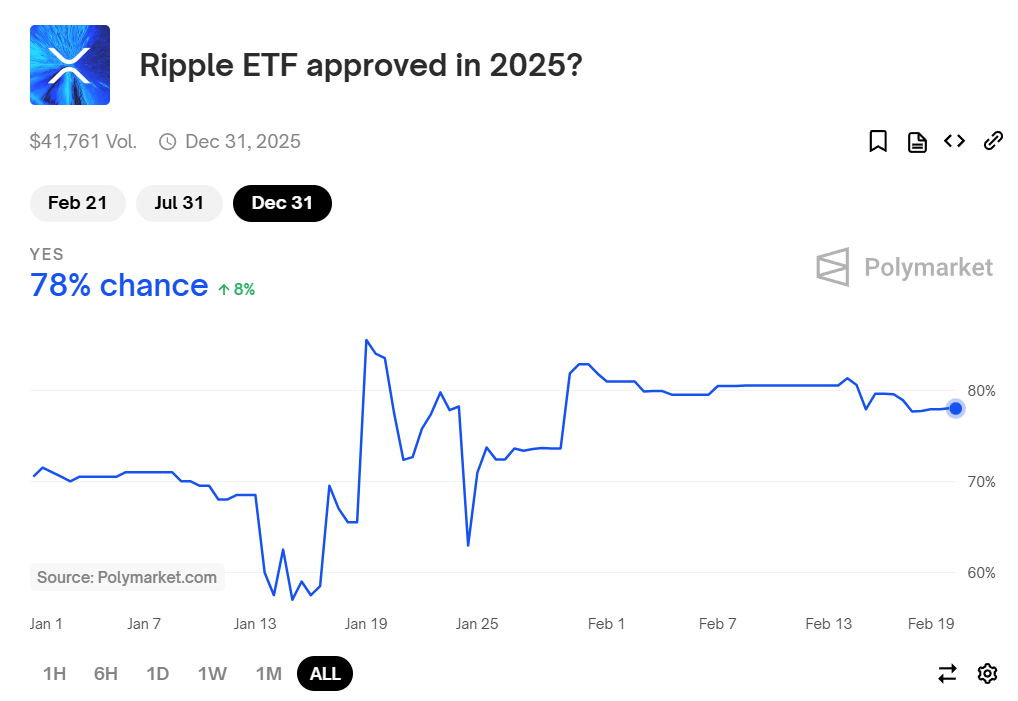

Fresh numbers from Polymarket suggest, there’s 78% chance that the SEC will give the green light to an XRP ETF this year.

The wisdom of crowd isn’t always accurate, but the chances are high.

Crypto ETFs are inevitable?

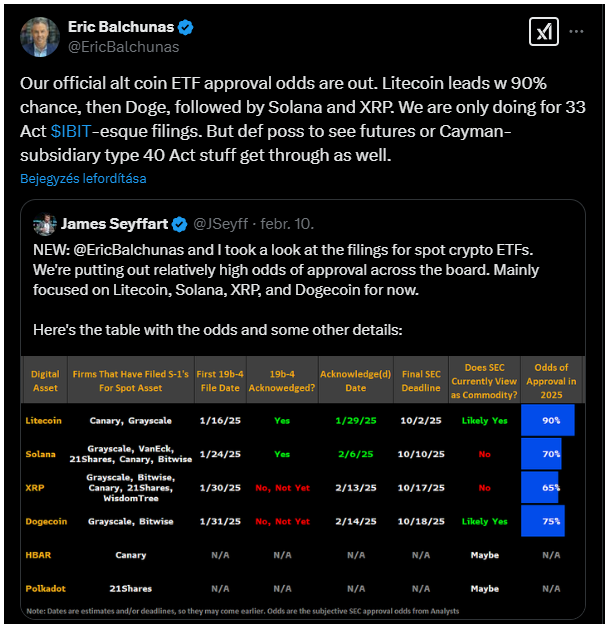

What’s fueling this optimism? Well, a pack of firms, including big names like 21shares, Grayscale, Bitwise, Canary Capital, and Wisdomtree have already thrown their hats in the ring with applications for an XRP ETF.

And with a modest betting volume on Polymarket backing this prediction, it seems like people are feeling pretty confident.

This forecast even outstrips the 65% approval odds suggested by Bloomberg analysts Eric Balchunas and James Seyffart, two well-known ETF experts.

