Guys, you know those big public companies that bet big on Bitcoin? Number go up? Future of money?

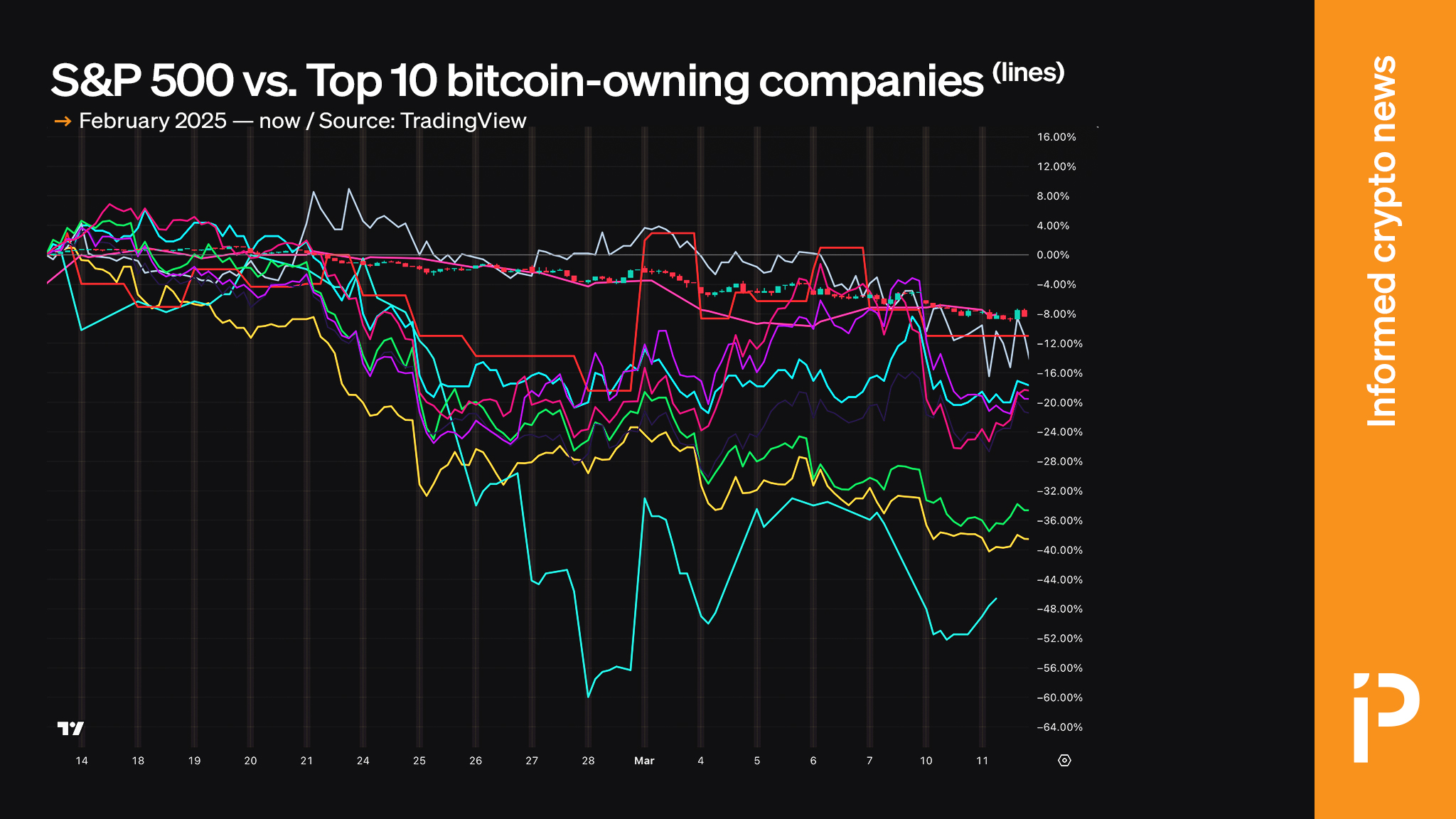

Yeah, they’re not exactly raking it in this year. In fact, they’re underperforming the S&P 500 and even gold.

Low time preference is the key?

Simply put, the world’s top 10 Bitcoin-owning companies have been left in the dust since January. Strong open, so let’s look at the numbers!

Aker ASA, the best of the bunch, is barely breaking even. Meanwhile, Galaxy Digital is down by 25% compared to the S&P 500.

