Experts think altcoins might just be gearing up for a wild ride. Forget Bitcoin for a minute, those smaller, lesser-known digital currencies are finally showing some serious signs of life.

Altseason is coming?

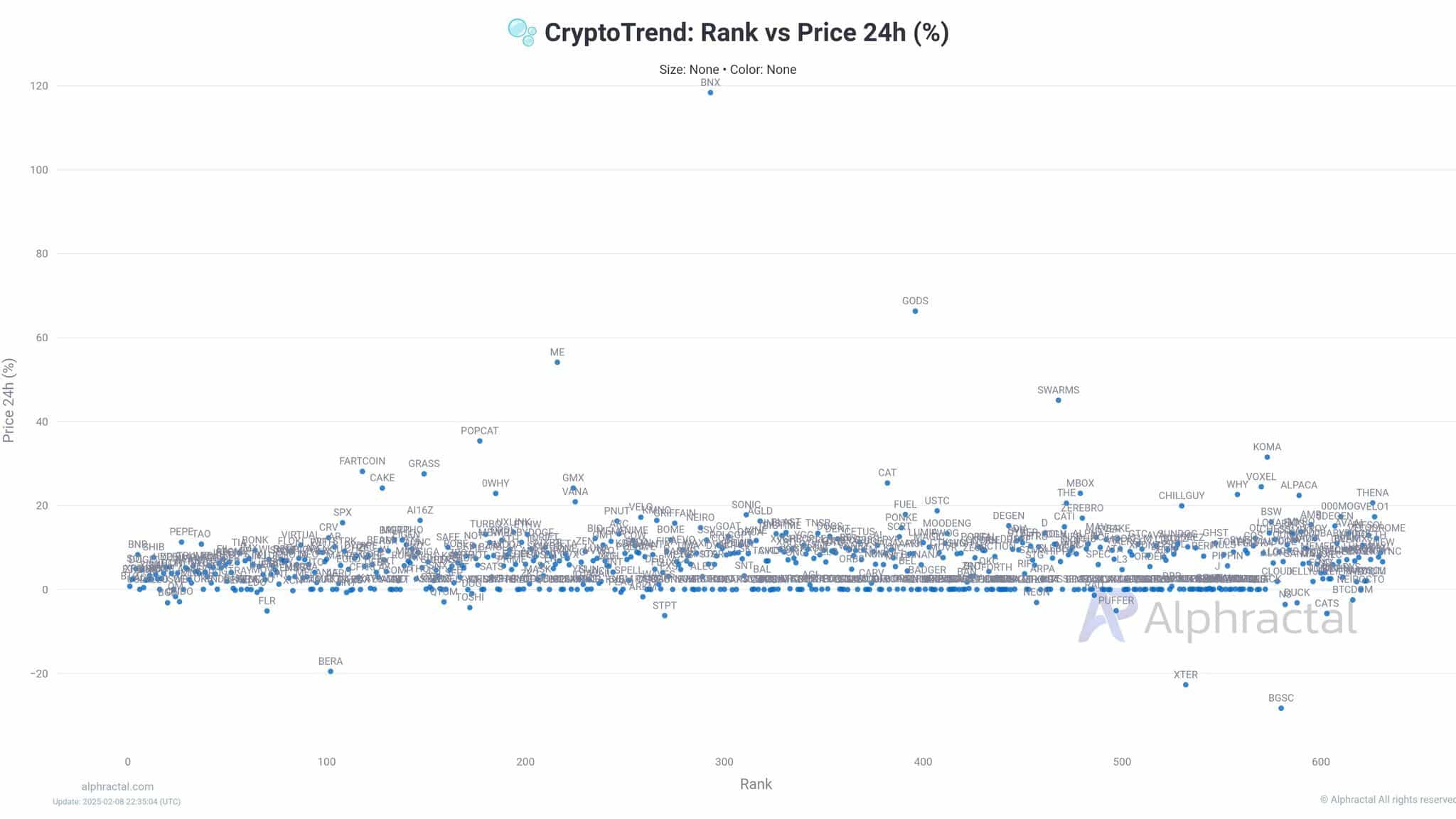

What’s making everyone so excited? Well, a bunch of small or mid-cap altcoins have been seriously outperforming the big boys lately.

We’re talking about coins outside the top 200 experiencing massive gains. BinaryX, PancakeSwap, and SPX6900 are just a few examples of alts that have surged lately.

It feels like traders are getting a bit bored with Bitcoin and are throwing money at these riskier, more speculative assets. The potential for massive returns is hard to ignore, even when it’s way more risky.

Golden cross = green light?

Here’s where it gets interesting, because a legendary “golden cross” pattern has appeared in the altcoin market.

Golden cross is a pretty positive sign, it’s when a faster-moving average, the 100-day crosses above a slower one, the 200-day.

Historically, this has been a very, very bullish signal, like back in the day when it preceded a 92% jump in altcoin market values, driving the total market cap from $710 billion to a peak of around $1.36 trillion.

Bitcoin taking a backseat?

Here’s another juicy bit, as Bitcoin’s dominance might be fading. Back in 2018 and 2021, alts took off when Bitcoin’s dominance dipped.

Some analysts are seeing similar patterns today that could lead to a $5 trillion market cap.

This happens when Bitcoin’s price goes up, but its RSI doesn’t keep pace. This is a textbook bearish divergence, in technical terms, and this could mean alts are about to have their moment.

Of course, this is crypto, so anything can happen. Alts are notoriously volatile, and their value often depends on the overall market vibe.