.77%, coinciding with its price reaching a ten-week high of $67,800.

Bitcoin briefly retraced to $64,880, but then it quickly climbed back to trade just above $67,000, bringing its market capitalization to $1.32 trillion.

Historically, when Bitcoin’s dominance increases, it often spells trouble for alts, which either remain flat or decline in value.

On this particular day, Bitcoin gained 2.5%, while most altcoins didn’t see any positive movement.

Some traders believe that Bitcoin’s dominance may not last long and could soon decline, potentially opening the door for altcoins to rise.

ICT Crypto founder Benjamin Cowen predicted that Bitcoin’s dominance might peak at 60%.

Similarly, crypto investor Coach K Crypto told that Bitcoin needs to make a big move before anything else can happen. He suggested that a drop in Bitcoin’s dominance would allow memecoins and other major alts to gain momentum.

GM FAM.#Bitcoin dominance (BTC.D) has touched an ATH for this cycle.

IT HASN'T BEEN THIS HIGH SINCE 2021

We need to let #Bitcoin rip before anything else can happen.

Soon enough, there's going to be a breakdown in BTC.D.

This will lead to memes and other major alts getting… pic.twitter.com/V73ZhVRt04

— Coach K Crypto (@Coachkcrypto) October 15, 2024

Market shift on the horizon?

Analyst Moataz Elsayed shared that he expects Bitcoin’s dominance to “crash hard,” signaling the start of an altcoin season.

Historically, Ether tends to be one of the first assets to react when Bitcoin’s dominance falls.

Right now the Ether to Bitcoin ratio has been close to its lowest point since April 2021, dropping below 0.039 again this week.

Sideway market is finally over?

Since reaching an all-time high of $73,738 in March, Bitcoin has mostly traded sideways but is now nearing a critical psychological level, the 2021 high of $69,000 that it held for about three years.

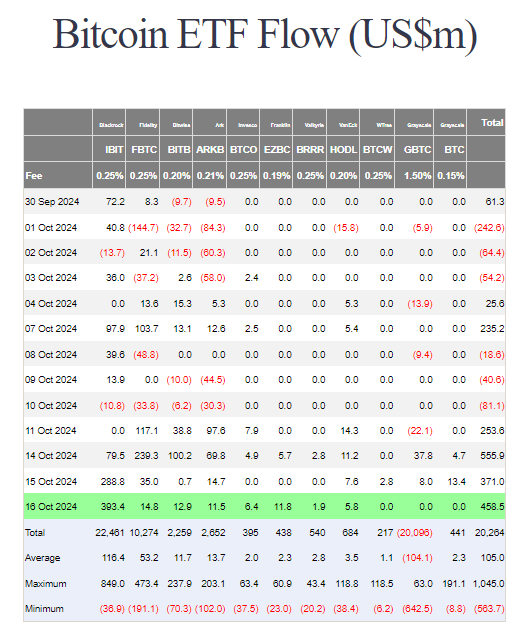

Institutional investors still show strong interest in Bitcoin, on October 15 alone, eleven U.S. spot ETFs saw net inflows of $371 million.

Over the past three trading days, these products have accumulated more than $1.1 billion in total inflows.