January saw a pretty jaw-dropping jump in new tokens, with over 600,000 new coins hitting the market.

That’s not just a little bump, it’s a 12-fold increase compared to the same time last year If you thought the crypto world was wild before, just wait until you hear what analysts are saying about this frenzy.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Liquidity crisis on its way?

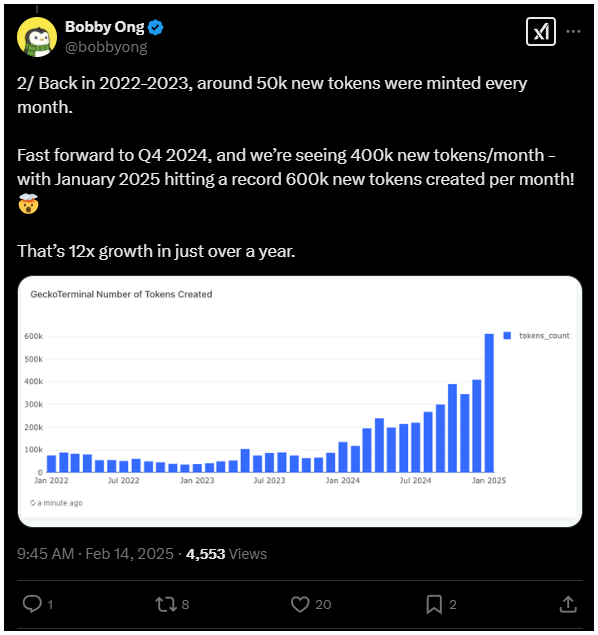

Bobby Ong, the co-founder of CoinGecko, shared some stats on X. He already noted that back in 2022-2023, we were seeing around 50,000 new tokens minted each month.

Fast forward to the end of last year, and that number skyrocketed to 400,000. And then came January 2025. Boom! A record-breaking 600,000 new tokens were created in just one single month. I mean, what?

So, what’s going on? Ong points to platforms like Pump.Fun that make it super easy to create new tokens, and it’s not just about convenience, but also a sign of a bullish crypto market where excitement is running high.

Maybe way too high, and this comes with a catch, because all these new tokens are spreading liquidity and investor attention thin.

Gabriel Halm from IntoTheBlock warns that this can lead to disjointed price action, means that basically, prices bouncing around without any clear direction.

Everything is on the market, but where’s the purchasing power?

The impact of this token overload is already being felt. Established altcoins are struggling to regain their 2021 highs because there just isn’t enough momentum in the market.

Analysts are predicting a delayed altseason as the sheer number of cryptocurrencies dilutes investor focus. And money.

And here’s where it gets even more interesting, traditional finance institutions are shaking things up.

In past bull markets, profits from Bitcoin would typically flow into Ethereum and then trickle down to alts and memecoins.

But with more institutional players entering the crypto game, that flow is changing. Halm explains that this influx will inevitably alter how capital moves within the crypto space.

Rising stars. Thousands.

Ong echoed these sentiments by pointing out that liquidity fragmentation is causing the current lack of momentum in the market.

With so many tokens out there, traders’ attention and liquidity are being stretched thinner than ever. That’s why we’re not seeing those explosive altcoin rallies we used to know and love.

At this rate, we could be looking at over one billion tokens in the next five years.

Have you read it yet? Bitcoin’s sentiment turns negative, are we in trouble?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.