European Central Bank President Christine Lagarde isn’t ready to roll out the welcome mat for Bitcoin as a reserve asset.

In a statement, she waved off BTC, citing concerns about its liquidity and security.

It’s called old continent…

Lagarde turning her back to the future, but Norway’s sovereign wealth fund is quietly boosting its indirect exposure to the crypto, and let’s not forget El Salvador, which is still on its Bitcoin-buying spree, even after tweaking its laws to keep the International Monetary Fund happy.

Grayscale has jumped into the mix with a new Bitcoin Miners ETF, giving investors a chance to dip their toes into the mining sector without getting their hands too dirty.

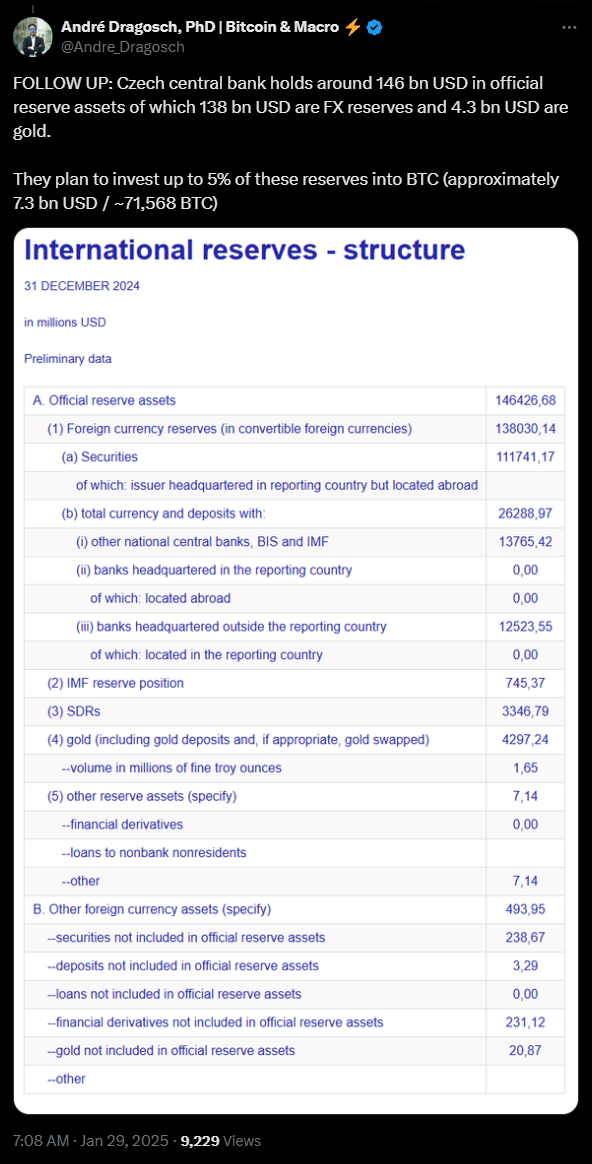

Lagarde’s comments come on the heels of Czech National Bank Governor Aleš Michl suggesting that maybe they should consider Bitcoin for diversification.

Also have to mention that the Czech central bank board didn’t exactly jump on that bandwagon.

Lagarde’s remarks mark one of the clearest rejections from the ECB regarding Bitcoin as a reserve asset, especially when discussions about digital assets are heating up.

Moving forward

And speaking of heat, there’s been quite a hype in the US about adopting Bitcoin as a reserve asset.

Lawmakers from states like Texas, Utah, Illinois, Wyoming, and Arizona are pushing for legislation that would allow them to stockpile BTC, besides the federal, national stockpile.

This movement has been fueled by the Satoshi Action Fund, which is all about promoting Bitcoin as a hedge against financial uncertainty.

Even Coinbase CEO Brian Armstrong has joined the chorus, urging global policymakers to consider BTC reserves to combat inflation.

Volatility and value

El Salvador remains the poster child for countries adopting Bitcoin for their national reserves. They’re setting an example that others are watching, albeit with a bit of caution.

Despite all this excitement around Bitcoin as a reserve asset, let’s not ignore its very, very volatile price action.

As of now, in the time of writing BTC is trading at $104,000, having slipped by 0.36% in the last 24 hours, but up 1,000% in the last five years.

I don’t know the EUR’s purchasing power how much more now than five years ago. Maybe it’s indeed better than Bitcoin.