Cardano holders faced significant pressure recently as prices dipped, but there may be a little relief, as there has been a visible increase in interest within the DeFi sector, and the Cardano DEX.

Big milestone, but what’s next?

Adaverse recently reported in the social media as Cardano’s decentralized exchange saw daily trading volumes exceed 23 million ADA, indicating a nice rise in trading activity.

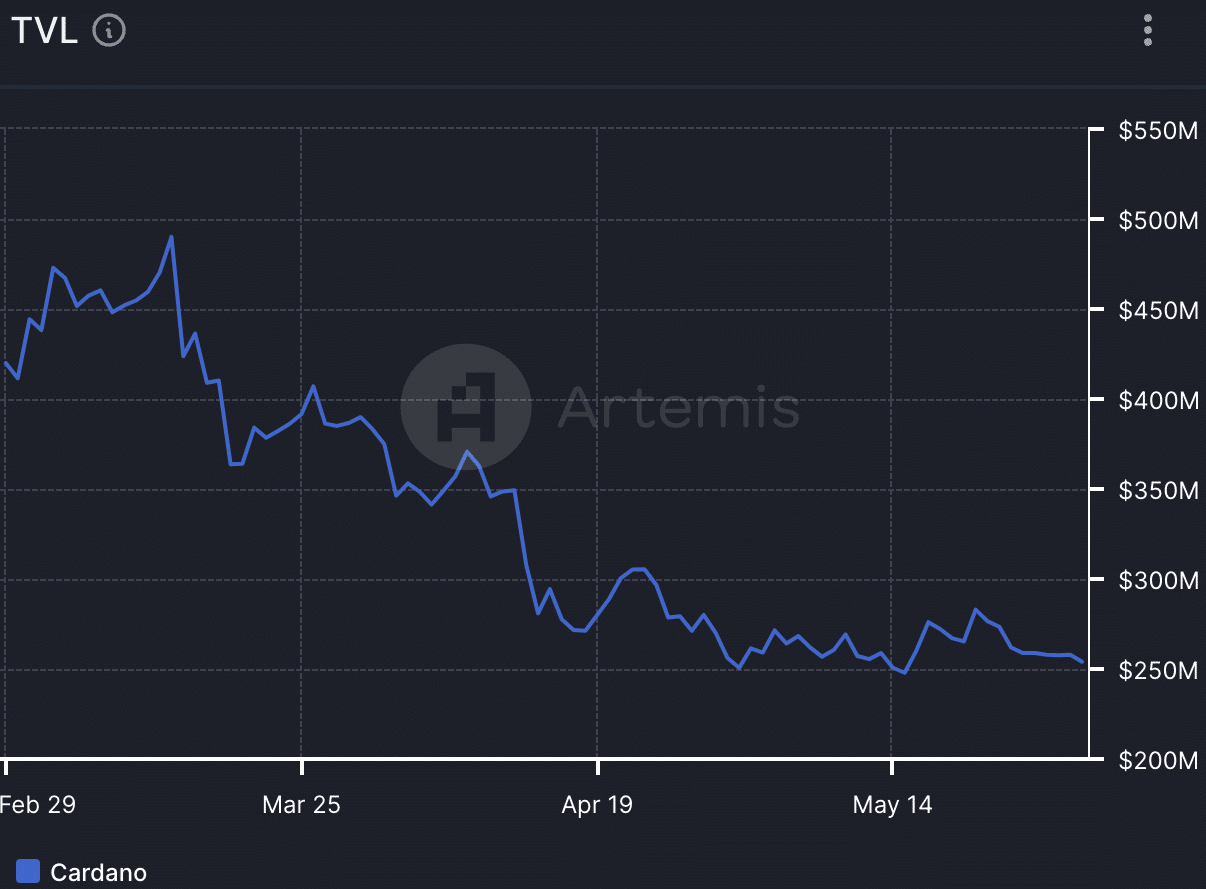

Despite this boost in DEX volumes, Cardano’s total value locked, the so called TVL metric experienced a pretty big drop.

According to Artemis, the TVL for Cardano decreased from $430 million to $230 million, suggesting declining interest in Cardano’s decentralized applications.

