Agridex, a platform focused on real-world asset tokenization, has successfully completed its first onchain coffee trade using the Solana blockchain.

This could pave the way for more efficient agricultural transactions in the future.

A double espresso please

The inaugural transaction was carried out by Tiki Tonga Coffee, a UK-based brand that exported premium coffee to South Africa, and the payment was made in South African rands but settled in British pounds through the Agridex blockchain.

Tiki Tonga is boasting about a mere 0.5% transaction fee, which is a steal compared to the typical 5% to 7% fees associated with traditional cross-border agricultural transactions. Plus, they enjoyed instant settlement.

“Not only have we saved significantly on transaction fees, but the headache of managing all that paperwork and compliance has been lifted.”

Beyond coffee

But Agridex isn’t just about coffee, it’s also facilitating instant settlements for various agricultural commodities like livestock, wine, and olive oil, and the company claims it has $4.5 billion in pending transactions from its agricultural partners.

In the past time, Agridex raised $9 million in funding with big names like Citadel, Goldman Sachs, and Palantir backing them. Clearly, investors are keen on this approach.

Tokenizing assets is seen as one of the most promising applications of blockchain technology, especially in agriculture. By converting real-world assets into digital tokens, it can make investments more accessible and streamline transactions.

New trend, new benefits

Jon Trask, CEO of agricultural tech company Dimitra, explained that RWA tokenization connects agriculture with blockchain by digitizing assets such as crops and land.

This shift addresses major challenges like inefficiencies and lack of transparency in supply chains.

Farmers can also benefit by selling directly to buyers without needing costly middlemen. Henry Duckworth, co-founder and CEO of Agridex, emphasized how blockchain can empower farmers and improve their bottom line.

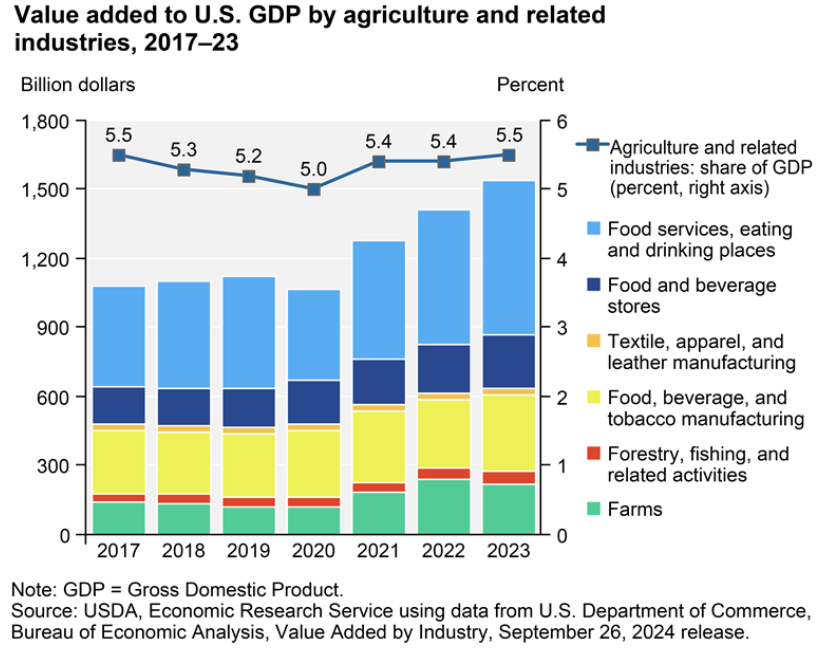

Agriculture plays a significant role in the economy, contributing about 5.5% to the U.S. GDP. With U.S. farmland valued at over $3 trillion, the potential for tokenization in this sector could be massive.