The crypto market’s got a bad case of the blues, and altcoins are taking the hardest hit.

While Bitcoin’s correction is nothing new, mid and small-cap altcoins are plummeting like they’re in a free fall.

But here’s the thing, history says these downturns often lead to some serious rebounds. So, is this the perfect time to buy the dip, or should you keep your wallet locked tight?

Bitcoin’s correction is a sign of things to come?

Bitcoin’s been on a pullback, in the time of writing trading at $86,000 with a daily decline of 0.25%. It’s not a pretty sight, especially after getting rejected at the $92,000 level, again.

The Relative Strength Index is hovering near oversold territory, which could mean a reversal is on the horizon.

But if Bitcoin can’t hold its current support, we might see it slide further to the $80,000-$82,000 range. Not exactly what you want to hear if you’re holding onto your coins.

Altcoins are the real victims here

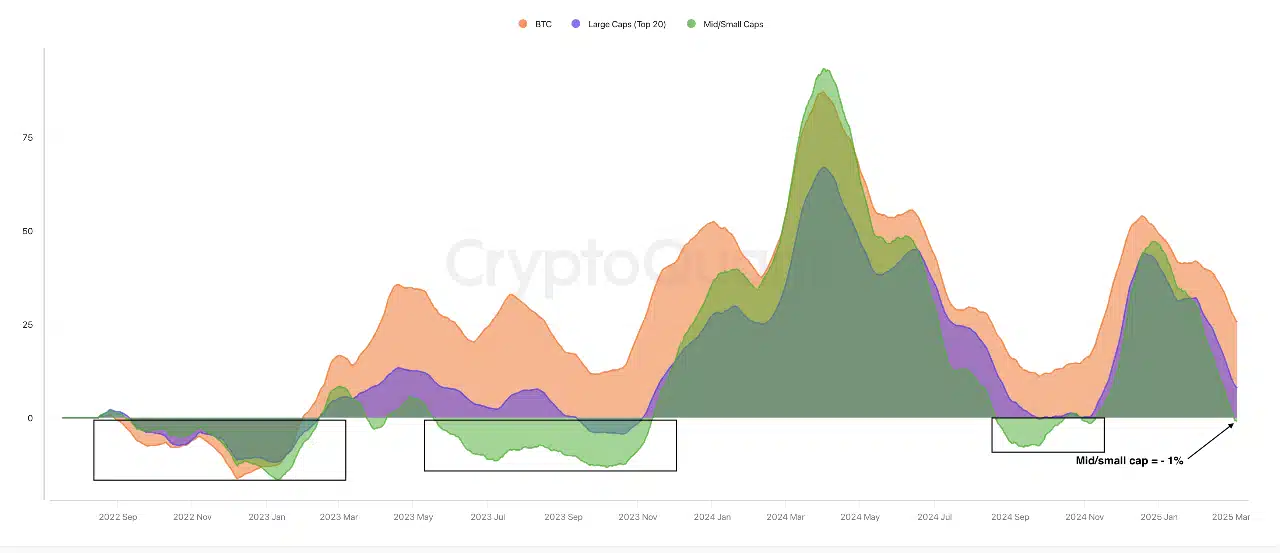

Mid and small-cap altcoins are getting hammered hard, with their market cap growth rate turning negative at -1%.

It’s like they’re stuck in a rut, unable to gain any traction. This is partly because investors are flocking to Bitcoin and other large-cap assets during these risk-off times.

Historically, this underperformance has led to some serious stagnation, making it tough for short-term traders.

But for those with a long-term view, it might just be the perfect time to start accumulating some undervalued gems.

The opportunity in the storm, but it’s risky

Past corrections have shown us that altcoins often stage some impressive comebacks after hitting rock bottom.

So, if you’re a strategic investor looking to get in on the action, now might be the time to start building your portfolio, if you like to take extremely high risk. Just remember, timing is everything.

You need sustained market stability before these altcoins can regain their momentum. It’s a gamble, but one that could pay off big time if you play your cards right.

Have you read it yet? Bitcoin miners finally freed after seizure

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.