Telegram reportedly had $400 million in digital assets at the end of 2023, based on the company’s financial statements for that year.

Telegram’s financial struggles despite big revenue

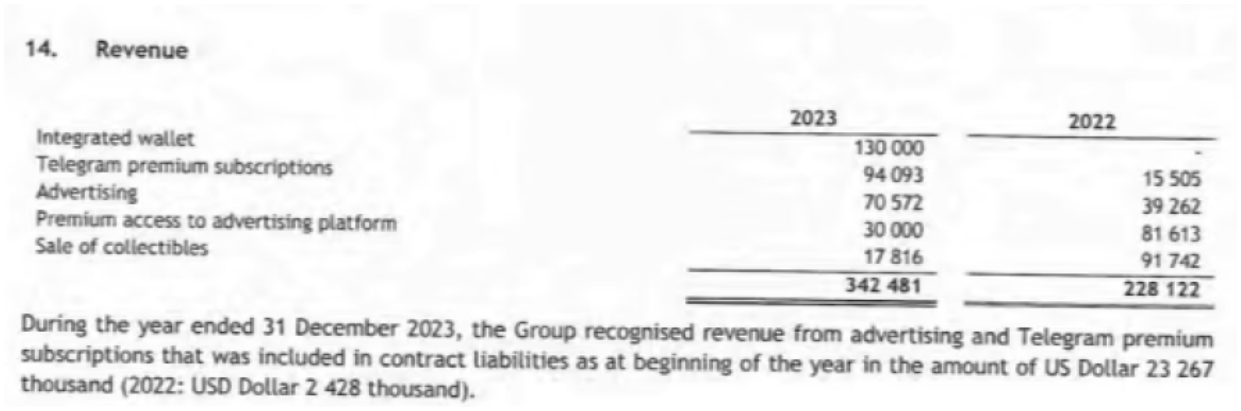

Despite earning $342.5 million in revenue, Telegram revealed a $108 million operating loss in the last year.

A pretty big portion of its income, about 40%, was linked to activities involving digital assets, and this includes money generated through an integrated wallet service and the sale of various digital collectibles.

The wallet within Telegram allows users to manage their cryptocurrency, like storing, sending, receiving, and trading assets.

Telegram also offers collectibles like usernames and virtual phone numbers, which users can buy, sell, and trade. The company takes a cut from these transactions, adding another revenue stream.

How it’s going?

This year started relatively good, the data shows that Telegram earned $11.66 million in in-app purchases during the first two months of 2024.

Since its launch, the app raised over $4 billion in investment funding, so the financial backing is more than strong.

But as profit-making venture, it facing challenges, and not just from he market.

On August 24, Telegram’s CEO Pavel Durov was arrested upon landing at Le Bourget airport near Paris.

He is facing serious charges, including supporting terrorism, trafficking, conspiracy, fraud, and money laundering. Durov was taken to court four days later, and then released by bail.

The TON ecosystem’s reaction

The cryptocurrency originally developed by Telegram, the TON experienced heightened trading activity as futures traders began to hedge their positions after Durov’s arrest.

TON’s price dropped to around $5.30, down more than 21% from $6.70 over the past week, and the market capitalization of TON also fell by nearly 2%, landing at $13.42 billion in time of writing.

Many market analysts believe TON could rebound, even if there is massive headwind now.

If Durov’s arrest is seen as an isolated incident that doesn’t fundamentally harm the Toncoin network, investors might view the current dip as a good, rare buying opportunity, potentially driving a price recovery amid the market’s uncertainty.