Bitcoin is experiencing a strong pullback that has left many investors feeling uneasy. After hitting an ATH of just over $108,000 on December 17, the cryptocurrency has seen its price drop by about 12%.

Bear force

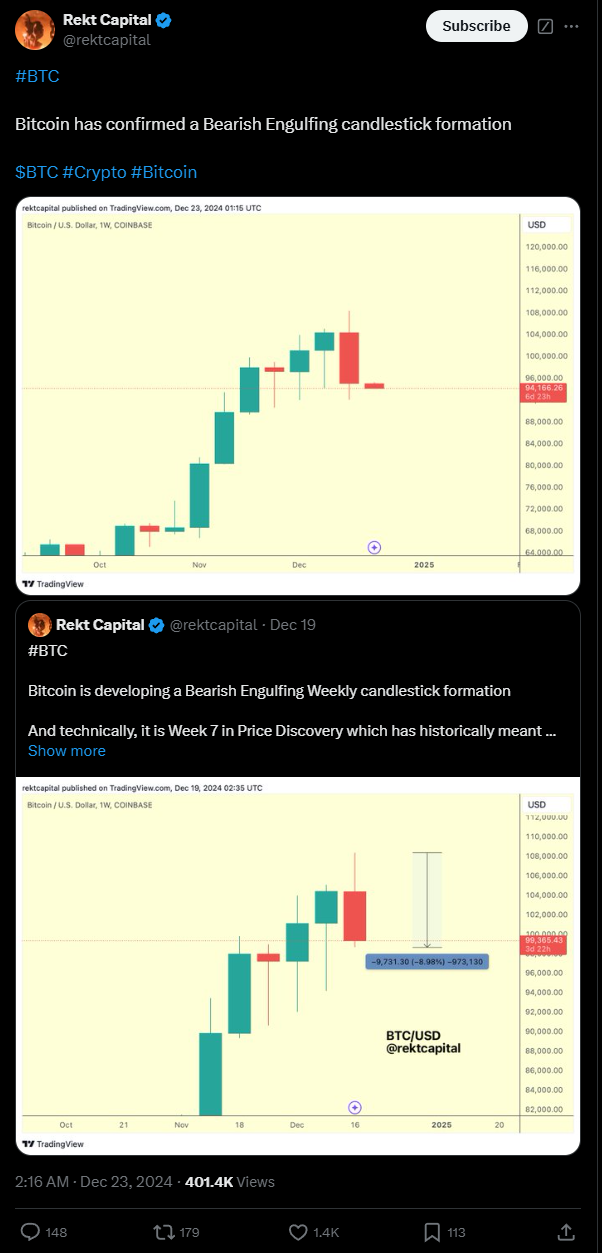

The downturn has resulted in what analysts are calling a “bearish engulfing” weekly candle. In simpler terms, it means that the losses have wiped out all the gains Bitcoin made over the past month.

Popular crypto analyst Rekt Capital noted that Bitcoin is showing signs of entering a multi-week correction phase, and compared this situation to previous market cycles, indicating that once Bitcoin gets through these typically rough weeks, it often finds a bottom and starts to recover.

“Historically, week eight in Bitcoin price discovery tends to be a corrective week.”

This week marks the worst performance for Bitcoin since Donald Trump won the U.S. presidential election back in November, and the Federal Reserve’s cautious outlook on monetary policy has also dampened the optimism surrounding Bitcoin’s rise.

Despite this correction, Bitcoin is still up over 40% since Trump’s victory.

Money market

David Lawant from FalconX highlighted that as we approach the end of the year, we might see more volatility due to a low-liquidity environment.

For example, on December 27, there’s a massive crypto options expiry event coming up with nearly $18 billion worth of BTC and ETH contracts set to expire, and many thinks that could shake things up even more!

Adding to the drama, spot Bitcoin ETFs saw nearly $950 million in outflows last Thursday and Friday as investors reacted to the market pullback.

The dip

While this correction is certainly unsettling, it’s important to remember that fluctuations are part of the crypto world.

Analysts are keeping a close eye on key support levels—if Bitcoin can hold above $90,000, it might just stabilize and bounce back, but if it dips below, we could be looking at more painful drops.

Some analysts even suggest that if things go south, Bitcoin could test levels around $80,000.