I got a story that’ll make your head spin faster than a roulette wheel in Vegas. BlackRock, the biggest dog of asset management, just dropped their Q1 numbers for 2025, and let me tell you, it’s as nice as you can imagine.

Lot of Bitcoin

Now, picture this. BlackRock’s sitting pretty with $11.6 trillion in assets. That’s trillion with a ‘T’, so lotf of money.

They’re raking in the dough like there’s no tomorrow. But here’s the most interesting part, their crypto game is starting to sing like a canary.

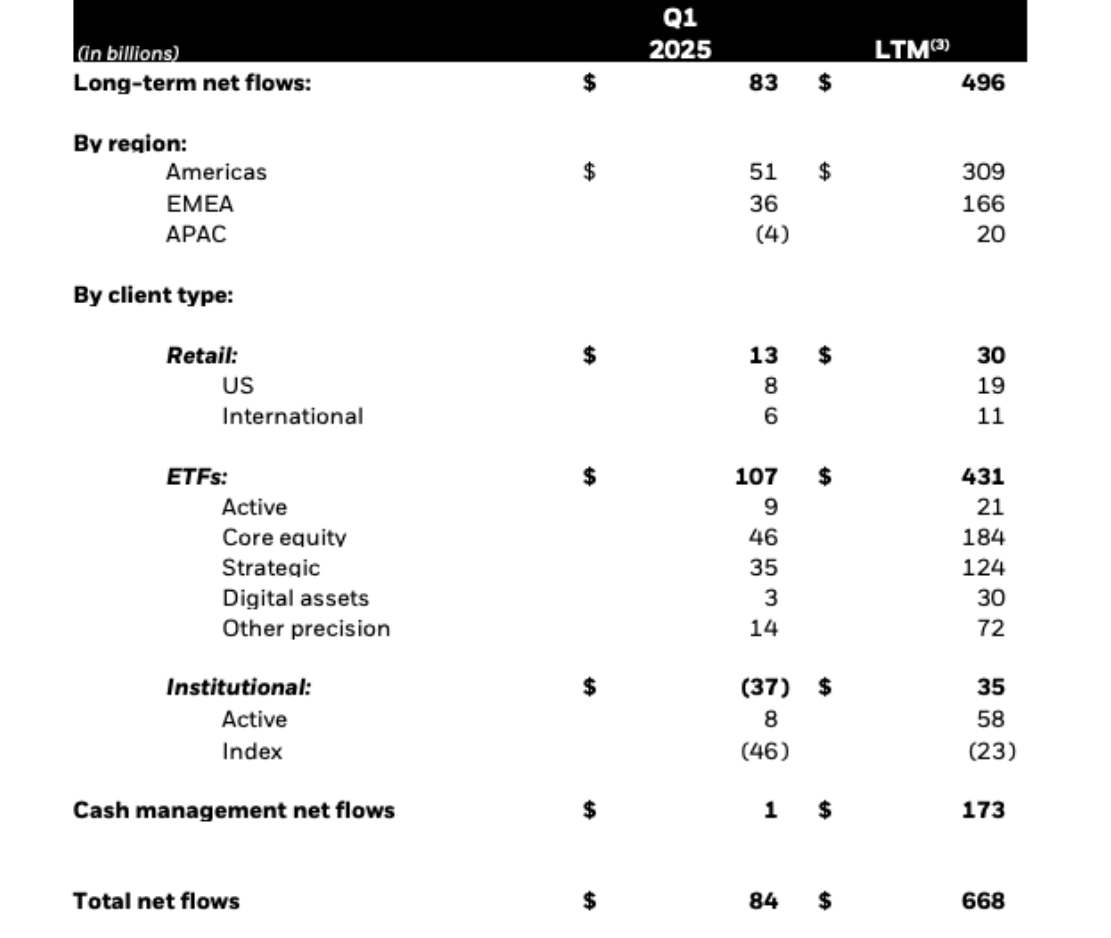

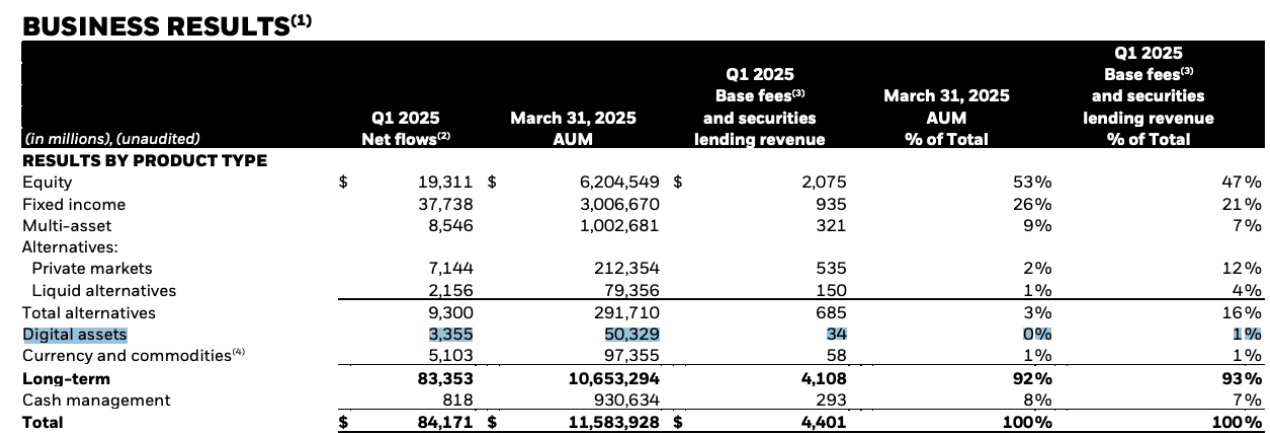

In the first quarter alone, they saw $3 billion flow into their digital asset products. That’s 2.8% of their total ETF inflows.

Now, I know what you’re thinking, that’s peanuts! But let me tell you something. In this game, every penny counts, and this amount is $3 billion more than a year ago.

Starting small

Sure, cryptocurrencies are still small potatoes in BlackRock’s empire. We’re talking $34 million in base fees, less than 1% of their long-term revenue.

By the end of Q1, they had $50.3 billion in digital assets under management.

