The International Monetary Fund (IMF) confirmed El Salvador’s compliance with its agreement to stop Bitcoin accumulation in the public sector.

Rodrigo Valdes, Director of the IMF’s Western Hemisphere Department, said in an April 26 briefing that El Salvador met its non-accumulation criteria.

“In terms of El Salvador, let me say that I can confirm that they continue to comply with their commitment of non-accumulation of bitcoin by the overall fiscal sector, which is the performance criteria that we have,”

Valdes said.

Valdes also pointed to strong progress in El Salvador’s governance and transparency improvements under the IMF fiscal reforms program.

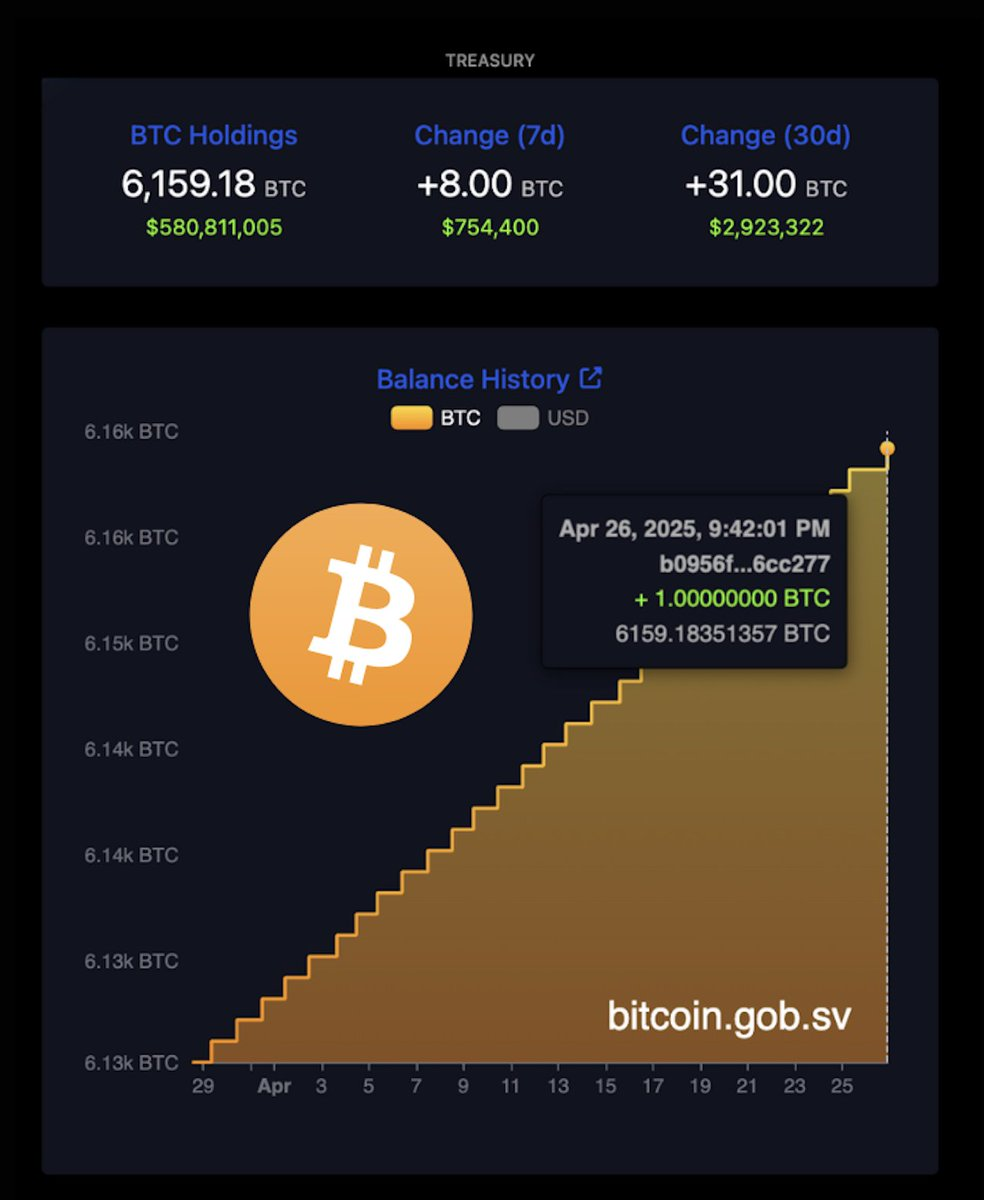

However, while the IMF praised El Salvador’s fiscal actions, on-chain data showed that Bitcoin accumulation in El Salvador quietly continued through other channels.

El Salvador Bitcoin Holdings Grow With 31 BTC Added in April

Blockchain records confirmed that El Salvador Bitcoin holdings increased despite IMF claims. According to the National Bitcoin Office, El Salvador Bitcoin reserves grew by 31 BTC in the past month.

The Bitcoin Office El Salvador reported that the country purchased 8 BTC over the past week alone.

These El Salvador Bitcoin purchases raised the total government holdings to 6,159 BTC. At the time of reporting, these Bitcoin assets were worth over $580 million.

NayibTracker data also showed that El Salvador had gained 99.93% profit on its Bitcoin investment.

The government spent around $155 million to build its Bitcoin reserves. Stacy Herbert, Director of the Bitcoin Office El Salvador, explained the country’s ongoing Bitcoin accumulation policy.

“El Salvador continues front-running the rest of the world by adding to its Strategic Bitcoin Reserve. First mover advantage intensifies,”

Herbert said.

The new Bitcoin acquisitions by El Salvador showed a clear gap between official statements to the IMF and actual government actions on digital assets.

El Salvador IMF Loan Tied to Major Bitcoin and Fiscal Policy Changes

The El Salvador IMF loan agreement, signed in December 2024, was valued at $1.4 billion. Under the deal, El Salvador agreed to significant Bitcoin policy changes to unlock new funding.

The IMF required the government to stop forcing Bitcoin acceptance for merchants, end Bitcoin-based tax collection, and cut back the Chivo wallet project. These steps were part of wider El Salvador fiscal reforms tied to the loan.

Rodrigo Valdes said these El Salvador fiscal reforms could unlock up to $3.5 billion in additional financial aid. He stressed that governance, transparency, and fiscal discipline were the focus of the program, not Bitcoin adoption.

IMF officials continued to monitor Bitcoin accumulation in El Salvador closely as a condition of ongoing financial support.

Tether and NVIDIA Partnerships Highlight El Salvador’s Technology Push

Beyond Bitcoin, El Salvador expanded its technology sector by attracting major companies. Tether El Salvador announced it relocated its headquarters to the country.

The company cited El Salvador’s supportive crypto regulations as a reason for the move.

NVIDIA El Salvador also entered into an agreement with the government. El Salvador signed a letter of intent with NVIDIA to develop sovereign artificial intelligence infrastructure. The project aims to build local AI capabilities to support national digital growth.

The arrival of Tether and the partnership with NVIDIA showed that El Salvador continued seeking new technology partnerships while managing its Bitcoin policies under IMF oversight.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.