Despite growing global interest in digital currencies, Canadians still favor cash for their transactions, according to the Bank of Canada’s latest report.

They want to pay with cash for their coffee

The Bank of Canada’s sixth Methods-of-Payment, MOP report, released on this week, reveals that crypto usage in Canada isn’t yet widespread.

In a survey of 4,000 people about their spending habits, many Canadians still prefer cash in 2023.

Only 3% used Bitcoin for payments

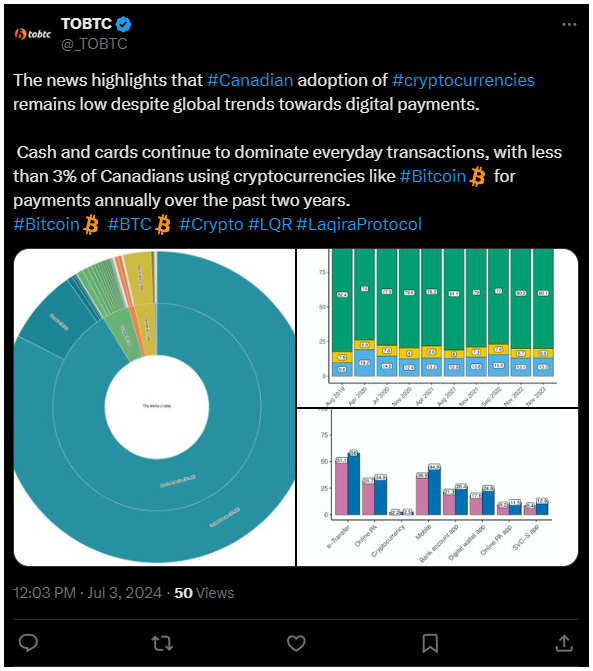

The MOP report shows that about 20% of all purchases in 2023 were made with cash, but alternative payment methods are also becoming more popular, and the most commonly used alternative is e-Transfer, with 58% of respondents using it in 2023, up 7% from the previous year.

PayPal is also popular, with a 35% adoption rate. In case of crypto, less than 3% of Canadians used Bitcoin for payments, which contrasts with the country’s status as the second-largest hub for Bitcoin ATMs globally, hosting over 3,000 machines.

The first crypto ATM was installed in Vancouver in 2013, more than ten years ago.

80% of survey participants said they have no plans to stop using physical cash, preferring it for its lack of bank fees, privacy, and reliability during internet outages.

Institutions are way more interested

While crypto adoption among the general public is slow, Canadian institutions are increasingly interested in digital assets.

A KPMG report from April shows that 39% of institutional investors in Canada had some exposure to crypto in 2023, up 31% from 2021.

These investors are attracted by the improving custody solutions and the maturing crypto market.

The approval of spot Bitcoin exchange-traded funds has been a huge factor driving institutional money tot he sector.