Could it be that the Bitcoin bull market is coming to a close? Despite some price fluctuations, Bitcoin has only dipped about 2.4% this month, and traders are keeping a close eye on the monthly and yearly candle close.

Gains

Bitcoin has lost less than 2.5% this month, which isn’t too much considering the market’s ups and downs, and even with some strong selling pressure lately, BTC is still up nearly 50% for the fourth quarter alone.

So, while it’s currently down about $15,000 from last week’s all-time high, it’s really only 2.4% lower than where it opened this month.

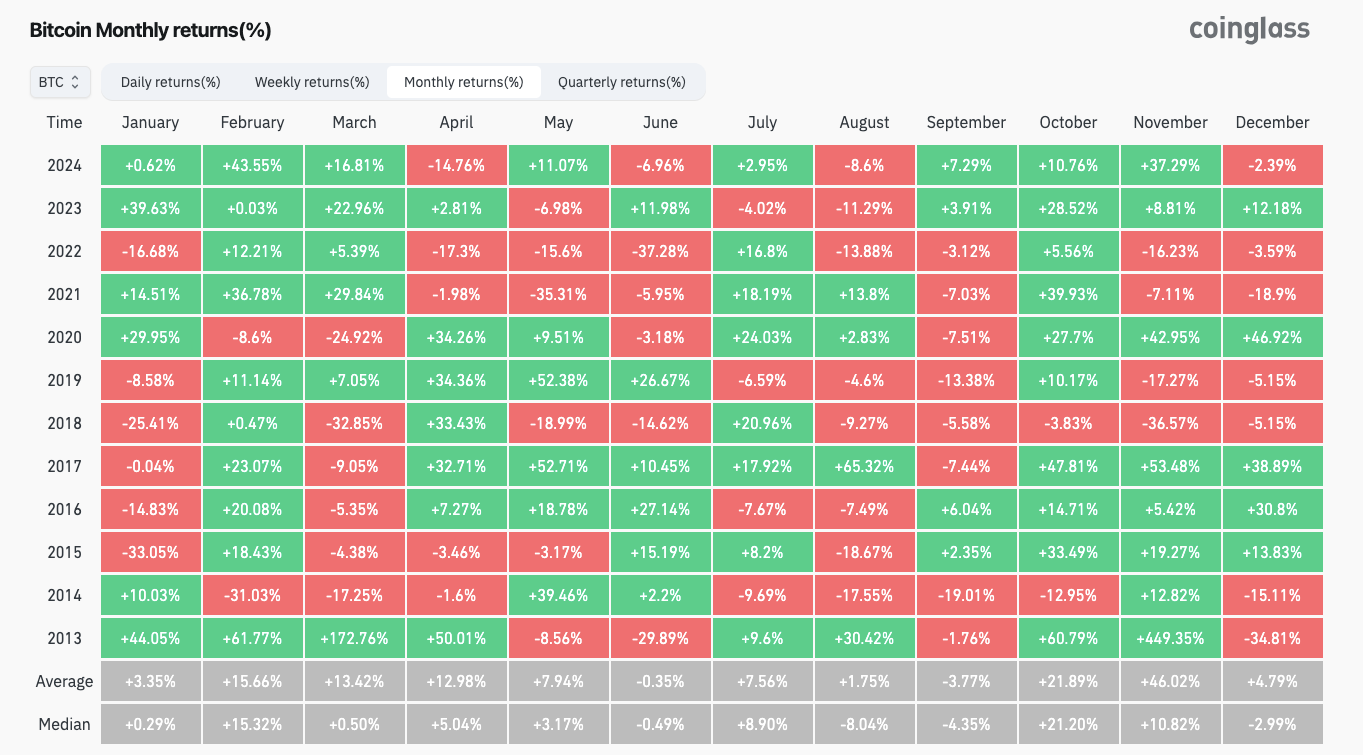

December is known for being a wild ride, and CoinGlass’ data shows that this month can bring both big gains and sharp drops, but so far, 2024 looks pretty average compared to historical trends.

No big gain, no big loss

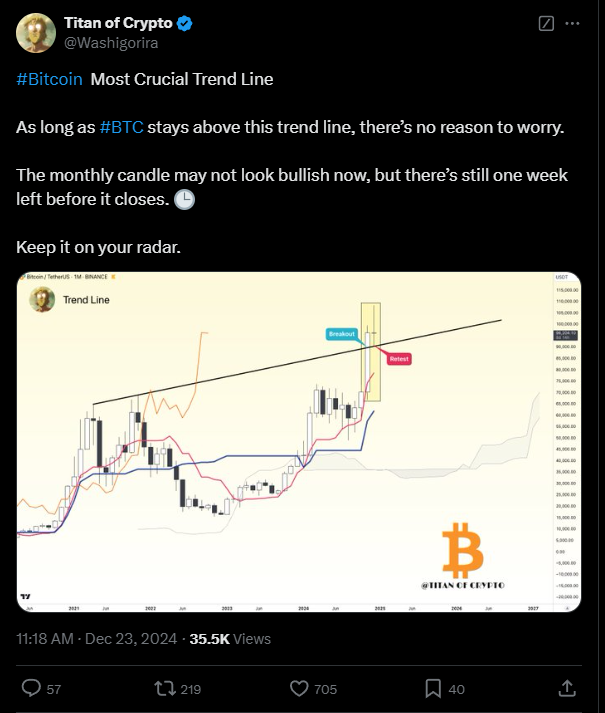

Trader and analyst Titan of Crypto shared some insights on X, pointing out that while the monthly candle may not look super bullish right now, there’s still a week left for things to change.

He highlighted a rising trend line that should act as support for Bitcoin.

“As long as BTC stays above this trend line, there’s no reason to worry.”

CoinGlass indicates that Bitcoin needs to step up its game to match last December’s performance.

Some traders are noticing a pattern where BTC is mimicking last year’s market behavior, almost like it’s on repeat!

Traders vs hodlers

Another interesting point comes from trading account Bitcoindata21, which suggests that Bitcoin might bounce back once it hits the realized price for short-term holders, as this price is currently around $86,000 and represents the average price at which these more speculative investors break even.

“It might not hit $86k, but if it does, I’ll be adding more risk.”

Have you read it yet? Bitcoin mining stocks struggle

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.