Crypto analyst Trader Tardigrade dropped the bombshell, and shared that Dogecoin might be gearing up for a rally that could see its price go to as high as $5.

The bullish case for DOGE

In a recent post on X, Trader Tardigrade shared his optimistic outlook, suggesting that Dogecoin is nearing the final stages of its bull run.

He pointed out that the *Chande Momentum Oscillator indicates there’s still plenty of room for growth before we hit the peak this cycle.

His analysis even hints at a wild possibility of DOGE climbing all the way to $9. Okay, that would be crazy, ngl.

The analyst’s chart shows a solid bullish pattern, and he believes that Dogecoin is currently aligning with the 50 Arnaud Legoux Moving Average indicator, mirroring trends from previous cycles between 2018 and 2020. With this setup, Tardigrade is convinced that DOGE is on the verge of a huge jump.

Price levels to watch

In another update, crypto analyst Kevin Capital noted that Dogecoin has officially closed above the macro .786 Fibonacci level, and mentioned that if this upside momentum continues, we could see DOGE targeting previous highs around $0.48.

Kevin previously hinted that breaking through the $0.41 was quite important, and now with Dogecoin reaching this level, eyes are on that next target.

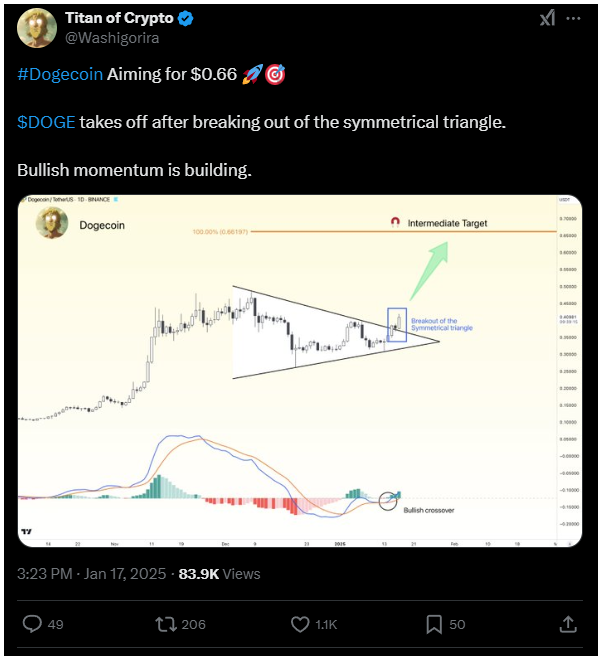

Titan of Crypto, yet another crypto influencer is eyeing a price target of $0.66, suggesting that once DOGE breaks out of a symmetrical triangle pattern, it could really take off.

Why all the hype?

Historical patterns suggest that after periods of consolidation, big price spikes often follow.

Trader Tardigrade has drawn parallels between Dogecoin’s current movements and its past performance in 2017 and 2021, telling that if it breaks above certain resistance levels, we could be looking at a massive bull run.

As we move further into January, all eyes are on Dogecoin to see if it can maintain this momentum and reach those nice price targets.