Bitcoin’s been on a textbook rollercoaster lately, and everyone’s wondering if this is just a normal correction or the end of the bull run.

Analysts are saying it’s the former, just a typical pullback before the real peak. They’re right?

This volatility is normal?

Let’s get real, this isn’t your grandma’s stock market with boring bonds. Bitcoin’s down 24% from its January high, and the uncertainty around U.S. tariffs and interest rates isn’t helping.

Now, you might be thinking, what’s the big deal? Bitcoin’s always volatile. And you’re right, it is.

But here’s the thing, this correction is part of a larger cycle. Collective Shift’s Ben Simpson says it’s just one of a few major corrections this cycle, compared to 12 last time around.

It’s like a speed bump on a long road trip, annoying, but you’ll get there eventually.

It’s the whole market, not just Bitcoin

But what’s really driving this? Well, it’s not just Bitcoin, it’s the whole macroeconomic environment right now.

Independent Reserve’s Adrian Przelozny points out that all asset classes are feeling the heat, which could lead to inflation and slower global growth.

That’s like trying to navigate a stormy sea, hard to predict where you’ll end up.

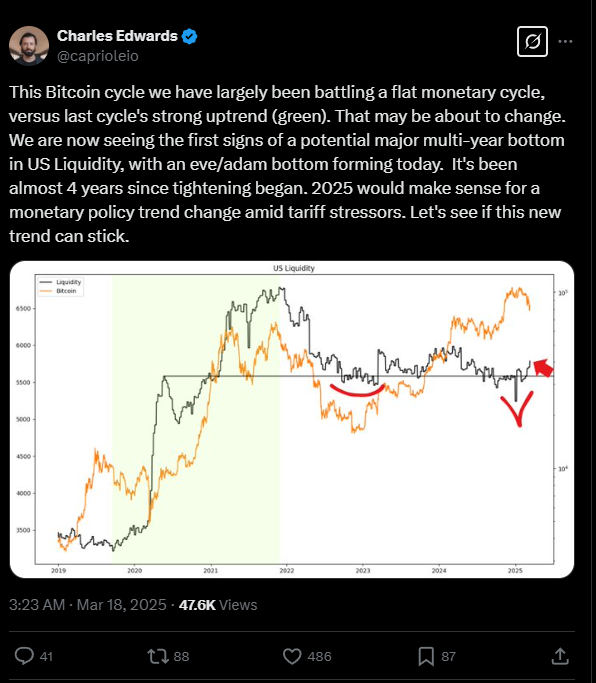

The good news? Analysts think Bitcoin’s current trend could change quickly. If the Fed eases up on rate cuts and quantitative tightening, we might see a new narrative emerge.

It’s like waiting for the next chapter in a thriller novel, you don’t know what’s coming, but you’re hooked.

Clash of views

Of course, not everyone agrees. Capriole Investments’ Charles Edwards says it’s a 50-50 chance the bull run is over.

And CryptoQuant’s Ki Young Ju thinks we’re in for a bearish or sideways ride for the next six to 12 months.

It’s like trying to predict the weather, sometimes you get it right, sometimes you get soaked.

Either way, Bitcoin’s still a wild card. It might be a normal correction, or it might be something more. But I’m pretty sure this isn’t the end of the story.

Have you read it yet? China’s AI labeling is about transparency or overreach?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.