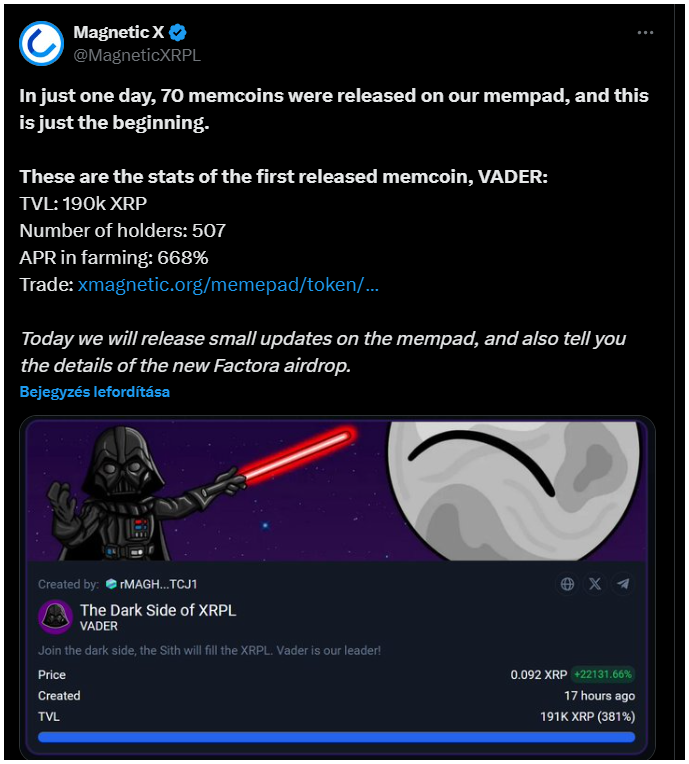

The leading decentralized exchange on the XRPL, Magnetic X launched the Memepad, a dedicated platform for meme tokens.

This new launch is giving users the chance to create and launch their own coins, sparking a wave of innovation. But what innovation.

The memecoin boom

With the rise of memecoins on XRPL, interest is skyrocketing. Since Memepad’s debut, around 70 memecoins have launched, and the first one, VADER, is making waves with a total value locked of 190k XRP and an impressive annual percentage rate of 668% for farming.

One user noted, “It’s only been a week, and some coins already have market caps over a million dollars!”

Scams and regulation

But not everyone is feeling optimistic. Some users are raising red flags about potential scams, and there are worries that unlicensed memecoins are popping up just to pump prices for quick profits.

One user voiced concerns about regulatory scrutiny, speculating that the SEC’s stance on Ripple might lead to confiscations of memecoins on the XRPL.

“The SEC hates Ripple; do you think they’ll let all the XRPL memecoins slip away? Nope! Those creators will find their tokens confiscated.”

Adding to the tension is the launch of the Illicit Virtual Asset Notification initiative, which wants to tackle criminal activities involving virtual assets in real-time.

This global partnership involves governments and law enforcement working together to combat emerging threats.

The future of memecoins

One thing is sure, the excitement around memecoins continues to grow.

As more tokens emerge on the XRPL, community members are encouraged to stay vigilant and verify information through official channels because as there are more and more legit tokens, there are new possible scams too.

With new platforms like First Ledger allowing users to trade and track tokens on XRPL, it’s pretty important to be cautious.