Toncoin holders might be seeing red in the short term, but don’t freak out just yet.

On-chain data is whispering some seriously good news, because even after the recent price dip, most of the investors are still sitting on a pile of unrealized profits.

In numbers we trust

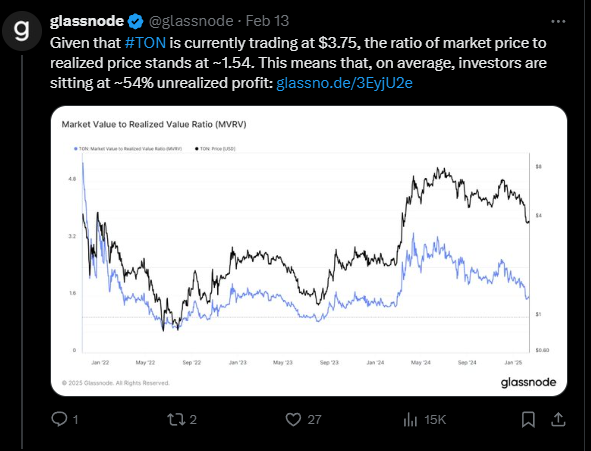

Glassnode dropped some knowledge on X, and it’s worth paying attention to. They started by looking at Toncoin’s Realized Price, which is the average buy-in price for all TON investors.

As long as the actual price of Toncoin is above this Realized Price, most holders are in the green.

And guess what? Toncoin’s price has been chilling above that Realized Price for a while, meaning profits have been flowing. Even with the recent pullback, that’s still the case.

Support and resistance

Historically, the Realized Price has acted as a sort of safety net for Toncoin. When the price dips close to it, bulls often jump in and buy more, creating a price floor.

Right now, that Realized Price is around $2.43, well below the current spot price. Glassnode thinks this level is super important for potential buying pressure.

But here’s the real kicker, as Glassnode also looked at the Market Value to Realized Value Ratio.

This fancy metric compares Toncoin’s current price to its Realized Price, and if we take a look to their chart, the MVRV Ratio is around 1.54. Translation? Glassnode says the situation is good.

“On average, investors are sitting at 54% unrealized profit.”

It’s keep dipping?

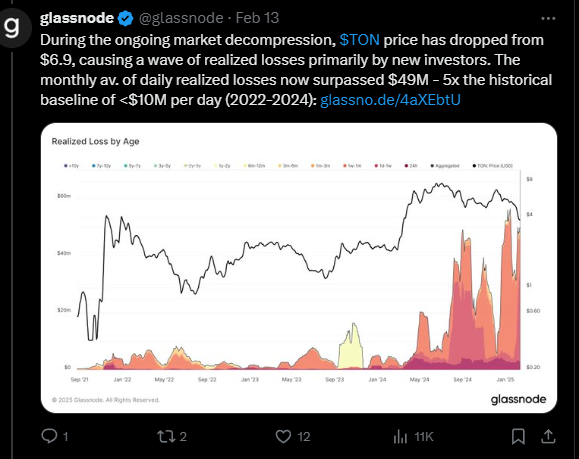

Now, it’s not all sunshine and rainbows. Some people who bought at the peak definitely panicked and sold during the dip, taking a loss. Paper hands, right? Don’t do that.

But overall, the Toncoin market has weathered the storm pretty darn well. So, HODL on, that 54% profit cushion might just soften the blow of any future dips.

Have you read it yet? BNB Chain takes the crown outshining Solana in daily fees

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.