Alright, the crypto world is buzzing with a tale of intrigue and uncertainty. Michael Egorov, the mastermind behind Curve Finance, has been on a selling spree, dumping nearly 2.5 million CRV tokens.

Something is brewing?

Now, you might wonder, why sell when the market is on the upswing? Egorov’s moves have left many scratching their heads.

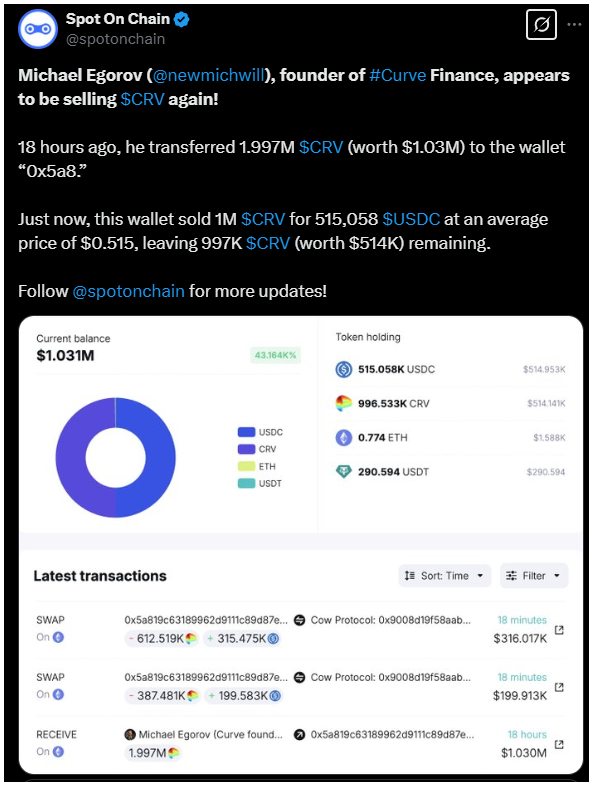

On March 26, he offloaded almost 2 million CRV tokens, adding to the 500,000 he sold a couple of days prior.

The numbers are quite staggering, 1.997 million tokens were transferred to a wallet, which then sold 1 million of them for a cool $515,058. That’s a nice sum, but it could be also a sign of something more complex brewing.

Realized losses

Let’s break it down. Egorov initially bought these tokens in mid-December for an average price of $1.114.

Fast forward to now, and he’s selling them at a significant loss, 54.6% to be exact. It seems like he’s trying to cut his losses, but the timing couldn’t be more puzzling.

The CRV price is on a tear, with intraday and weekly gains of 12% and 23%, respectively. You’d think this would be the perfect time to hold on tight, not sell.

Speculation

But either way, Egorov’s actions have sent a ripple through the market, regardless of his personal losses.

Investors are getting nervous, wondering if this is a sign of things to come. The CRV price might be defying expectations for now, but the broader sentiment is clearly bearish.

It’s like watching a high-wire act, will it all come crashing down, or will Curve Finance somehow manage to keep its balance?

In the end, it’s a game of speculation. Is Egorov’s move a strategic play to mitigate losses, or is it a sign of deeper issues within the project? Whatever the reason, the crypto community is watching with bated breath.

Have you read it yet? Can a 10M DOGE reserve ignite real adoption?”

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.