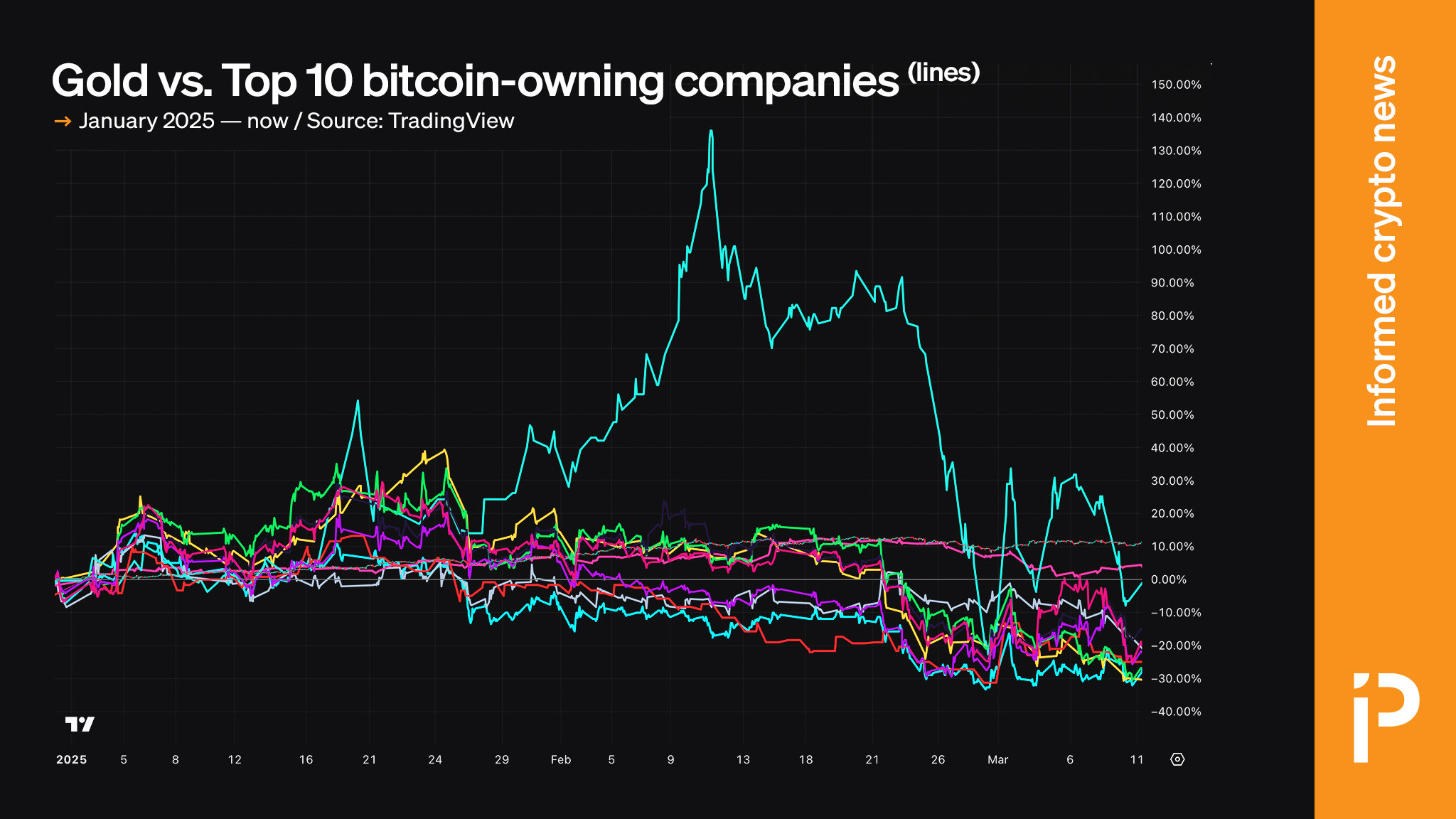

And if you thought that was bad, gold has outperformed all of them.

MetaPlanet, the strongest in this group, is still down 7% compared to gold, while Galaxy Digital is 43% behind. Looks bad, but we’re talking about months. Experts say think in years, or decades.

The ETFs are calculated investments, or indeed a gamble?

Bitwise Asset Management just launched an ETF that invests in these Bitcoin-owning companies.

It includes names like Strategy, MARA Holdings, and Galaxy Digital. But here’s the thing, despite past successes, these companies are struggling in 2025. They just can’t keep up with traditional benchmarks.

Michael Saylor, founder of Strategy, has been preaching the gospel of Bitcoin treasuries for years.

He’s got a 499,096 coins on his balance sheet, and he’s convinced other executives to follow suit. But so far this year, his strategy hasn’t exactly paid off. Maybe it’s time to rethink the plan, huh?

Time will tell

Investing in Bitcoin through these companies was supposed to be a smart move, but it’s not looking so brilliant right now.

Maybe it’s just a bad year, or maybe it’s time to face the music, betting on Bitcoin isn’t always a sure thing.

So, what’s next for these corporate Bitcoin whales? Only time will tell. Until then, hodl!

Have you read it yet? Crypto trading hits Spain, thanks to the BBVA

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.