Rising Bitcoin supply in Asia highlight the region’s role in influencing price movements.

The house of the rising sun

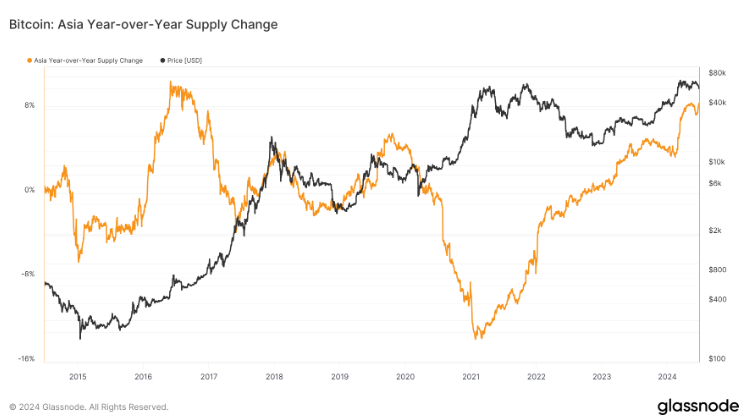

The year-over-year change in Bitcoin supply within Asia has shown very visible fluctuations that align with its price changes.

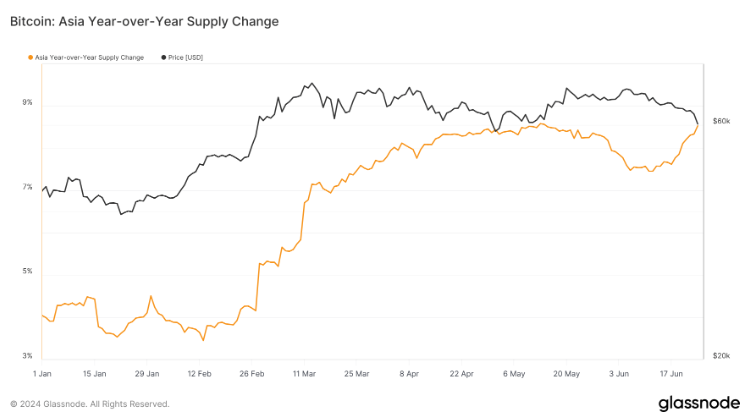

Since January, the supply change in Asia has surged from about 4% to over 8% by mid-May.

In the same time-period, Bitcoin’s price rised to over $70,000. Then it dipped at the start of June, of course, but it has since returned to the 8% level. It’s basically doubled.

This trend suggests that Bitcoin accumulation in the Asian market is growing, likely driven by increased trading activity and investor interest, despite the market downturns.

Supply is growing, so prices are growing?

Historically, the Asian market has big role in shaping Bitcoin’s price trends. Long-term data shows that periods of high supply change in Asia often coincide with major price movements.

For example, during the 2017 bull run, a similar increase in supply change was followed by the price appreciation, when the Bitcoin price reached the $20,000.

The current data mirrors this historical trend, and many experts think this means a possible continuation of this pattern in 2024.

Market makers

In the 2020-2021 bull run, Asia didn’t follow this trend because they sold as the market peaked, unlike in 2016, when they sold as Bitcoin approached its 2017 peak.

In 2021, the supply change went negative for the first time since records began with Glassnode.

While there was accumulation in late 2017, the supply change has never returned to its 10% peak from 2016.

Right now, the supply change in Asia is closer to the top than it has been in over eight years. Some says this is pretty promising sign. Time will tell.

The Asian market’s impact on Bitcoin’s supply and the possible correlation with price movements remains an interesting factor to monitor, that’s sure, as the region’s role is undoubtedly vital in the crypto market.