Listen up, Bitcoin’s been stuck in a rut, trading in a quite tight range between $83,000 and $86,000 since April 9.

It’s like the whole market is holding its breath, waiting for some clarity on Trump’s economic policies.

The 200-day SMA is acting like a brick wall, refusing to budge. You gotta wonder, what’s the holdup?

The Trump-trade

It all comes down to Trump’s mixed signals on tech tariffs. One day, he’s talking about exemptions for smartphones and semiconductors, the next, his team is walking it back.

This flip-flopping is creating uncertainty, and uncertainty is the last thing markets need. It’s like trying to navigate a minefield blindfolded.

Tariffs could disrupt supply chains, affecting not just tech firms but also crypto infrastructure. It’s a mess.

Yes or no?

On April 11, Bitcoin rallied when Trump announced those tariff exemptions. We’re happy. But then, on April 13, Commerce Secretary Howard Lutnick said it was all temporary.

Trump chimed in, saying the tariff rate would be announced next week with some flexibility for certain companies. We’re not happy.

It’s like they’re playing a game of policy ping-pong. The Kobeissi Letter pointed out that the whole thing was a misunderstanding from the start. Investors are now in a wait-and-see mode, unsure whether to buy or sell.

Here's exactly what happened with tariff exemptions:

The White House published a note titled "Clarification of Exceptions Under Executive Order 14257" on April 11th.

Certain goods were apparently NEVER supposed to be subject to the "reciprocal tariffs" announced on April 2nd.… pic.twitter.com/msktTOEHXF

— The Kobeissi Letter (@KobeissiLetter) April 13, 2025

Trendlines

Bitcoin’s also trapped between two key trendlines, the 50-day SMA at $84,400 and the 200-day SMA at $87,500.

It’s like being stuck between a rock and a hard place, and we all fell the pain. The RSI is right in the middle, indicating a tug-of-war between bulls and bears.

To break free, Bitcoin needs to smash through that 200 SMA and face resistance at $90,000.

If it falls below the 50-day SMA, we’re f*cked I mean chances are high there will be a deeper correction.

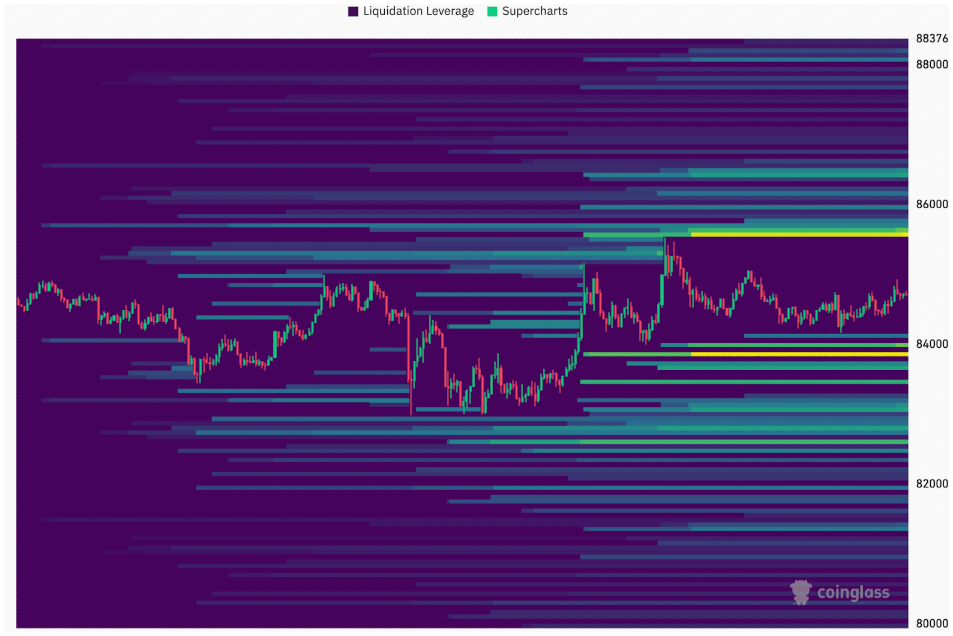

The liquidation heatmap shows heavy ask orders around the 200-day SMA and bid positions just below the 50-day SMA.

It’s like the market is holding its breath, waiting for a move. So, when will the brake be released? Today? Not today?

Have you read it yet? Bitcoin is strong, unbothered by tariffs and market turmoil?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.