The hype around Donald Trump’s new Solana-based memecoin, aptly named TRUMP, is reaching a fever pitch, with its market cap skyrocketing to $42 billion.

But not everyone is celebrating, there are whispers of suspicious trading activity that have raised eyebrows across the crypto community.

Kinda sus

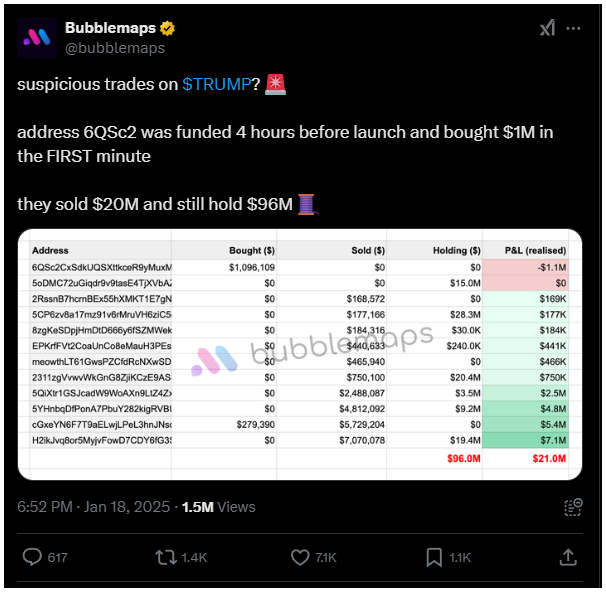

Just hours before the TRUMP token launched on January 18, Bubblemaps discovered a wallet that had been funded with $1 million, then went on to purchase $5.9 million worth of TRUMP tokens in the first minute after launch and later sold off about $20 million, while still holding onto $96 million in tokens.

This wallet then funneled the tokens through multiple addresses, which are now actively selling on Solana’s DEXs. Sounds a bit fishy.

Preetam Rao, CEO of QuillAudits, expressed concerns about the allocation of TRUMP tokens. He pointed out that 80% of the supply is locked for CIC Digital, a company linked to the Trump Revocable Trust, which previously launched Trump NFT Trading Cards.

Rao noted that the top ten holders control nearly 89% of the total supply, raising questions about market manipulation.

The memecoin mania is infinite

Major exchanges like Coinbase and Binance have jumped on board, no matter the controversies in case of the token, listing it and driving trading volumes through the roof.

In just 24 hours, TRUMP saw trading activity grow to around $864.9 million, pushing its price up by 194% to about $54.62.

Solana’s ecosystem has also felt the impact, with its largest DEX, Raydium, raking in record fees and revenue.

In fact, Solana’s DEX volume hit an impressive $19.47 billion, largely thanks to the frenzy surrounding memecoins like TRUMP.

Bitcoiners not impressed

Of course, not everyone is thrilled about Trump’s foray into the crypto space. Many in the Bitcoin community are criticizing the TRUMP token as nothing more than a cash grab that undermines Bitcoin’s core values.

Brandon Quittem from Swan Bitcoin called it “an extreme case of shitcoinery,” while others echoed similar sentiments about it being a “get-rich-quick scheme.”