Tether CEO Paolo Ardoino has been musing about the future, specifically the quantum future, and what it means for Bitcoin

He’s not predicting the immediate demise of your precious crypto, but he is hinting that those long-lost Bitcoin wallets might be in trouble down the line.

Quantum FUD, or real issue?

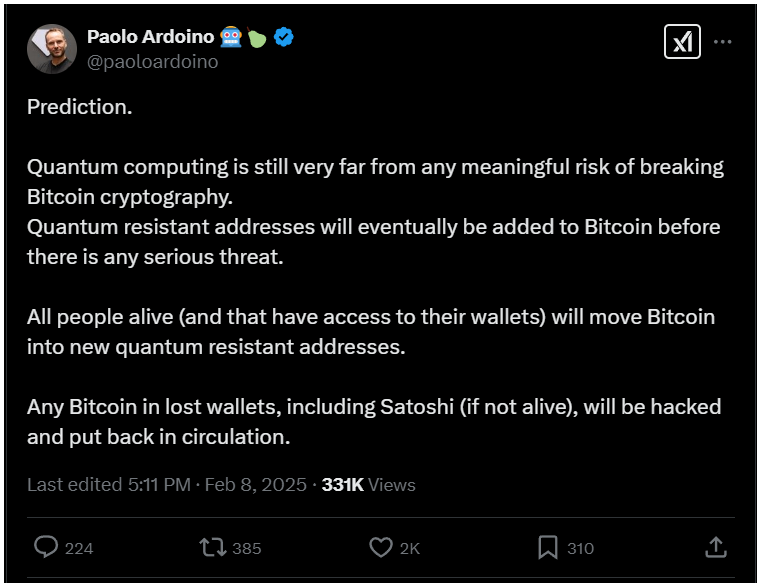

Ardoino assures us that quantum computers aren’t about to crack Bitcoin’s code anytime soon, and also mentioned that developers will have already rolled out quantum-resistant addresses before things get dicey.

Think of it like upgrading your home security system before the neighborhood gets a bit too interesting.

He believes everyone with access to their wallets will have plenty of time to move their Bitcoin to these new, quantum-proof addresses.

However, there’s a catch, as the old Bitcoin addresses from way back in 2009, the Pay-to-Public-Key, or P2PK are the vulnerable ones.

Apparently, they’re like leaving your public key, think house key, lying around for anyone to grab. Later versions were much better, but those old-school wallets?

Release the stash?

And who has a lot of Bitcoin sitting in those early wallets? None other than Satoshi Nakamoto, the mysterious founder of Bitcoin, and there’s a concern as all those 1.2 million BTC could be at risk if quantum computing gets too good.

Plus, Ardoino points out that any inactive wallets, especially those where the keys are lost forever, could be sitting ducks.

If quantum computers crack those wallets, all that Bitcoin could suddenly flood back into the market.

Upgrade

Of course, upgrading Bitcoin involves getting everyone on board, which isn’t always easy, but Ardoino’s comments highlight that Bitcoin can adapt, and already did more times.

The real question is what happens to all that lost Bitcoin. Some say a few million coins are MIA, so a quantum breakthrough could seriously shake things up.

Have you read it yet? Bitcoin and Ethereum: Price Ranges, Key Influences, and Market Dynamics

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.