That’s about 0.5% of their total assets. It’s like finding loose change in your couch cushions when you’re already swimming in cash.

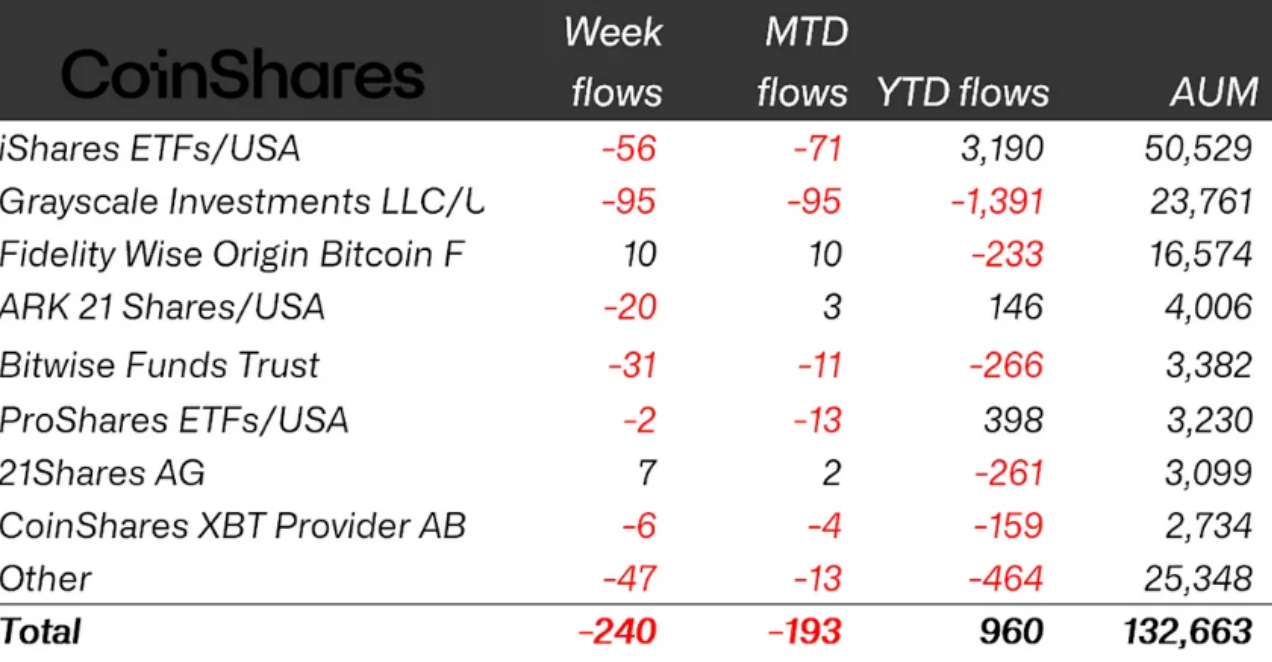

But here’s the thing, you see. While everyone else was running around like chickens with their heads cut off, liquidating their Bitcoin ETFs, BlackRock stood firm.

They’re playing the long game, and they’re playing it like a virtuoso.

Go

Now, I’ve seen my fair share of trends come and go. But this crypto thing? It’s got legs.

And BlackRock, they’re not just dipping their toes in the water. They’re jumping in headfirst, ready to make a splash.

So, what’s the moral of the story, you ask? It’s simple. In this crazy world of finance, you gotta be ready for anything.

Today’s small potatoes could be tomorrow’s golden goose. And BlackRock? They’re betting big on Bitcoin being the next big score.

Right now, BlackRock’s putting their chips on crypto. So, ask yourself: are you gonna sit on the sidelines, or are you gonna get in on the action?

Have you read it yet? Bitcoin is strong, unbothered by tariffs and market turmoil?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.