As the U.S. election approaches, the excitement in the crypto industry is palpable, especially among Bitcoin traders.

Despite some uncertainty surrounding the election, large funds are making huge bets on Bitcoin’s future.

The current picture

Bitcoin flirted with an all-time high in the past days, moving above $73,000, thanks to strong demand for Bitcoin ETFs and increasing optimism about a potential Trump victory.

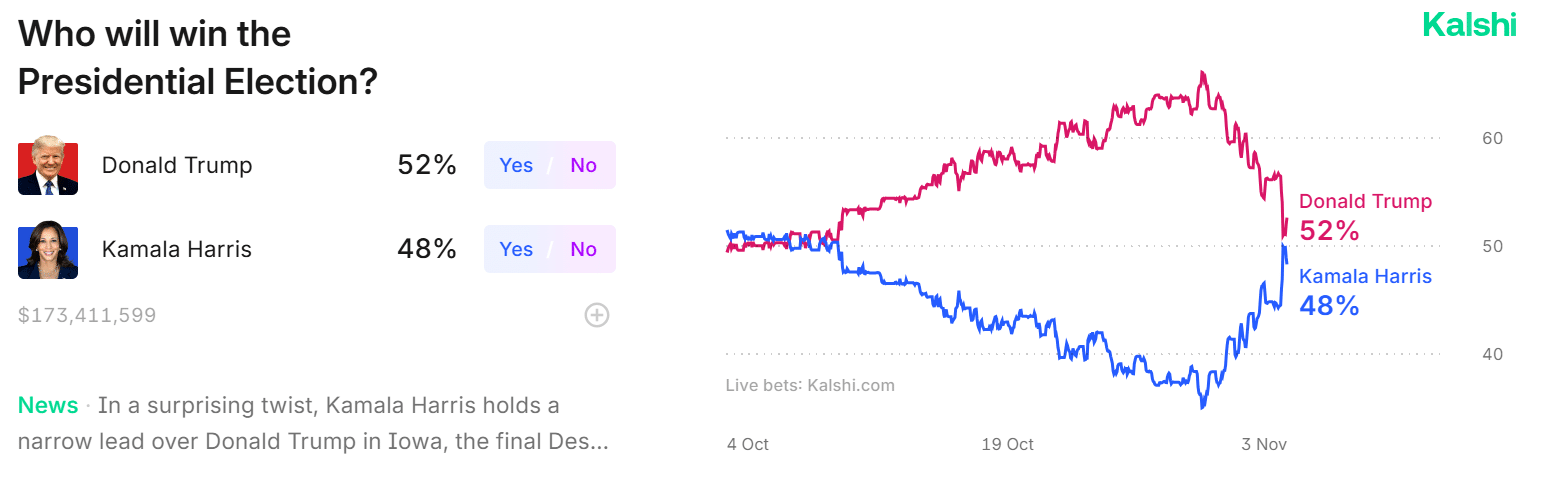

But then things have tightened up, and Kamala Harris has nearly matched Trump’s odds on Polymarket, making it a nail-biter of a race.

Even with the election heating up, hedge funds remain bullish on Bitcoin. They’re not just sitting back, they’re actively covering their bases in case the market swings in either direction.

There’s been a surge in options trading, with big players buying call options targeting prices between $70,000 and $85,000 by November.

Hedge funds eyeing big targets, they’re gambling?

A new Deribit report shared that there’s overwhelming option buying leading up to the election, indicating that funds are hedging their bets with strategies like buying both calls and puts to protect against price swings.

1) Overwhelming Option buying in the Election runup.

Large Fund buying echoing (covering?) CME Nov 70+80+85k Call buying with Nov 74-85k Calls +Nov 70k Straddles.

In addition, a large Fund added to Mar 85k upside with Mar 90k Calls.

Even ETH stirred, 5k Nov 2.6k straddles bought. pic.twitter.com/k5BGFYmxs1— Deribit Insights (@DeribitInsights) November 2, 2024

Interestingly, traders are shifting their focus from options expiring on November 8 to those set for November 29.

This suggests that many expect delays in determining the election outcome, likely due to potential controversies or claims of rigging.

“November 8 still has some activity, but larger flows are heading toward November 29 due to less theta decay if results take longer.”

Hello volatility, my old friend!

This rather cautious approach might explain why Bitcoin’s price dipped from last week’s high of $73K to below $68K.

Some analysts even predict it could drop further based on historical trends around election time.

With all this activity and speculation, it’s clear that traders are preparing for volatility as we head into election week.

The stakes are high, and whether you’re a seasoned trader or just curious about the crypto space, what’s ahead us it’s definitely a game-changer week.