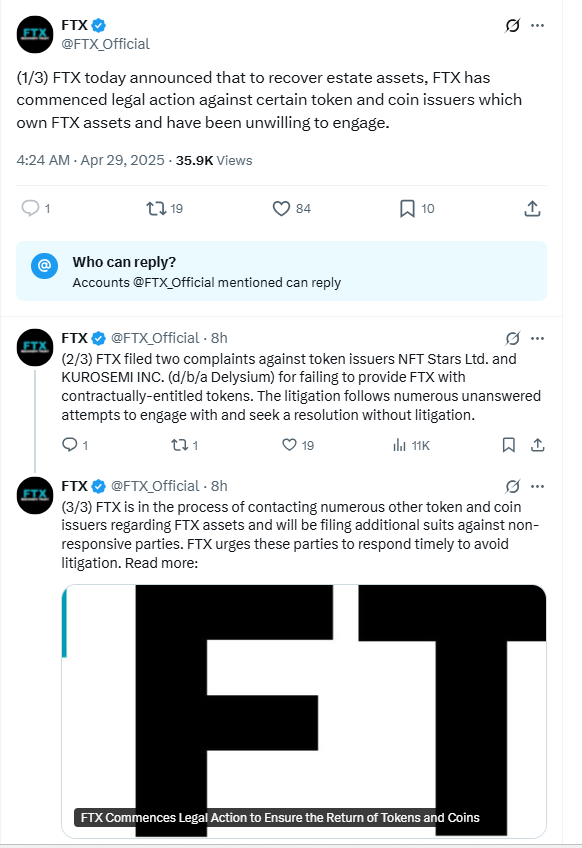

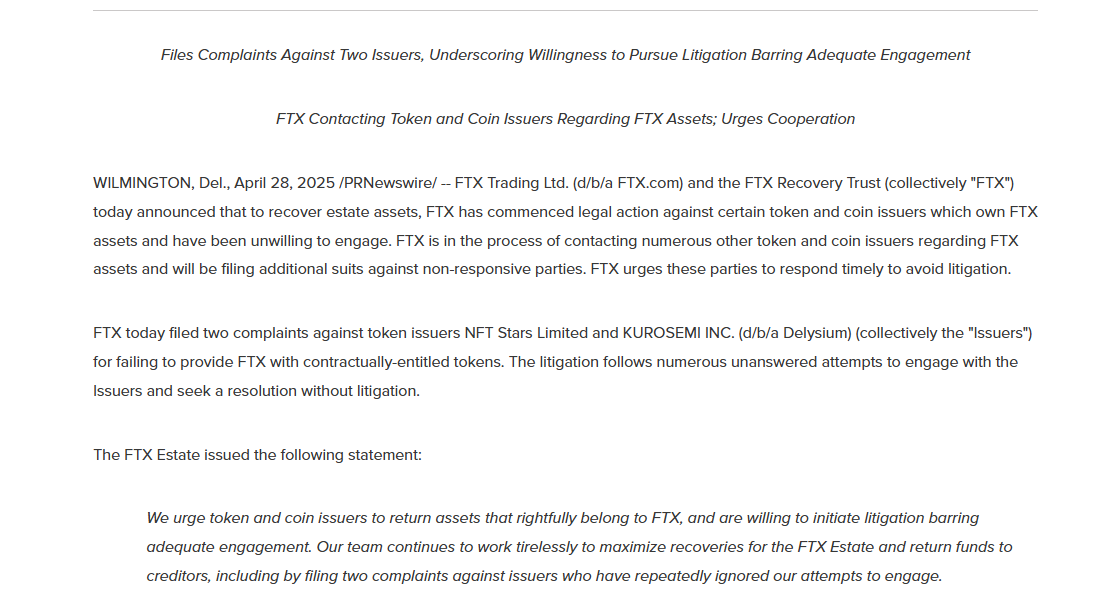

FTX filed lawsuits against NFT Stars Limited and Kurosemi Inc. on April 29, 2025, accusing them of failing to deliver tokens as agreed.

Kurosemi operates the Delysium platform. The lawsuits are part of FTX’s asset recovery strategy to repay creditors after its bankruptcy.

According to a press release by the FTX Estate, the company had made multiple attempts to negotiate without litigation. However, both NFT Stars and Kurosemi reportedly ignored these efforts.

In a public statement, the FTX Estate said,

“We urge token and coin issuers to return assets that rightfully belong to FTX, and are willing to initiate litigation barring adequate engagement.”

FTX lawsuits against NFT Stars and Kurosemi show the company’s determination to retrieve assets to distribute among creditors.

The exchange collapsed in November 2022 following a liquidity crisis and an $8 billion account shortfall.

FTX Expands Legal Action to More Token Issuers

FTX stated it is negotiating with other token issuers beyond NFT Stars and Kurosemi. The company warned that it would pursue legal action against any issuers who refuse cooperation.

The goal remains to maximize asset recovery for the FTX Estate. Litigation is now a major tool as FTX accelerates its recovery process.

The lawsuits against NFT Stars and Kurosemi mark the latest development in FTX’s broader effort to rebuild funds after the bankruptcy. The asset recovery plan aims to benefit creditors waiting for repayment.

FTX Prepares for Second Round of Fund Distributions

FTX initiated its first round of fund distributions on February 18, 2025. Payments went to holders in the Convenience Class, a group for smaller approved claims.

The exchange announced that the next distribution record date was April 11, 2025, with payments beginning on May 30, 2025.

This second round will include payouts for Class 5 Customer Entitlement Claims, Class 6 General Unsecured Claims, and new Convenience Claims.

These steps come as FTX moves through its approved creditor repayment plan. However, challenges continue to emerge in the bankruptcy process.

In March 2025, FTX faced a setback when Three Arrows Capital (3AC) had its claim against FTX increased.

A court ruling raised the claim from $120 million to $1.5 billion after discovering more extensive dealings between 3AC and FTX. The amendment proceeded despite FTX’s objections.

New Crypto Regulations Proposed After FTX Collapse

The fall of FTX continues to influence crypto regulation discussions. Earlier this month, US Senators introduced the PROOF Act to address industry risks.

If passed, the PROOF Act will require crypto exchanges to separate customer assets from company funds. It will also enforce monthly “Proof of Reserves” audits by independent firms.

Lawmakers aim to use these measures to ensure asset transparency and avoid situations like the FTX collapse.

The focus remains on protecting customers and maintaining accurate balance sheets.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.