Not just the XRP, but others too

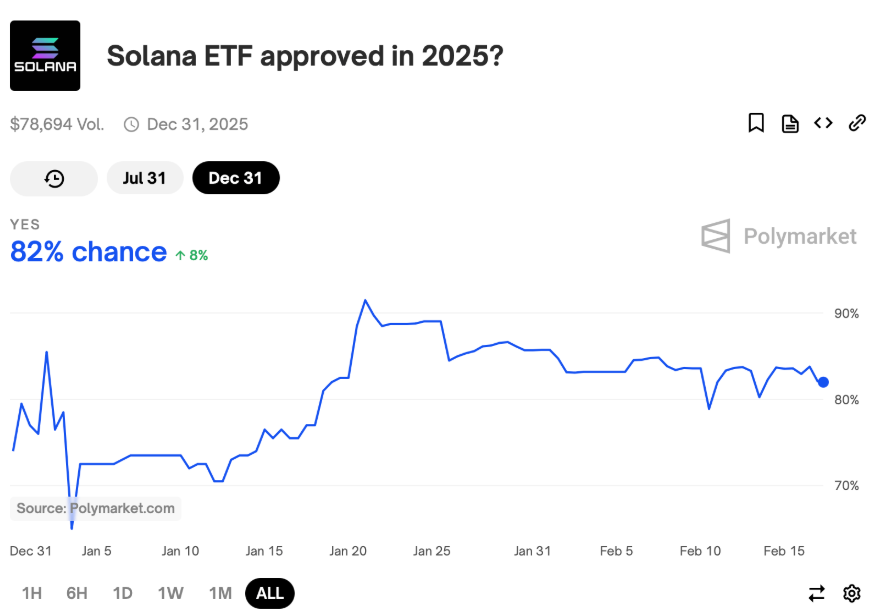

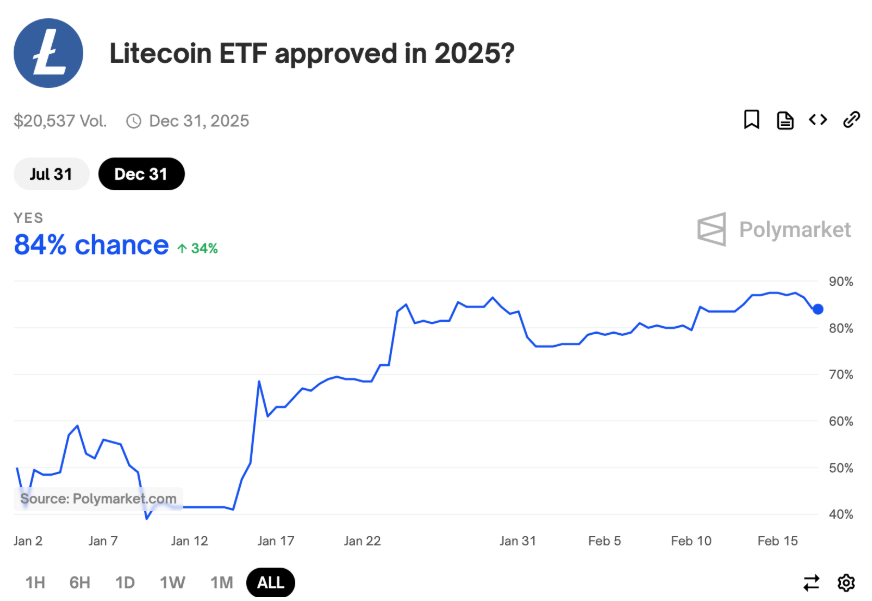

Our betting buddies at Polymarket aren’t just placing their chips on XRP, but they’re also feeling quite lucky about Litecoin and Solana.

In fact, Balchunas and Seyffart have cranked up the odds even higher for these two, and they’re predicting a nice 90% chance for an LTC ETF and a solid 70% for SOL.

And while Dogecoin isn’t currently up for grabs on Polymarket, those analysts are still giving it a decent 75% shot at SEC approval.

The future is here

Now, let’s break down what’s happening on Polymarket. The odds for a SOL ETF approval are sitting pretty at 82%, backed by a volume of $78,694.

LTC isn’t far behind at all with an 84% chance based on a smaller volume of $20,537. It looks like bettors are riding high on the wave of optimism.

With all this excitement brewing under the Trump administration’s watchful eye, we might be witnessing a huge shift in how crypto financing operates.

If these predictions hold true, it could pave the way for innovative asset management strategies, and a whole new selection of crypto ETFs.

Have you read it yet? Bitcoin to a million? Bitwise CEO thinks it’s possible!

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.