What’s happening with Bitcoin right now? After hitting a record high of $109.5K in January, Bitcoin has been struggling, retesting its lows around $90K for the fourth time this year.

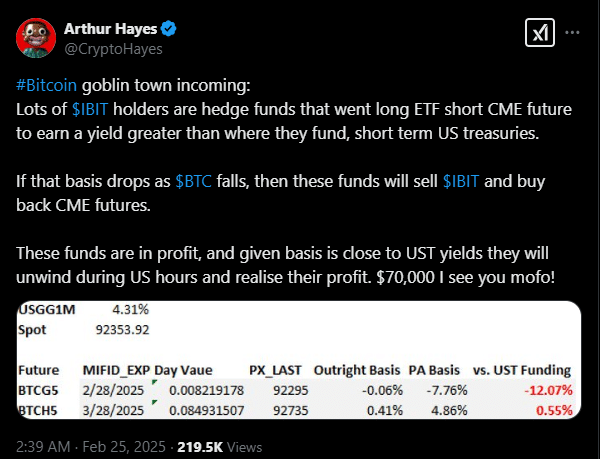

And Arthur Hayes, the founder of BitMEX thinks that things could get even worse, potentially plummeting to $70K.

Why the pessimism?

Hayes points to the unattractive yields on CME Bitcoin Futures as a major concern.

Essentially, if large funds don’t see enough profit, they might start unwinding their positions, leading to a price drop.

He also noted that short-term U.S. treasuries are offering better returns, making Bitcoin less appealing.

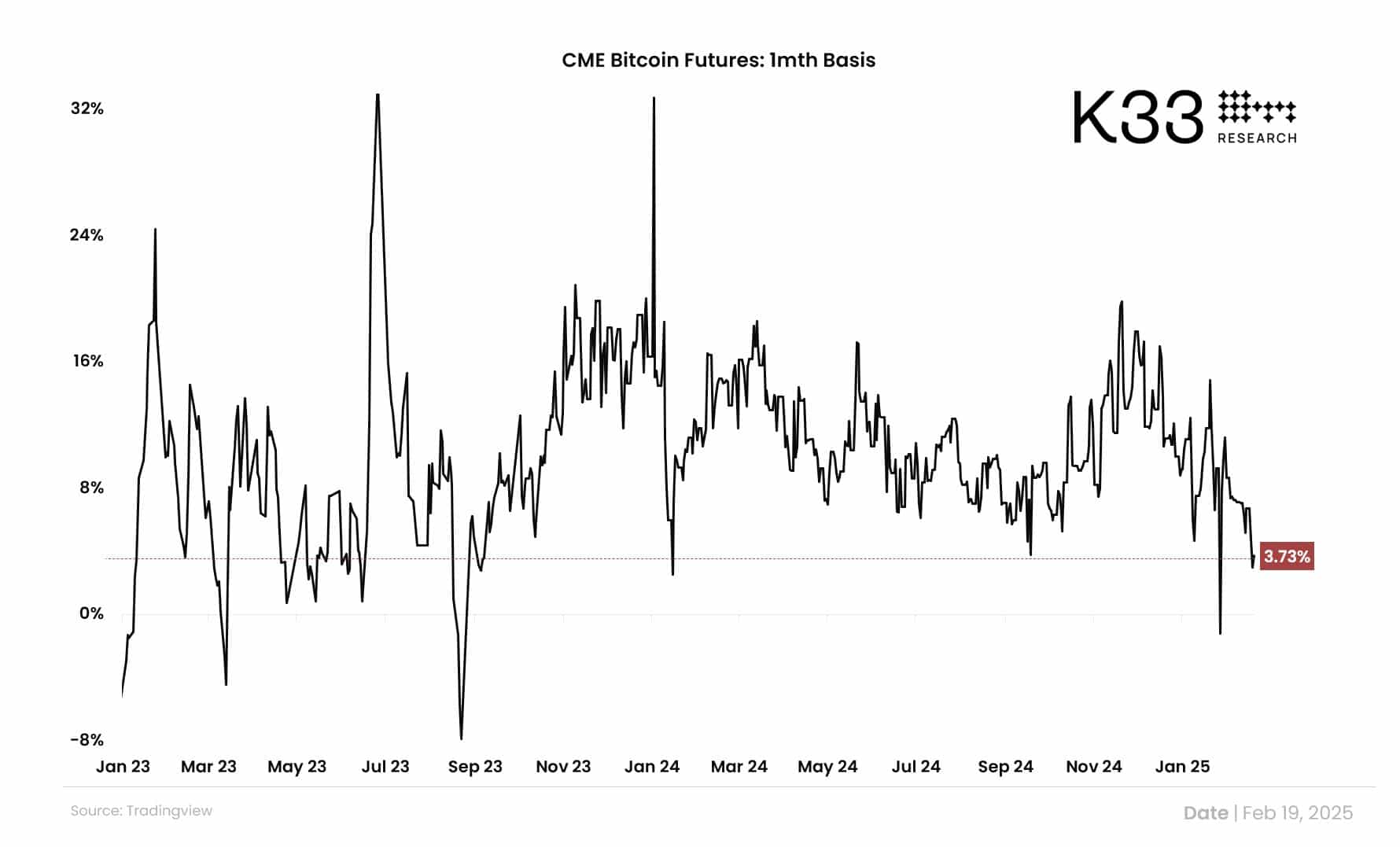

Vetle Lunde from K33 Research agrees, highlighting that the CME BTC Futures basis has fallen to pre-bull market levels, indicating quiet bearish sentiment.

Macro uncertainty weighs in

It’s not just about Bitcoin tho, as macroeconomic uncertainty is affecting the entire market.

Bitfinex analysts suggest that Bitcoin’s increasing correlation with traditional markets means it’s feeling the pinch from the U.S. equity market’s struggles.

The S&P 500’s downturn has dampened risk appetite across the board, impacting Bitcoin too.

A mid-bull run reset?

On the other hand, the party isn’t over yet. Chris Burniske from Placeholder thinks this pullback is just a typical mid-bull run reset, similar to what happened in 2021. He reminds us that Bitcoin can be volatile, but these cycles aren’t new.

From a fundamental perspective, Bitcoin’s Market Value to Realized Value ratio is looking pretty overheated, which could signal a cycle top if it reaches certain levels. But we aren’t there.

Have you read it yet? Bybit Bounces Back from $1.4 Billion Hack

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.