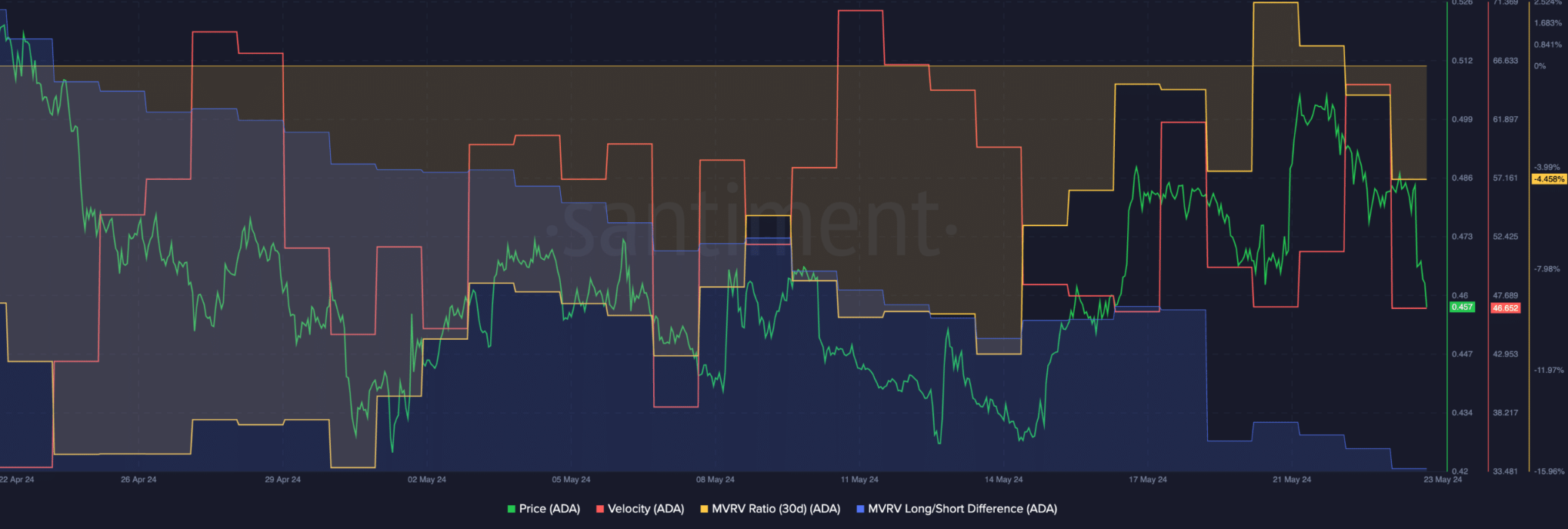

Many expert highlights the numbers on TradingView and Santiment aren’t looks good at all, multiple importand indicators flashing bad signs for the near future.

Testing ADA resistance. Once again.

And if this isn’t enough, the NFT trades on the Cardano network also declined.

Over the past month, popular NFTs on the Cardano blockchain saw a massive drop in both floor price and trading volume.

Most of the experts and analysts agree that this fading interest in Cardano’s ecosystem could negatively affect the protocol and ADA’s price performance.

As of now, ADA is trading at around $0.45. The past weeks have seen ADA prices forming multiple lower lows and lower highs, pointing to a bearish trend.

ADA’s price fluctuated between $0.512 and $0.421, with the $0.512 level being tested multiple times.

If ADA retests and weakens the $0.512 level again, a price reversal might occur, and we get a long awaited uptrend. But current indicators do not support a bullish outlook for ADA.

Rainy days for the traders

The Relative Strength Index for ADA has significantly declined, signaling the momentum is far from bullish.

Similarly, the Chaikin Money Flow for Cardano has also dropped, showing a decrease in money flowing into ADA.

Another problematic aspect is ADA’s declining velocity, suggesting that the frequency of ADA trades has decreased big time in recent days.

The Market Value to Realized Value ratio for ADA has fallen too, indicating reduced profitability for most addresses. The majority of holders are in red.

These trends suggest investors and traders likely move away from ADA in favor of more promising options, both for long-term investments and trading, and many are afraid the increasing activity on Cardano’s DEX might not be enough to counteract the declining prices.

Have you read it yet? MicroStrategy’s newest follower purchased bitcoin for $40 million

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.