Listen up, guys, the streets of crypto are always unpredictable, but right now, Bitcoin’s got everyone on edge.

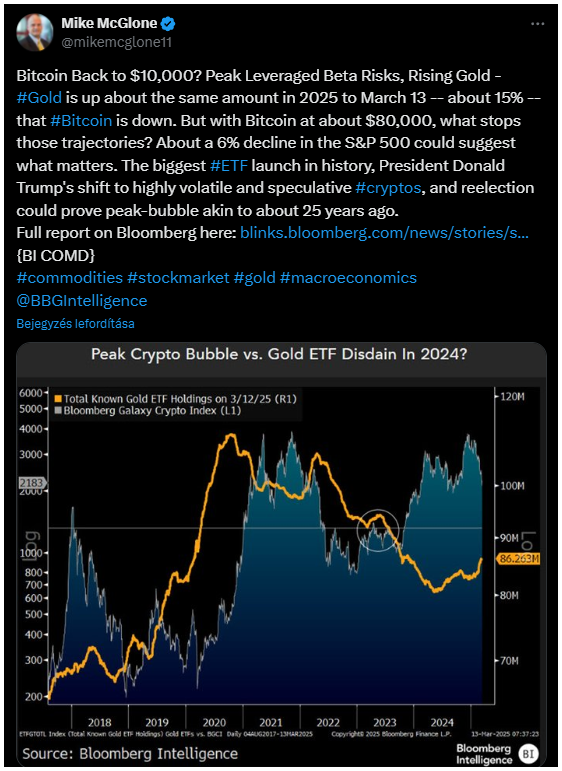

Bloomberg analyst Mike McGlone is sounding the alarm, warning that Bitcoin could plummet to $10,000.

It’s like the whole market is playing a game of high-stakes poker, and no one knows who’s bluffing.

The warning signs

McGlone points out that gold is on fire, up 15% this year, while Bitcoin is struggling. He asks, what stops those trajectories, and honestly, there is no exact answer yet. A 6% dip in the S&P 500 could be the trigger.

It’s like the whole financial world is waiting for someone to blink. And let’s not forget, Bitcoin was born during the 2009 stock market crash. History might just repeat itself.

The community’s take is quite mixed

Dave Weisberger threw out a worst-case scenario on X, as Bitcoin adoption stalls, gold investors bail, the stock market crashes, and Bitcoin’s price tanks.

But he quickly dismissed it, saying it’s pretty unlikely. The community is loud about the topic.

Ted, an investor, is optimistic, but Joe Buchner, a Bitcoin maximalist, thinks if Bitcoin hits $10,000, we’re in for a global crisis. Like, World War III-level stuff. And even then, he believes Bitcoin would still be a safe haven.

The current state of play

Despite all the doom and gloom, Bitcoin is still showing some fight. It’s up 0.46% in the past 24 hours, sitting at $84,290 in the time of writing.

Technical indicators like the MACD and RSI say it’s still in a bullish phase. So, while the skeptics are loud, Bitcoin’s trajectory is still anyone’s guess.

It’s like the old days in the mafia, everyone’s watching, waiting for the other shoe to drop. But here’s the thing, Bitcoin’s resilience is real.

It’s been through tough times before and always bounces back. So, will it crash to $10,000? Maybe. Or maybe not. No one knows.

Have you read it yet? Cardano and Natural Gas futures are coming to Coinbase

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.